Our collection of resources based on what we have learned on the ground

Resources

Q&A

Why is Singapore such an important source of Foreign Direct Investment (FDI) int...

- February 2015

- Free Access

Singapore accounted for almost 25% of India’s total Foreign Direct Investment (FDI) in 2013-14. This large share is explained by a provision of Singapore Double Tax Agreement (DTA) with India – the Limitation of Benefit (LoB). The LoB pro...

Q&A

How are employer tax compliance requirements different in India than any other A...

- February 2015

- Free Access

Employers are required to withhold tax on various payments including rent, interest, dividend, royalty, and service income. In this sense, the compliance requirements for employers are more complex in India than in any other countries explored. Busin...

Q&A

What is the significance of PAN to employers in India?

- February 2015

- Free Access

In addition to witholding individual income tax monthly, businesses must issue an annual certificate within two months from the end of the tax year to employees regarding the amount of tax deducted at the source of income. All employees must be...

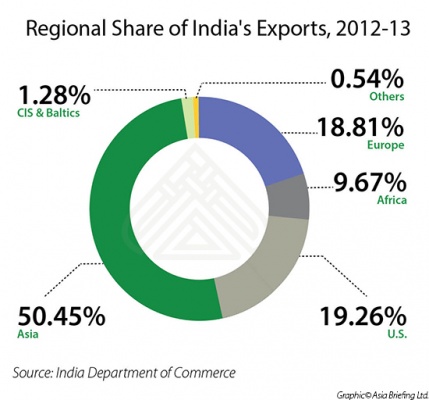

infographic

Regional Share of India's Exports, 2012-13

- February 2015

- Free Access

This infographic shows the regions that India exports mostly to. These numbers are highly influenced by India's free trade agreements.

infographic

Overview of the BIMSTEC Trade Bloc

- February 2015

- Free Access

This infographic displays an overview of the BIMSTEC trade bloc of which India is a part of.

infographic

India's Other Trade Agreements

- February 2015

- Free Access

This infographic displays the "other" trade agreements India has, apart from the agreements mentioned in the February 2015 India Briefing Magazine: "Understanding India's Free Trade and Double Tax Agreements"

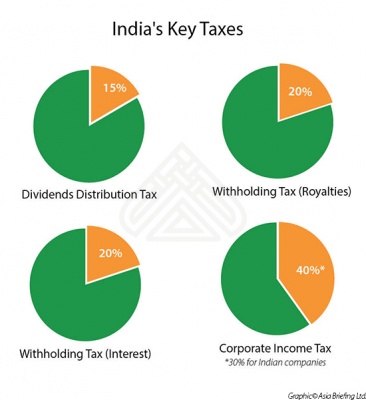

infographic

India's Key Taxes

- February 2015

- Free Access

This infographic displays India's key corporate tax rates

infographic

Country List of India's Comprehensive Agreements on Double Taxation

- February 2015

- Free Access

This infographic displays a list of country that India has comprehensive agreements on double taxation with.

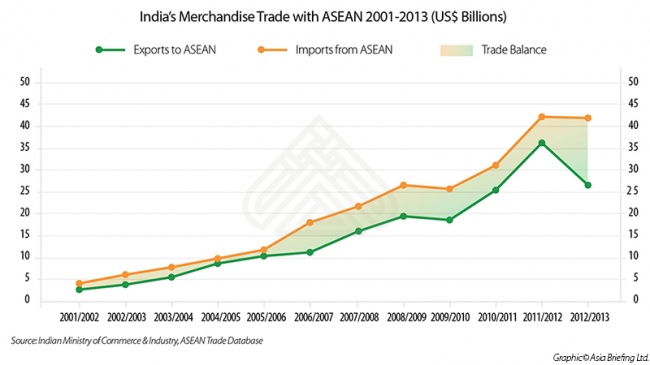

infographic

India's Merchandise Trade with ASEAN (2001-2013)

- February 2015

- Free Access

This infographic shows the increase that trade between India and ASEAN has seen over the last 15 years.

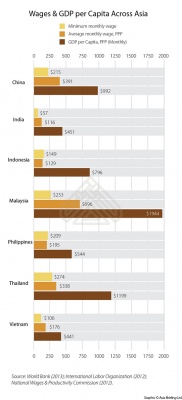

infographic

Wages & GDP per Capita Across Asia

- January 2015

- Free Access

This infographic compares minimum monthly wage, average monthly wage and GDP per Capita across various Asian countries.

videographic

An Introduction to India's Free Trade Agreements

- January 2015

- Free Access

This prezi introduces you the free trade structures that India engages and the free trading partners India collaborates with

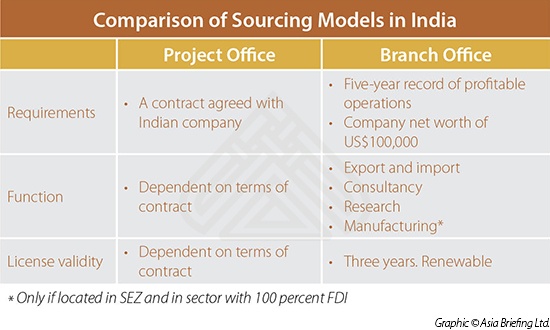

infographic

Comparison of Sourcing Models in India

- January 2015

- Free Access

This infographic compares the two commonly used sourcing models in India.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us