Our collection of resources based on what we have learned on the ground

Resources

webinar

Relocating Supply Chains to Vietnam

- June 2020

- Members Access

Given the difficulties foreign investors are facing when considering and developing a supply chain relocation strategy in the current context of the pandemic, the webinar explained why Vietnam features high on the radar for foreign businesses scaling...

infographic

Investing in Vietnam

- April 2020

- Free Access

This infographic reviews the investment environment in Vietnam. If you would would like to dive deeper in the topic, please refer to An Introduction to Doing Business in Vietnam 2020 and Vietnam Briefing.

webinar

Response to Supply Chain Disruption during COVID-19 – The Vietnam Perspective

- April 2020

- Free Access

The webinar was available exclusively for German Business Association in Vietnam’s members (GBA), aiming to help German businesses in Vietnam overcome this difficult time and develop a post-crisis strategy for supply chains.

magazine

A Guide to Vietnam’s Supply Chains

- April 2020

- Members Access

Vietnam’s supply chains have significantly evolved from how they were a decade ago. Today, supply chain shifts to Vietnam are ongoing, helped in some part by the US-China trade war, as a growing number of businesses seek out ASEAN or alternate mark...

presentation

Navigating Asia's Business Landscape: How Vietnam Could Complement Your China Op...

- September 2019

- Free Access

(Part 1) Vietnam has successfully established itself as a leading destination for foreign direct investment, thanks to its increasing integration with world markets. Its current FTA network connects Vietnam to 68% of the worlds population. Add to tha...

presentation

Navigating Asia's Business Landscape: How Vietnam Could Complement your China Op...

- September 2019

- Free Access

(Part 2) Vietnam has successfully established itself as a leading destination for foreign direct investment, thanks to its increasing integration with world markets. Its current FTA network connects Vietnam to 68% of the worlds population. Add to tha...

legal

Tax Exemption of Foreign Sourced Income - Singapore

- September 2019

- Free Access

A Singapore tax resident company can enjoy tax exemption on its specified foreign income that is remitted into Singapore. This document outlines the requirements company has to fulfill in order to avail this tax exemption.

magazine

Import and Export in Vietnam

- June 2019

- Members Access

Vietnam has followed an export-led growth model, combining trade liberalization and policies to attract foreign direct investment to spur exports. This has allowed Vietnam to accelerate growth in recent years, emerging as a clear leader in low-cost m...

infographic

Novitá dell'accordo sulla doppia imposizione fiscale

- April 2019

- Free Access

Infographic showing the changes to the China-Italy Double Taxation Avoidance Agreement

infographic

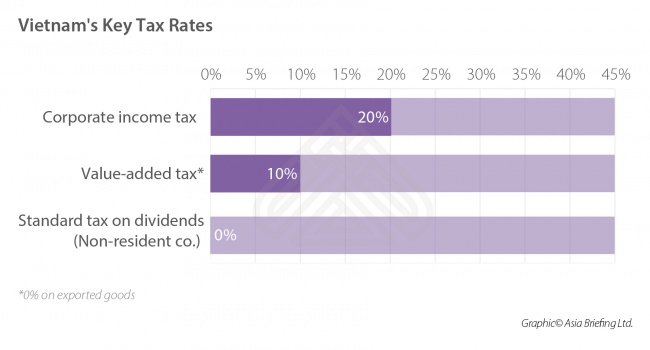

Tax calculation for Imports & Exports in Vietnam

- April 2019

- Free Access

Tax rates and tax calculations for imports and exports in Vietnam

Q&A

China's Catalog of Foreign-Invested Industries and the Negative List

- March 2019

- Free Access

What is meant by the term ‘Negative List’? The term negative list is used to define industries in which foreign companies cannot invest and specifies restrictions or bans on certain types of foreign investment. For those industries not ...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us