Our collection of resources based on what we have learned on the ground

Resources

infographic

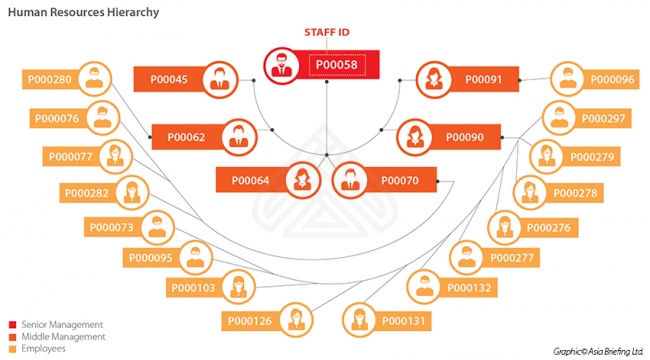

The Human Resources Hierarchy

- April 2017

- Members Access

This infographic explains how the hierarchy structure works in human resources from senior management and finally to basic employee level.

infographic

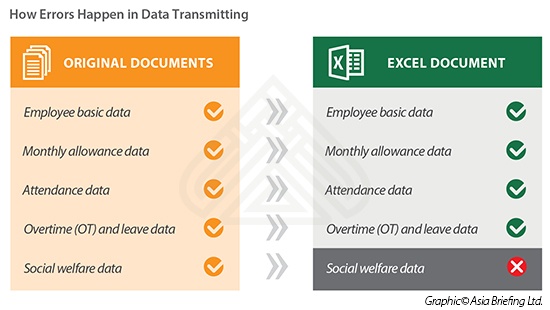

How Errors Happen in Data Transmitting

- April 2017

- Free Access

This infographic shows some of the errors which could happen when transferring original documents to an excel sheet including employee basic data, monthly allowance data, attendance data, etc.

infographic

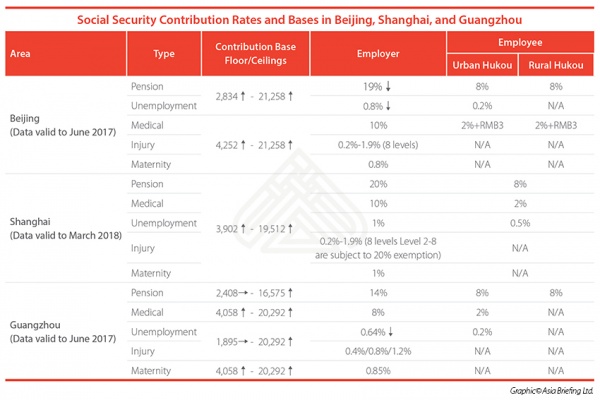

Social Security Contribution Rates and Bases in Beijing, Shanghai, and Guangzhou

- April 2017

- Members Access

This table shows the social security contribution rates in Beijing, Shanghai, and Guangzhou.

infographic

China's Social Security System

- April 2017

- Free Access

This infographic shows the mandatory benefits types in China's Social Security System, including housing fund, pension, medical, maternity, unemployment and work-related injury insurance.

infographic

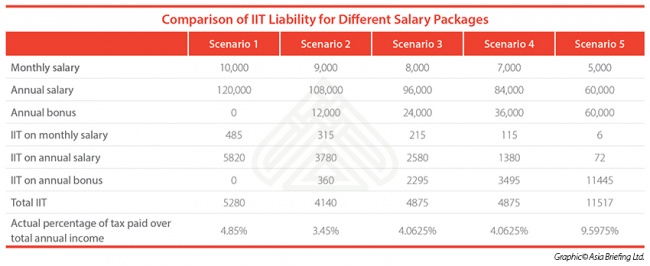

Comparison of IIT Liability for Different Salary Packages

- April 2017

- Members Access

This infographic shows how IIT liability varies depending on the monthly or annual salary and annual bonus.

infographic

Taxable Income of Foreign Individuals

- April 2017

- Free Access

The infographic above explains the income sourced within China from less than 90 days starting from income sourced within China

infographic

Monthly Taxable Income: Chinese and Foreign Nationals

- April 2017

- Free Access

This table and the descriptions presents the tax income of both Chinese and Foreign Nationals that involves based Salary, fringe benefits, Mandatory Social Security contribution, and Deductible allowances.

magazine

Working as an Expat in India

- March 2017

- Members Access

In this issue of India Briefing Magazine, we look at India’s living and working environment, HR and payroll laws, and the taxation norms as applicable to foreign nationals. India is the second most favored destination for expatriates that want to w...

infographic

Personal Income Tax in ASEAN

- March 2017

- Members Access

This infographic shows the level of the personal income tax across ASEAN countries.

infographic

Comparison Between China Wages and Other Asian Countries

- March 2017

- Free Access

This table compares the national minimum wage and the adjusted social insurance contributions for employers between China and other Asian countries.

Q&A

What are the visa requirements for foreign nationals working in India?

- March 2017

- Members Access

The Indian government is progressively working on simplifying and liberalizing its visa regime. With regards to the working visa, an employee is eligible if they are at least 18 years old and in good health. Moreover, the applicant has to fill a posi...

Q&A

What characterizes the Indian business environment and working culture?

- March 2017

- Free Access

India’s business etiquette includes a mixture of Western and Eastern practices, but local customs do permeate relationships. The concept of hierarchy between management levels is widely accepted and respected in the workplace. This ...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us