Our collection of resources based on what we have learned on the ground

Resources

video

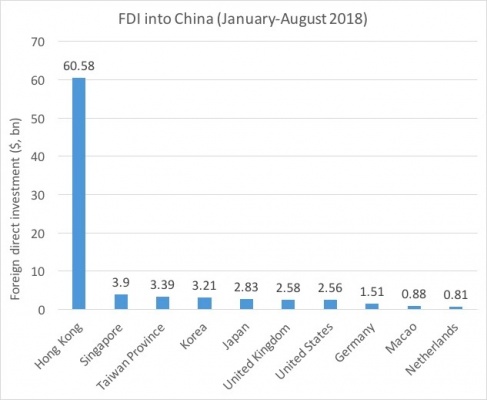

US-China Trade War and Tariffs - Riccardo Benussi's Interview with Scope

- February 2019

- Free Access

Riccardo, Manager for International Business Advisory at Dezan Shira and Associates, discusses the ongoing trade war between China and US and its effects on the global business environment.

infographic

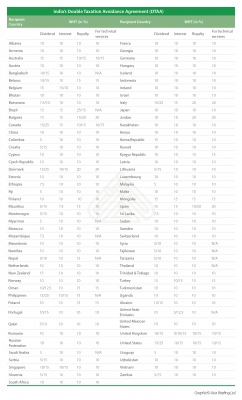

India's DTAA

- February 2019

- Free Access

List of India's Double Taxation Avoidance Agreement

presentation

Outbound Investments - Vietnamese Investment Laws (越南投资的法律、税�...

- January 2019

- Free Access

Daisy Zang, Manager of the Asian Outbound Investment department of Dezan Shira & Associates’ Beijing office, explained outbound policies and shared her professional client experiences at the Vietnam investment conference organized by the Vi...

DTA

Double Taxation Avoidance Agreement Between Hong Kong and India

- January 2019

- Free Access

On March 19, 2018, India and the Hong Kong Special Administrative Region (HKSAR) of China signed a double tax avoidance agreement (DTAA). The DTAA offers protection from double taxation to over 1,500 Indian businesses with a pres...

magazine

Export and Import Procedures in ASEAN: Best Practices

- December 2018

- Members Access

In this issue of ASEAN Briefing magazine, we highlight the region’s export and import procedures for the benefit of trading businesses. We begin by outlining the export procedures in each ASEAN member state. Next, we focus on import procedures in e...

DTA

Double Taxation Agreement between China and India

- November 2018

- Free Access

Double Taxation Agreement between China and India

magazine

The China plus One Strategy in Vietnam

- November 2018

- Members Access

In this issue of Vietnam Briefing magazine, we discuss the growing popularity of China plus one manufacturing. We highlight market entry strategies available to investors, analyze the differences between these locations, and finally highlight the imp...

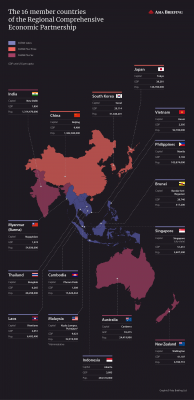

infographic

The 16 Member Countries of the Regional Comprehensive Economic Partnership

- September 2018

- Free Access

magazine

How to Manage Transfer Pricing in China

- May 2018

- Members Access

Countries across Asia have been amending their transfer pricing legislation to come into alignment with the OECD/G20 Action Plan for Tax Base Erosion and Profit Transfer Projects – or the BEPS Action Plan – since it was unveiled in 2015. China an...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us