Real-time expense reporting across your Asia operations

Digital expense management helps businesses streamline administration, enable remote submissions, reduce approval errors, and strengthen internal controls. Dezan Shira & Associates supports clients in managing employee reimbursements and vendor payments through mobile and desktop software that digitizes applications and approvals.

Our solutions increase efficiency in staff reimbursements, simplify monthly accounting, and deliver real-time, transparent expense reporting. We offer digital expense management as a value-added service for our accounting clients or as a standalone solution, fully integrated with existing accounting systems and technology platforms to improve financial oversight and operational efficiency.

Digital Expense Management: Our Advantage

Faster claims and fewer errors

Automated verification and mobile-enabled submissions reduce manual entry errors, speed up processing, and improve user experience.

Real-time compliance controls

Expenses are validated against accounting codes and policies in real-time, supporting strong internal controls and accurate reporting.

Scalable digital solutions

As your business grows, the platform adapts—handling increased users and transaction volumes while maintaining or improving oversight and efficiency.

How We Can Help Your Business

Our mobile-enabled solution allows employees to efficiently submit expenses with minimal errors or delays. Submissions are automatically routed through defined workflows, ensuring quicker reviews and seamless integration with your accounting processes.

- Mobile submission and approval

- 99% accuracy for receipt recognition

- Multi-device access for faster processing

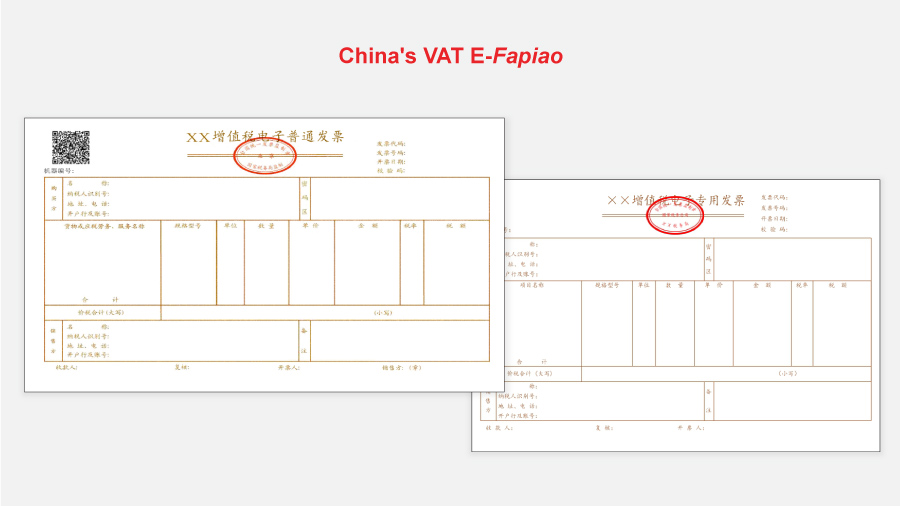

Submitted receipts are verified in near real-time for authenticity and duplication, reducing the risk of errors and fraud. Integration with local tax systems ensures compliance—particularly critical in jurisdictions like China. The platform is fully integrated with China’s pay environment and pulls expense data directly from leading travel, office supply, and banking platforms.

- Sync with tax bureau databases

- Automatic identification of duplicates

- Enhanced audit readiness

- Integration with major China e-platforms

Expense claims are mapped directly to your chart of accounts, with built-in approval flows aligned to internal control policies. This minimizes compliance risks and improves the quality of financial records.

- Policy-based approval routing

- Expense classification and allocation

- Flexible workflows for compliance

Detailed analytics, trend breakdowns, and real-time reporting dashboards help finance teams identify cost drivers and improve budget visibility across business units.

- Cross-period reporting

- Graphical trend analysis

- Exportable data for finance teams

With 99.5% data accuracy, the system integrates seamlessly with your existing ERP, T&E, and AP modules—ensuring consistency and reducing manual rework across platforms.

- High-accuracy optical recognition

- ERP integration options

- Reduced manual entry risk

Designed to support high transaction volumes, the solution scales with growing teams and increasing compliance demands—without compromising operational efficiency.

