Our collection of resources based on what we have learned on the ground

Resources

Q&A

Which deductions can be made from an employee's salary according to the Vietname...

- May 2017

- Members Access

Currently, the following deductions are permitted under the Vietnamese tax code: Personal allowances of VND 9 million (US$395); Dependent allowances of VND 3.6 million (US$158) per dependent; All mandatory contributions to Vietnam’s social...

Q&A

What are the main benefits of outsourcing payroll for companies in Vietnam?

- May 2017

- Members Access

Savings are now kicking in in Vietnam as companies can handle their HR processes remotely. Yet, the main motivation for companies to choose an outsourced model is the ability to achieve more consistency in data management, greater transparency for ma...

magazine

Payroll Management in Vietnam

- May 2017

- Members Access

In this edition of Vietnam Briefing, we discuss Vietnam’s current statutory requirements regarding payment, social insurance withholdings, and individual income taxation. We go on to explain the areas where compliance is likely to become a concern ...

infographic

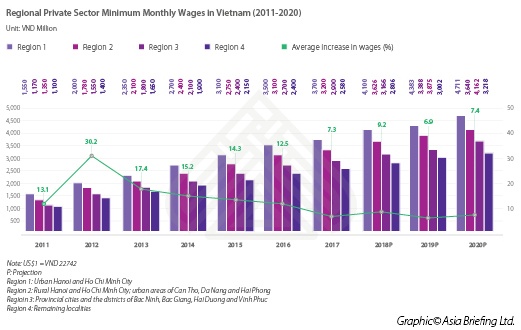

Regional Private Sector Minimum Monthly Wages in Vietnam

- May 2017

- Members Access

This graph shows the regional minimum monthly wages in Vietnam's private sector.

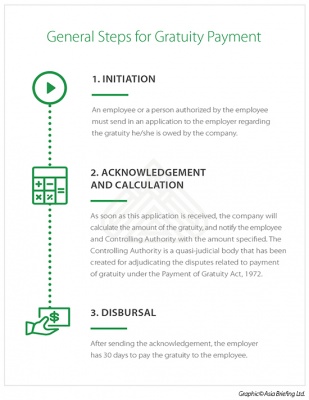

infographic

General Steps for Gratuity Payment

- May 2017

- Members Access

This infographic shows the steps needed to calculate gratuity payment.

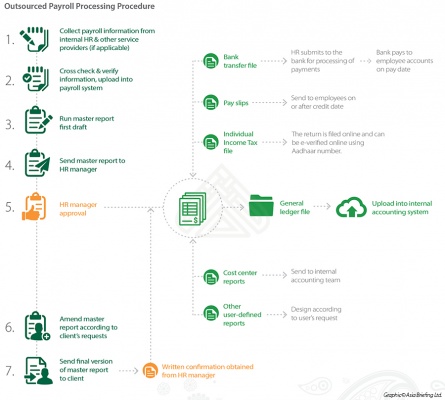

infographic

Outsourced Payroll Processing Procedure

- May 2017

- Members Access

This infographic shows the 7 steps in outsourcing payroll processing.

report

Introducción: Hacer Negocios en China 2017

- May 2017

- Members Access

La guía Hacer Negocios en China 2017 está diseñada para introducir los fundamentos de la inversión en China. Compilada por los profesionales de Dezan Shira & Associates, esta guía es ideal, no sólo para las empresas que buscan entrar en el mer...

magazine

Payroll Processing and Compliance in India

- May 2017

- Members Access

In this issue of India Briefing Magazine, we discuss payroll processing and reporting in India, and the various regulations and tax norms that impact salary and wage computation. Further, we explain India’s complex social security system and gratui...

infographic

Taxable Allowances

- May 2017

- Members Access

This infographic shows fully and partly taxable allowances.

infographic

Calculation of Tax in Metropolitan and Non-Metropolitan Areas

- May 2017

- Members Access

This infographic shows tax calculations in metropolitan and non-metropolitan areas, based on an annual income of RS 1,500,000.

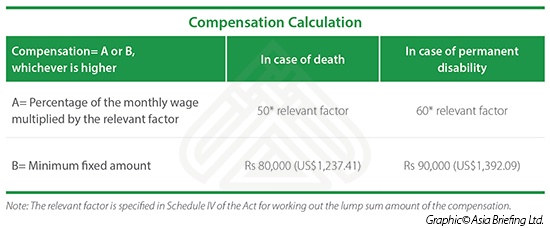

infographic

Compensation Calculation

- May 2017

- Members Access

This table shows how to calculate compensation in case of death or permanent disability.

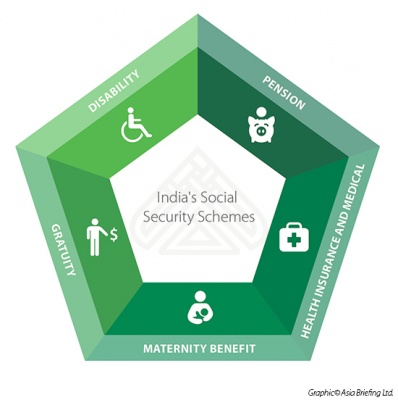

infographic

India's Social Security Schemes

- May 2017

- Members Access

This infographic explains five of India's social security schemes.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us