Our collection of resources based on what we have learned on the ground

Resources

Q&A

How are individuals taxed in Hong Kong, and who must file annual tax returns in ...

- February 2015

- Free Access

Individuals are taxed at a progressive rates on their net chargeable income (i.e assessable income after deductions and allowances) starting at 2% and ending at 17% or at a standard rate of 15% on net income (i.e. income after deductions), depending ...

Q&A

How are employer tax compliance requirements different in India than any other A...

- February 2015

- Free Access

Employers are required to withhold tax on various payments including rent, interest, dividend, royalty, and service income. In this sense, the compliance requirements for employers are more complex in India than in any other countries explored. Busin...

magazine

Establishing Your Sourcing Platform in India

- November 2014

- Members Access

In this issue of India Briefing, we highlight the advantages India possesses as a sourcing option and explore the choices available to foreign companies seeking to create a sourcing presence here. In addition, we examine the relevant procurement, pro...

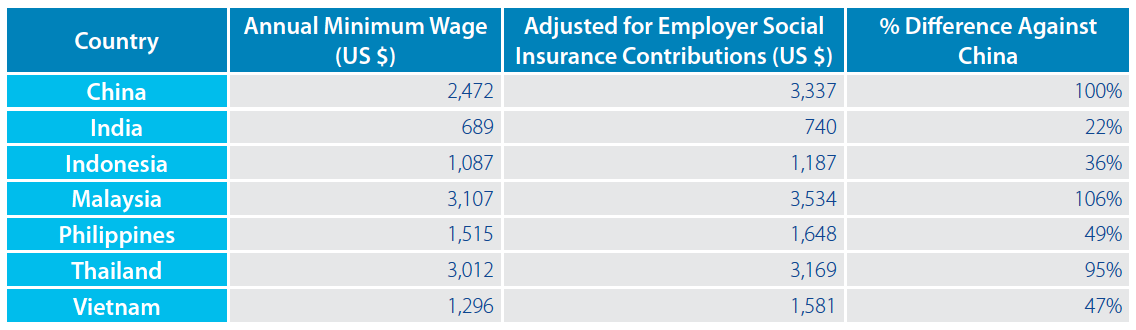

infographic

Comparison between China wages with other Asian countries

- July 2014

- Free Access

This infographic details the different amount of minimum wage across countries in Asia and draws comparisons with China.

presentation

Mandatory Benefit Administration and Payroll Processing in China

- May 2014

- Members Access

A presentation by Adam Livermore, Partner and Regional Manager, demonstrating a typical payroll processing implementation, the usage of dispatch agreements and the responsibilities of the employer with regards to the mandatory benefits system in Chin...

presentation

Payroll Processing and HR Administration

- May 2014

- Free Access

Adam Livermore, Partner and Regional Manager, discusses outsourced payroll processing procedures and services as well as HR administration services.

presentation

Explaining the Monthly Payroll Process in China: What Does Your HR Manager Reall...

- May 2014

- Free Access

This presentation by Adam Livermore, Payroll & HR Admin Manager, will draw a practical guide on monthly payroll processing for your business in China from a HR manager perspective.

Q&A

Do female employees get paid maternity leave in China?

- May 2014

- Free Access

The Special Provisions on Labor Protection of Female Workers promulgated by the Chinese State Council on April 28, 2012, state that a pregnant female employee should be given 98 days of maternity leave, of which 15 days can be taken prior to givin...

Q&A

What are the regulations regarding unemployment insurance in China?

- May 2014

- Free Access

Employers should contribute 2 percent of the total salary paid to its employees to the unemployment insurance fund, while employees should pay 1 percent of their own wages to the fund. The Unemployment Insurance Regulations provide that the amount o...

Q&A

What are the consequences of a foreigner leaving China before they can use their...

- May 2014

- Free Access

If the foreigner leaves China prior to reaching the prescribed statutory age for pension withdrawal, their social insurance personal account will be retained, and the contribution years will be calculated on a cumulative basis if they come back to Ch...

Q&A

When can an individual collect basic pension in China?

- May 2014

- Free Access

An individual can collect basic pension on a monthly basis if the cumulative premium payment period reaches 15 years at the time he or she reaches the statutory retirement age. In China, the statutory retirement age for men is 60; for white-collar fe...

Q&A

Is it possible for an individual to transfer their pension funds to another juri...

- May 2014

- Free Access

When an employee moves from one jurisdiction to another, they will be able to transfer their pension funds and, when they retire, they will be able to receive a pension amount based on the entire amount of their accumulated funds. Once the personal a...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us