- Scalable infrastructure

- Multi-user workload optimization

- Strong internal control enforcement

Feature | Traditional Expense Management | Digital Expense Management |

|---|---|---|

Expense submission and approval | Manual entry and routing; prone to delays and errors | Mobile app-based submission with automated approval routing |

Receipt authenticity verification | Time-consuming manual verification of receipts | Real-time fapiao validation with duplicate detection |

Policy compliance and approvals | Manual cross-checking with inconsistent application of policies | Pre-configured COA mapping and policy-aligned approval flows |

Reporting and analytics | Reports compiled manually; trend insights limited or unavailable | On-demand graphical reports, cross-period analysis, and drill-down capabilities |

Data accuracy and integration | High risk of error due to manual entry; low integration with ERP systems | 99.5% scan accuracy with direct ERP and finance module integration |

Operational scalability and control | Increased workload and internal control risk as volume grows | Scales seamlessly with user and transaction volume; maintains strong internal control |

Connect with our regional experts for tailored guidance

Benchmark economic, regulatory, and market conditions across Asia to identify the most competitive locations for growth and investment.

Get in touch

Reach out to our local experts.

FAQs – Digital Expense Management

Digital expense management replaces manual reimbursement workflows with automated systems that capture, review, and approve expense claims in a centralized platform. This reduces paperwork, eliminates processing delays, and improves audit traceability.

Our solution allows employees to submit claims online, enables managers to review and approve remotely, and connects seamlessly to finance and payroll systems to complete the reimbursement process.

The platform can handle a wide range of reimbursable and company-paid expenses, including:

- Travel and accommodation

- Meals and hospitality

- Transportation and mileage claims

- Petty cash purchases

- Supplier or vendor invoices

- Staff training or certification costs

Expense categories can be customized based on company policy and linked to cost centers or GL codes.

Yes. Employees can submit receipts via a mobile app, uploading photos directly into the system. The platform uses OCR technology to automatically extract key details like vendor name, date, amount, and tax breakdown—reducing manual entry and minimizing errors.

Submitted claims are routed through customizable approval workflows, with audit logs maintained for each submission.

Yes. The platform supports integration with ERP and accounting software such as SAP, NetSuite, Microsoft Dynamics, and QuickBooks.

This allows:

- Automated journal entry creation and posting

- Expense categorization and GL mapping

- Synchronization of cost centers, vendors, and project codes

- Consolidated reporting across systems

We work with client-side finance or IT teams to ensure the integration reflects internal processes.

Expense reimbursement rules vary by country, especially regarding receipt documentation, VAT input eligibility, and withholding tax obligations. Non-compliant submissions may create audit risk or tax exposure.

Our system allows country-specific policy configuration—such as required fields, per diem limits, and documentation standards. Local teams monitor regulation changes and update templates accordingly, ensuring compliance with tax authorities across markets like China, India, Singapore, and Vietnam.

The platform includes customizable dashboards that provide real-time visibility into expense claims and departmental spending. Key features include:

- Budget tracking by cost center or project

- Expense approval status and exception alerts

- Policy violation reporting

- Trend analysis by category, employee, or department

- Exportable reports for audit or board-level review

This enables finance teams to monitor compliance, control overspending, and improve forecasting accuracy.

The system is built with enterprise-grade security protocols, including:

- Role-based access controls and data segregation

- Encrypted transmission and storage of receipts and reports

- Audit logging for every action taken within the system

- Multi-factor authentication for system access

- Data hosting in compliance with regional laws such as China’s PIPL or Singapore’s PDPA

Security is continuously monitored and updated to meet client IT governance requirements.

Onboarding typically includes:

- Requirement gathering and workflow mapping

- Configuration of approval flows, categories, and policies

- Integration with finance or payroll systems (if applicable)

- Staff training and admin handover

- User testing and soft launch

Timelines vary by complexity, but most standard implementations are completed within 4–6 weeks.

Yes. The platform supports multi-currency expense entry, allowing users to select the currency at the time of submission. It automatically applies the applicable exchange rate based on configured sources (e.g., OANDA or central bank rates) or allows for manual entry if preferred.

Approved reimbursements are then converted into the company’s base currency for accounting purposes.

Yes. Approved expense claims can be pushed directly into asiaadmin® or other supported payroll systems, allowing reimbursements to be included in the next pay cycle.

This integration reduces manual handling, ensures accuracy, and provides a fully auditable trail from submission to payment. We coordinate with your payroll team to configure the data flow and approval timing.

Our Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about usContact Our Experts

We provide expert advisory and corporate services across Asia, guiding businesses through complex markets and regulations.