Our collection of resources based on what we have learned on the ground

Resources

infographic

Corporate Structuring in India, China - WFOE vs WOS

- September 2018

- Free Access

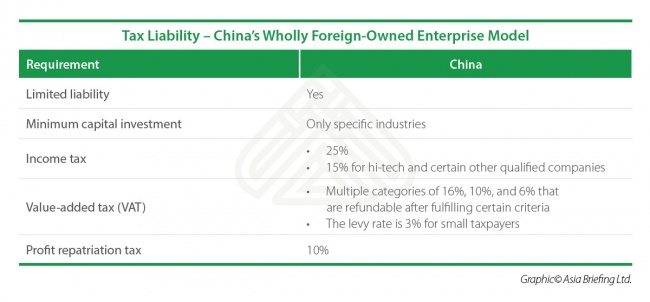

In China, a wholly foreign-owned enterprise (WFOE) is a limited liability company (LLC) formed by one or more foreign investor(s). In this type of corporate structure, there is no mandatory requirement to collaborate with a domestic partner...

infographic

Monthly Wages in China's First Tier Cities

- September 2018

- Free Access

This year, the first tier cities in China—Shanghai, Shenzhen, Beijing, and Guangzhou—showed a GDP growth of more than six percent, with Shenzhen touching the eight percent growth mark. The jump in GDP is attributed to the ...

infographic

Market Share of Mobile vs Non-Mobile Payments in China

- September 2018

- Free Access

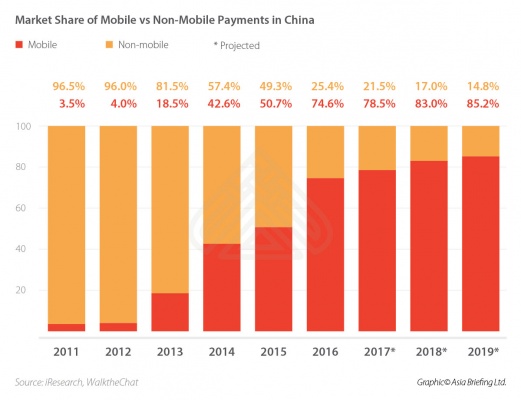

The way Chinese consumers make payments has changed drastically over the last decade. In 2012, 96 percent of payments were still made in cash. Fast forward to 2018, 85.2 percent of payments are made via mobile payment modes. The Chinese market is e...

infographic

Highlights of the 2018 State Investment Potential Index- Doing Business in India

- September 2018

- Free Access

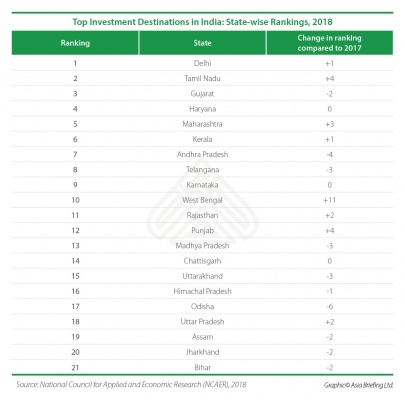

The NCAER publishes its annual State Investment Potential Index by reviewing Indian states based on six key categories – land, labor, infrastructure, economic climate, political stability and governance, and business perceptions. The top-performin...

infographic

Singapore's Corporate Income Tax – Quick Facts

- August 2018

- Free Access

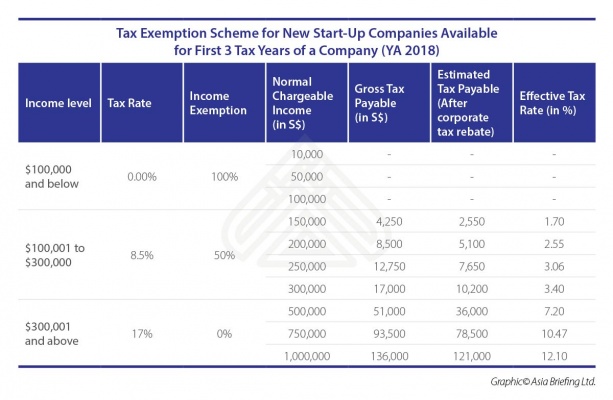

Singapore is globally renowned for its competitive tax structure. The country imposes a flat rate of 17 percent corporate income tax (CIT) – lowest among the ASEAN member states. The single-tier corporate tax system reduces compliance cos...

infographic

Contemporaneous Documentation in China

- May 2018

- Free Access

An overview of the documents needed to be prepared and submitted to tax authorities in China, depending on the scope of business.

infographic

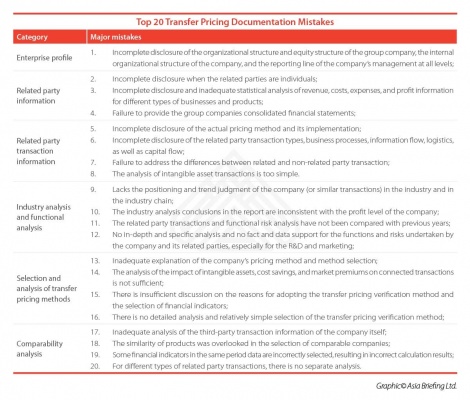

Top 20 Transfer Pricing Documentation Mistakes

- May 2018

- Free Access

Advice on what to watch out for when preparing transfer pricing documents.

infographic

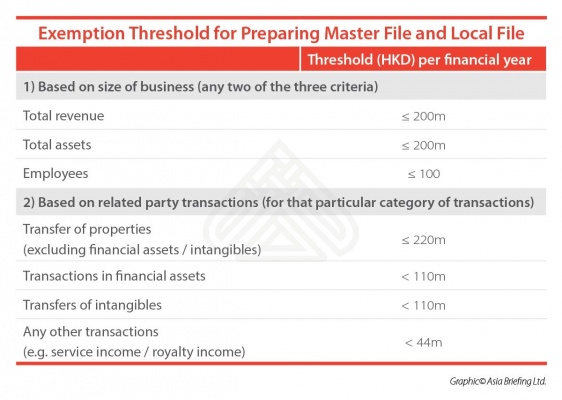

Exemption Threshold for Preparing Master File and Local File

- May 2018

- Free Access

All companies carrying out trade or business in Hong Kong are required to prepare master and local file reports for accounting periods beginning on or after April 1, 2018, unless they meet one of the exemption thresholds available, as shown in the ta...

infographic

India's Double Taxation Avoidance Agreements and Withholding Tax Rates (II)

- December 2017

- Members Access

DTAAs prevent double taxation by allowing the tax paid in one of the two countries to be offset against the tax payable in the other country. India has entered into double tax agreements with over 90 countries.

infographic

ASEAN-India Trade in Goods 2014-2016

- December 2017

- Free Access

This infographic shows the trade balance between India and ASEAN from 2014 to 2016.

infographic

Singapore-India FDI Flows 2014-2016

- December 2017

- Free Access

This infographic shows the foreign direct investment flows between India and Singapore.

infographic

India's Free Trade Agreements

- December 2017

- Free Access

India has negotiated trade liberalization arrangements with several countries and trade blocs.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us