Tax calculation for Imports & Exports in Vietnam

The unit volume of each actually imported or exported goods item is listed in the customs declarations. This is then multiplied by the tax calculation price and tax rate of each item (at the time of trade), which can be found in the tariff tables.

Method to Calculate Tax

Payable Tax = Unit volume (of each imported or exported goods item)×Tax calculation price ×Tax rate of each item at time of calculation

Payable Tax = Unit Volume (of each imported or exported goods item) × Absolute tax rate (for a goods unit at time of tax calculations)

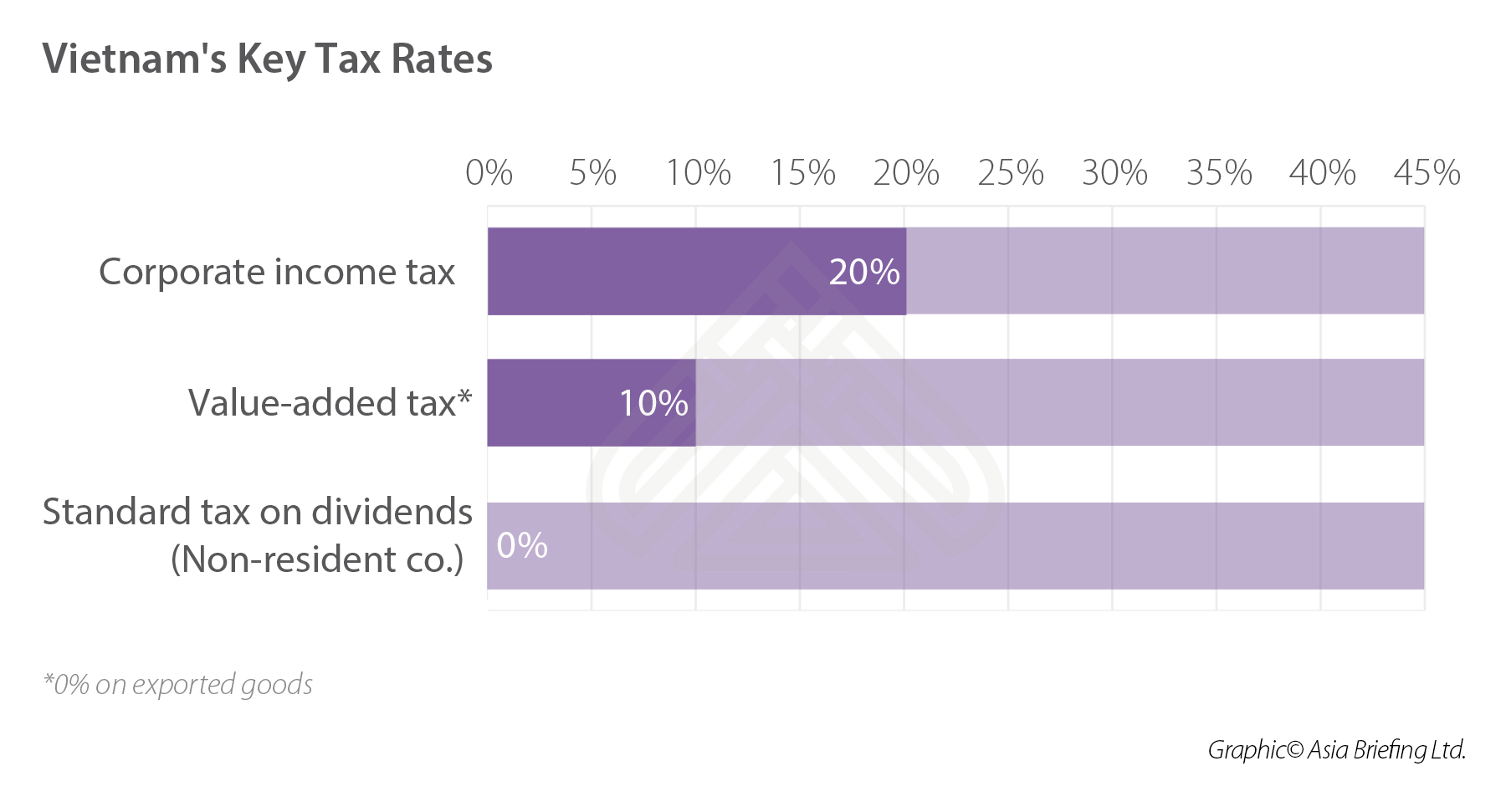

Imports into Vietnam are subject to import tax, Value-added tax (VAT) and, for certain goods, Special Consumption Tax (SCT). The below infographic shows the VAT rate as well as the corporate income tax rate and the standard tax on dividends for non-resident companies:

We provide expert advisory and corporate services across Asia, guiding businesses through complex markets and regulations.