Our collection of resources based on what we have learned on the ground

Resources

Q&A

What are the consequences of social security offences committed by employers in ...

- April 2017

- Members Access

Starting from January 2017, labor and social security offences committed by employers – including “failure to pay employees’ remuneration without reason” or “failure to pay or enroll in social insurance premiums” &...

Q&A

How can IT solutions help improve efficiency in payroll processing in China?

- April 2017

- Free Access

The HR and payroll processes of many companies operating in China are still paperbased or recorded on obsolete digital archives. Single function software such as tax processing programs can thus be a solution for both small and medium enterprises, bu...

Q&A

What are the benefits of outsourcing payroll processing in China to a third part...

- April 2017

- Members Access

New market entrants, SMEs with limited budget and rapidly expanding companies are particularly advised to outsource their payroll processing. By outsourcing payroll, businesses can increase its accuracy, decrease the room for errors that may cause re...

infographic

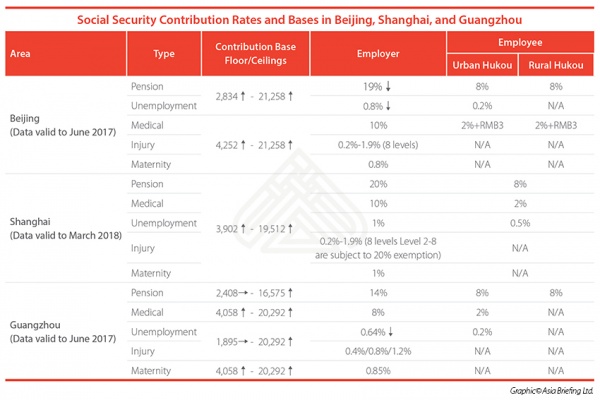

Social Security Contribution Rates and Bases in Beijing, Shanghai, and Guangzhou

- April 2017

- Members Access

This table shows the social security contribution rates in Beijing, Shanghai, and Guangzhou.

infographic

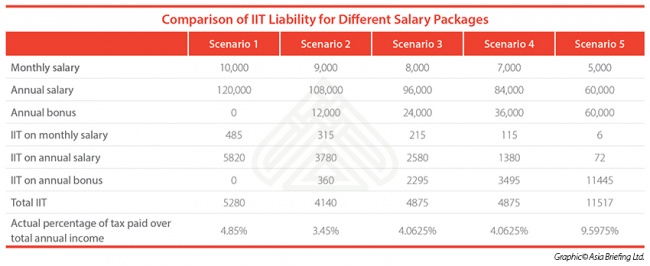

Comparison of IIT Liability for Different Salary Packages

- April 2017

- Members Access

This infographic shows how IIT liability varies depending on the monthly or annual salary and annual bonus.

infographic

Taxable Income of Foreign Individuals

- April 2017

- Free Access

The infographic above explains the income sourced within China from less than 90 days starting from income sourced within China

magazine

Working as an Expat in India

- March 2017

- Members Access

In this issue of India Briefing Magazine, we look at India’s living and working environment, HR and payroll laws, and the taxation norms as applicable to foreign nationals. India is the second most favored destination for expatriates that want to w...

Q&A

Do foreign nationals working in India have to contribute to the country’s soci...

- March 2017

- Members Access

India’s social security system is regulated by the Employee Provident Fund and Miscellaneous Provisions Act, 1952 (PF Act). The PF Act was amended in 2008 and now includes a new category of employees called International Workers (IWs). Th...

Q&A

To what extent do people falling under the visa category “International Worker...

- March 2017

- Members Access

One who is under the visa category of International Worker and employed in India prior to 1September 2014 will contribute 12% of their salary to the Provident Fund Scheme, while the employer will make an equal contribution of 12% but this will be spl...

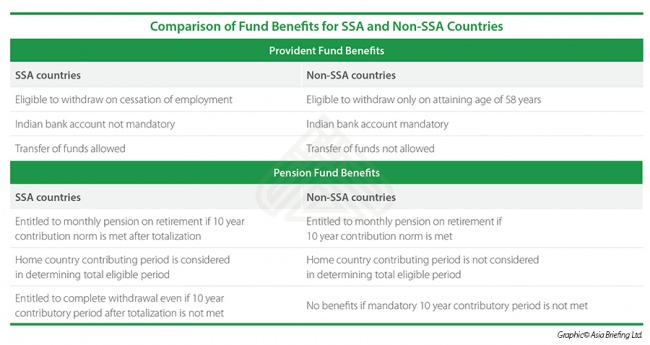

infographic

Social Security Obligations for Foreign Nationals Working in India

- March 2017

- Members Access

Countries with whom India has a Social Security Agreement (SSA) benefit from particular conditions.

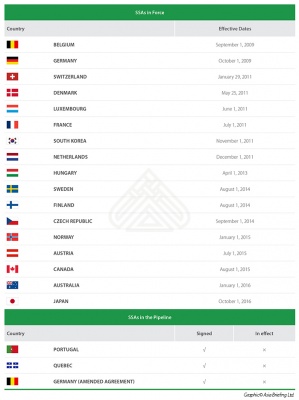

infographic

Social Security Agreements (SSA) in Force between India and Other Countries

- March 2017

- Free Access

Currently there are 17 Social Security Agreements (SSA) in force between India and other countries, plus 3 that have been signed but not yet implemented.

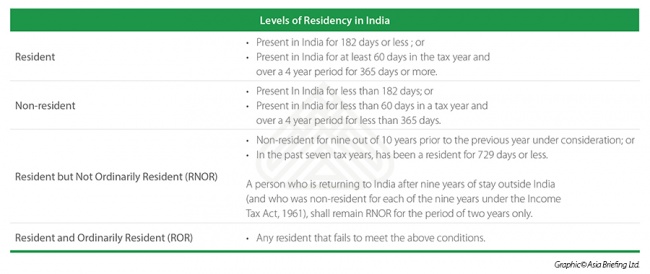

infographic

Levels of Residency in India

- March 2017

- Members Access

Foreign employees in India must file tax returns by 31 July. When filing, expatriate workers should be aware of their residential status, on which the taxability will be based.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us