Our collection of resources based on what we have learned on the ground

Resources

infographic

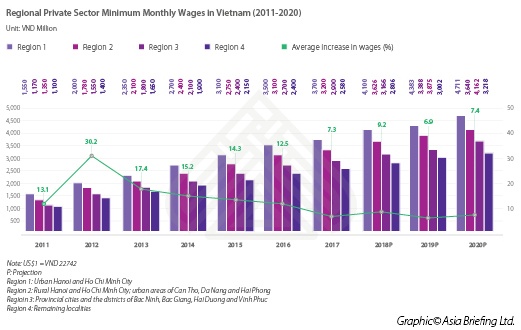

Regional Private Sector Minimum Monthly Wages in Vietnam

- May 2017

- Members Access

This graph shows the regional minimum monthly wages in Vietnam's private sector.

infographic

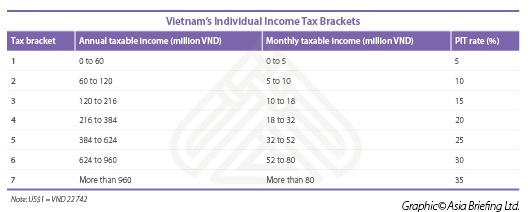

Vietnam's Individual Income Tax Brackets

- May 2017

- Members Access

This table shows Vietnam's individual income tax brackets.

infographic

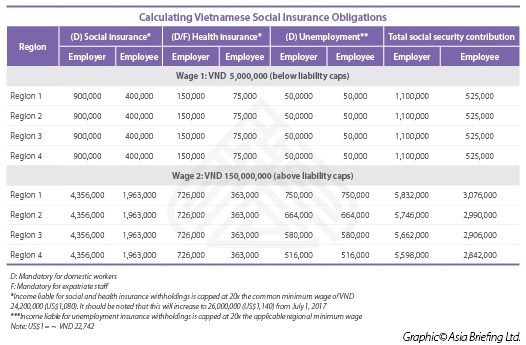

Vietnamese Social Insurance Obligations Calculation

- May 2017

- Members Access

This table shows how to calculate social security obligations in Vietnam.

infographic

Vietnam's Annual Compliance Calendar

- May 2017

- Members Access

This table shows the calendar for income tax and social security annual compliance in Vietnam.

infographic

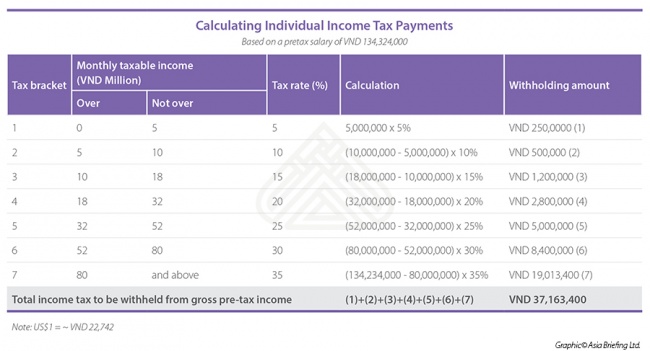

Calculating Individual Income Tax Payments in Vietnam

- May 2017

- Members Access

This table shows how to calculate individual income tax payments based on a pretax salary of VND 134,324,000.

infographic

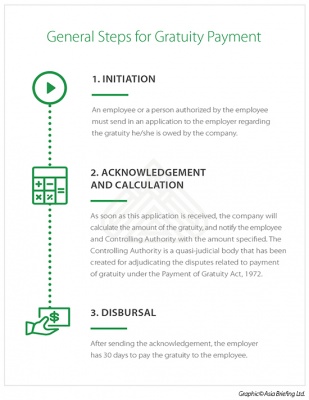

General Steps for Gratuity Payment

- May 2017

- Members Access

This infographic shows the steps needed to calculate gratuity payment.

infographic

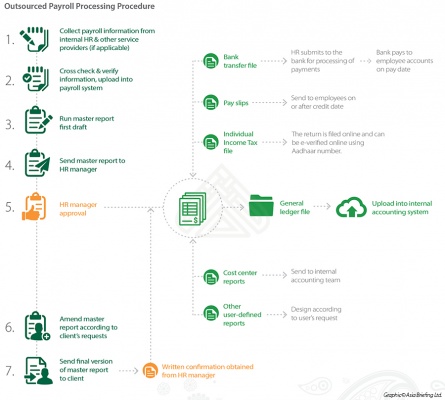

Outsourced Payroll Processing Procedure

- May 2017

- Members Access

This infographic shows the 7 steps in outsourcing payroll processing.

report

Introducción: Hacer Negocios en China 2017

- May 2017

- Members Access

La guía Hacer Negocios en China 2017 está diseñada para introducir los fundamentos de la inversión en China. Compilada por los profesionales de Dezan Shira & Associates, esta guía es ideal, no sólo para las empresas que buscan entrar en el mer...

magazine

Payroll Processing and Compliance in India

- May 2017

- Members Access

In this issue of India Briefing Magazine, we discuss payroll processing and reporting in India, and the various regulations and tax norms that impact salary and wage computation. Further, we explain India’s complex social security system and gratui...

infographic

Taxable Allowances

- May 2017

- Members Access

This infographic shows fully and partly taxable allowances.

infographic

Calculation of Tax in Metropolitan and Non-Metropolitan Areas

- May 2017

- Members Access

This infographic shows tax calculations in metropolitan and non-metropolitan areas, based on an annual income of RS 1,500,000.

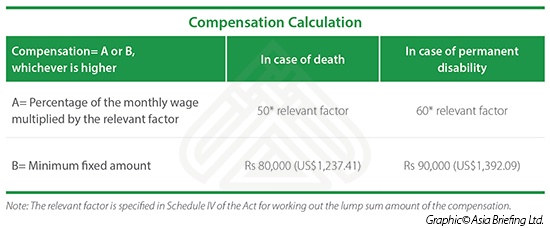

infographic

Compensation Calculation

- May 2017

- Members Access

This table shows how to calculate compensation in case of death or permanent disability.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us