Our collection of resources based on what we have learned on the ground

Resources

Q&A

How is corporate income tax (CIT) calculated in Asia?

- January 2015

- Free Access

Corporate Income Tax (CIT) is levied on the profits of a company. The rate varies considerably for different countries - it can be anywhere between 17 and 40% and is determined by various different factors including the priorities of the government, ...

Q&A

How does indirect tax differ from corporate income and individual income tax in ...

- January 2015

- Free Access

Indirect tax adds to the price of a product which makes the consumer indirectly pay the rate of taxation. For corporate and individual income tax, a business or individual has to pay the necessary amount directly to the government. Also, the indirec...

Q&A

What is withholding tax and how is it paid in Asia?

- January 2015

- Free Access

Withholding tax is kept back from an employee's salary and is subsequently paid to the government to combat tax evasion. It is divided into royalties, dividends and interest in Asia, however the amount varies depending on the country.

Q&A

How is individual income tax (IIT) calculated in Asia?

- January 2015

- Free Access

In Asian countries individuals are taxed according their salary. Therefore those with a higher salary will have to pay higher taxes. However, rates vary in different Asian countries and could be anywhere between 17 and 45%. Exceptions of this are Br...

Q&A

What are the current sales and service tax rates in Malaysia?

- January 2015

- Free Access

In Malaysia, service tax is currently at 6% and is calculated based on the value of taxable services provided by the individual. However, on 1st April 2015 a 6% goods and services tax (GST) will replace the current sales and service tax.

Q&A

How do China's tax treaties affect withholding tax payments for dividends, inter...

- January 2015

- Free Access

If the tax rate written in the relevant treaty is higher than 10%, the tax will be fixed at 10%. If the rate specified in the treaty is lower than 10%, the amount of tax payable will be the amount specified.

magazine

The Asia Sourcing Guide 2015

- January 2015

- Members Access

In this issue of Asia Briefing, we explain how and why the Asian sourcing market is changing, compare wage overheads, and look at where certain types of products are being manufactured and exported. We discuss the impact of ASEANâs Free Trade Ag...

Q&A

What is the significance of ASEAN?s Free Trade Agreements with China and India?

- January 2015

- Free Access

The Free Trade Agreements (FTAs) between these countries have removed import/export tariffs on 90 percent of all manufactured goods to zero essentially. Therefore, preferential access to ASEAN manufacturing is not solely granted to countries within t...

Q&A

What is the difference between ?indirect? and ?direct? sourcing in Asia?

- January 2015

- Free Access

An indirect method of managing a sourcing operation means employing offices that cannot undertake any commercial or industrial activities, receive payment in local currency, or manage export/import activities. Indirect methods are relatively uniform ...

Q&A

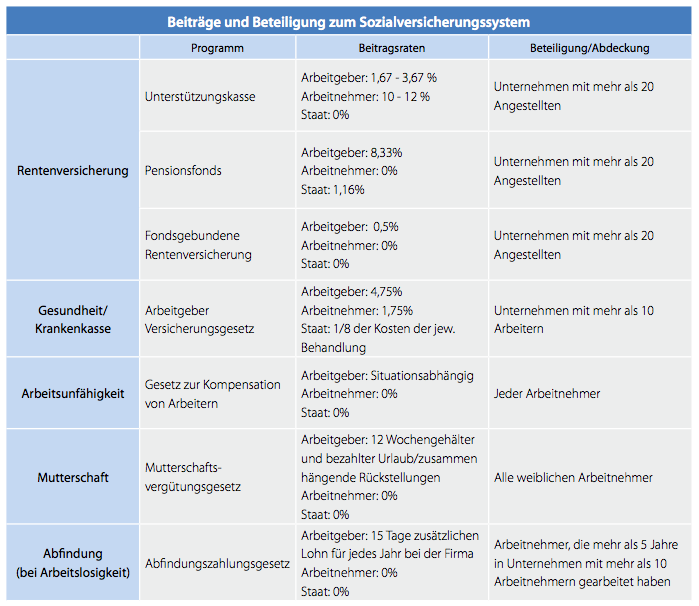

Wie ist das Sozialsystem in Indien aufgebaut?

- December 2014

- Free Access

In Indien sind die Sozialleistungen nicht für das ganze Volk zugänglich, lediglich Arbeitnehmer im formellen Sektor sind sozialversicherungspflichtig und können dadurch die Sozialleistungen Rente, Krankenversicherung, Mutterschaft, Abfindung bei A...

infographic

Indien: Beitr�ge und Beteiligung zum Sozialversicherungssystem

- December 2014

- Free Access

Diese Tabelle beschreibt das Sozialversicherungssystem Indiens näher. Welches Programm und welchen Anteil die Arbeitgeber bzw. Arbeitnehmer zahlen, wird für die Rentenversicherung, die Krankenkasse, Arbeitsunfähigkeit, Mutterschaft und Arbeitslosi...

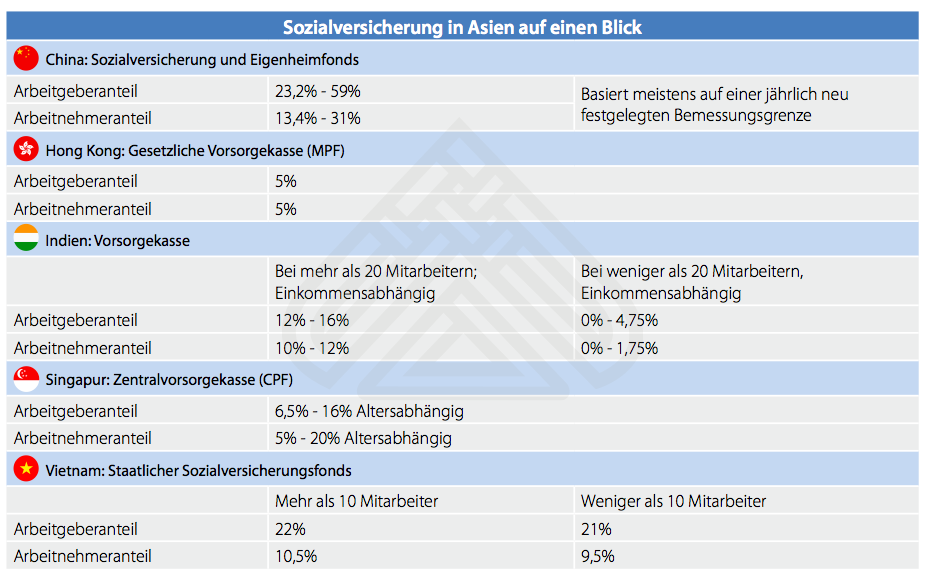

infographic

Sozialversicherung in Asien auf einen Blick

- December 2014

- Free Access

Die Sozialsteuersysteme von China, Indien, Hong Kong, Singapur und Vietnam unterscheiden sich in einigen Punkten, wie z.B. die Höhe der Beiträge. Folgende Tabelle gibt einen Überblick über die Sozialsteuersysteme dieser Länder.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us