Our collection of resources based on what we have learned on the ground

Resources

infographic

Individual Income Tax Rates in China

- May 2013

- Members Access

The table shows the formula, rates and deductions of Individual Income Tax (IIT) rates in China.

infographic

Countries with Double Taxation Avoidance Agreements with China

- May 2013

- Free Access

The table shows the countries which have double taxation avoidance agreements with China as of January 2013.

infographic

Corporate Tax Rates in Vietnam and China

- March 2013

- Free Access

The graph compares the Corporate Taxes between Vietnam and China

infographic

Corporate Tax Rates in India and China

- March 2013

- Free Access

The graph compares the Corporate Taxes between India and China.

infographic

Chinese Consumption Tax Formula

- March 2013

- Members Access

The formulas show how to calculate Consumption Tax (CT) in China

infographic

Chinese Value-Added Tax Formula

- March 2013

- Members Access

The formula shows how to calculate Value-added tax (VAT) in China.

infographic

Annual Compliance Timeline for China Foreign-Invested Entities

- January 2013

- Free Access

The table shows the timeline of annual compliance for China foreign-invested entities (FIEs).

infographic

Comparison of Indian Corporate Income Tax Rates

- January 2013

- Members Access

The table compares the Corporate Income Tax (CIT) rates for domestic and foreign companies in India.

infographic

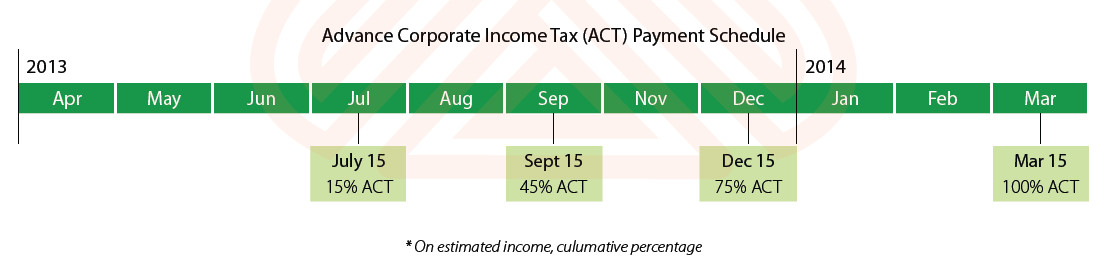

Advance Corporate Income Tax (ACT) Payment Schedule for Indian

- January 2013

- Members Access

The timeline shows the payment schedule of Advance Corporate Income Tax (ACT) for Indian companies.

infographic

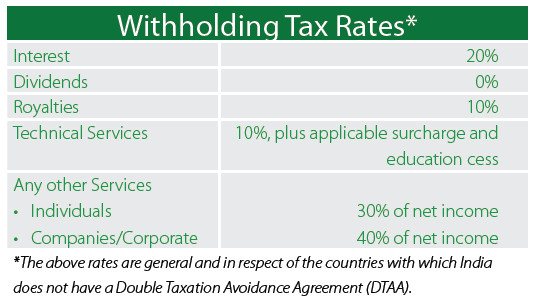

Withholding Tax Rates in India

- January 2013

- Free Access

The table outlines the percentage of withholding tax rates in India.

infographic

Individual Income Tax Rates 2013-14 in India

- January 2013

- Free Access

A table comparing the individual income tax rates in India between 2013-14 and in 2012-13

infographic

Interests and Loyalties under Indian Double Taxation Avoidance Agreements (DTAA)

- January 2013

- Members Access

The tables shows the interest and loyalty rates under Indian double taxation avoidance agreements (DTAA) in different countries.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us