Our collection of resources based on what we have learned on the ground

Resources

magazine

Tax Incentives in India

- March 2018

- Members Access

In this issue of India Briefing magazine, we examine India’s corporate tax structure, analyze the latest trends in India’s tax system, and strategies that companies can use to offset their tax burden. We also answer frequently asked questions on ...

magazine

Tax Incentives in Vietnam

- December 2017

- Members Access

In this issue of Vietnam Briefing, we discuss the importance of taxation to new investment projects and outline the role that corporate tax incentives can play in reducing costs in Vietnam. We highlight Vietnam’s current preferential tax rates and ...

infographic

India's Double Taxation Avoidance Agreements and Withholding Tax Rates (II)

- December 2017

- Members Access

DTAAs prevent double taxation by allowing the tax paid in one of the two countries to be offset against the tax payable in the other country. India has entered into double tax agreements with over 90 countries.

infographic

India's Double Taxation Avoidance Agreements and Withholding Tax Rates (I)

- December 2017

- Members Access

DTAAS prevent double taxation by allowing the tax paid in one of the two countries to be offset against the tax payable in the other country. India has entered into double tax agreements with over 90 countries.

magazine

ASEAN's FTAs and Opportunities for Foreign Businesses

- November 2017

- Members Access

In this issue of ASEAN Briefing magazine, we provide an introduction to some of ASEAN’s FTAs and how foreign investors and exporters can maximize opportunities in this dynamic region. We begin by discussing the salient features of each FTA and the ...

infographic

Taxable Allowances

- May 2017

- Members Access

This infographic shows fully and partly taxable allowances.

infographic

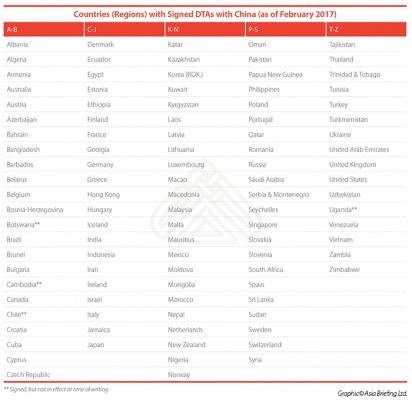

Countries Holding Double Tax Agreements With China

- April 2017

- Members Access

The table shows the countries (regions) with signed DTAs with China (as of February 2017).

infographic

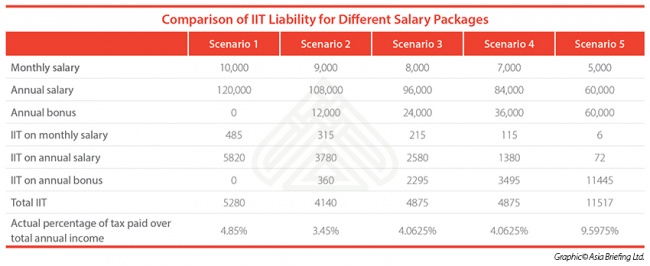

Comparison of IIT Liability for Different Salary Packages

- April 2017

- Members Access

This infographic shows how IIT liability varies depending on the monthly or annual salary and annual bonus.

infographic

Monthly Taxable Income: Chinese and Foreign Nationals

- April 2017

- Free Access

This table and the descriptions presents the tax income of both Chinese and Foreign Nationals that involves based Salary, fringe benefits, Mandatory Social Security contribution, and Deductible allowances.

infographic

Corporate Income Tax Rate Over Time in Singapore

- February 2017

- Members Access

This infographic shows the corporate income tax rate over time, from 1997 to 2017.

infographic

Example of Taxation for a Singapore Holding Company

- February 2017

- Free Access

The table shows how a hypothetical Singapore holding company would be taxed on business profits from a PE in a foreign country.

infographic

Hong Kong's Existing Comprehensive DTAs

- January 2017

- Members Access

These infographics show a list of the existing comprehensive DTAs in Hong Kong.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us