Our collection of resources based on what we have learned on the ground

Resources

infographic

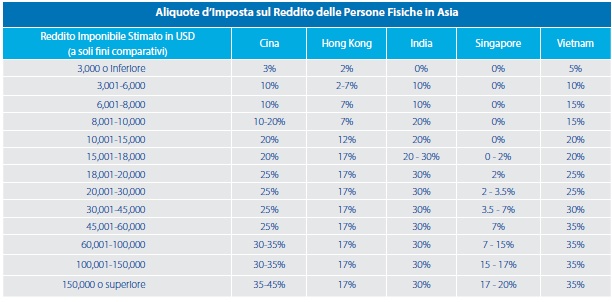

Aliquote di Imposta sul Reddito della Persone Fisiche in Asia

- August 2014

- Free Access

Questo infographic mostra e confronta le diverse aliquote sul reddito di persone fisiche in: Cina, Hong Kong, India, Singapore e Vietnam.

Q&A

What is the Directorate General of Foreign Trade (DGFT) and what steps are neces...

- July 2014

- Free Access

The Directorate General of Foreign Trade (DGFT) is the body which oversees India’s Export-Import (EXIM) policy. In order to bring goods into India, importers are required to register with the DGFT and receive an Importer Exporter Code (IEC). Fu...

Q&A

What types of joint ventures (JVs) are available for foreign firms and investors...

- July 2014

- Free Access

Entering into a joint venture (JV) with a local company can provide benefits such as brand exposure for foreign firms in the Indian market while avoiding the risks associated with establishing local branches or subsidiaries. Licensing JVs entail an I...

infographic

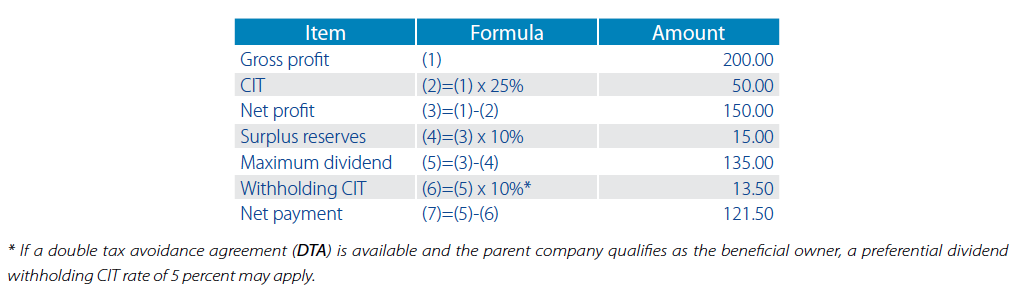

Tax Burdens of Paying Dividends from China to Overseas

- July 2014

- Free Access

This infographic shows the tax burdens when dividends are being paid out of China to overseas.

infographic

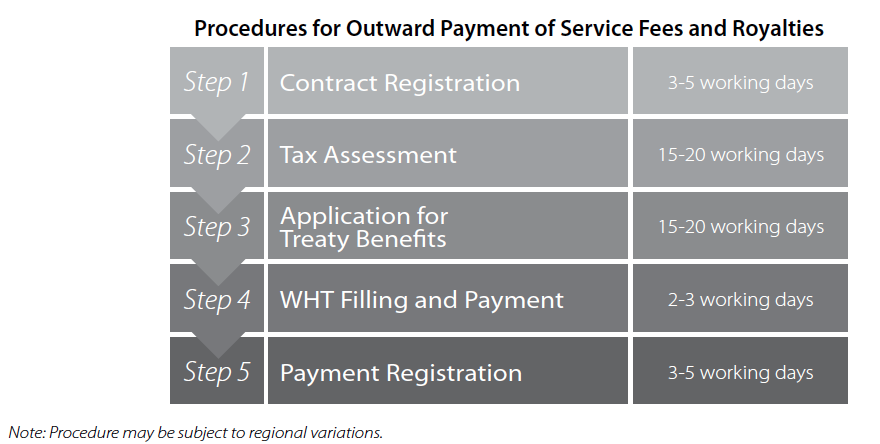

Procedures for Outward Payment of Service Fees and Royalties

- July 2014

- Free Access

This infographic details the necessary steps which need to be taken for outward payment of service fees and royalties.

infographic

Annual Compliance Timeline in China

- July 2014

- Free Access

A timeline outlining the process for annual tax compliance, including the steps which need to be taken and the deadlines which must be met.

infographic

Procedures for the Declaration & Repatriation of Dividends in China

- July 2014

- Free Access

This infographic details the steps that need to be taken during the procedure for declaring and repatriating dividends.

Q&A

What factors would hamper the determination of being a beneficial owner in China...

- July 2014

- Free Access

In determining whether the non-resident company is indeed the beneficial owner of the royalties, the tax authorities will apply a “substance over form” principle and conduct analysis based on the actual circumstances of the case. In gener...

Q&A

When are service fees deemed to be royalty fees in China?

- July 2014

- Free Access

In accordance with Circular No. 507 [2009], if, in the course of the transfer or licensing of technical know-how, a licensor assigns personnel to support and guide the licensee in using the technical know-how and charges fees for these services, then...

Q&A

Can a company repatriate all their profits made in China?

- July 2014

- Free Access

Only profit that has undergone annual audit can be repatriated. Annual audit for tax compliance conducted by the local tax authority is usually completed around June or July every year. The audit allows the State Administration of Taxation (SAT) t...

Q&A

When is profit allowed to be repatriated in China?

- July 2014

- Free Access

Profit is allowed to be repatriated in China if an entity complies with all of the following points: The wholly foreign-owned enterprise’s (WFOE) registered capital has been injected within the time limits as set out in the Article of Associ...

Q&A

Why are double taxation avoidance agreements (DTAs) beneficial to companies repa...

- July 2014

- Free Access

Companies repatriating dividends need to be aware of whether or not there is a DTA in place between China and their home country, which can reduce the 10 percent withholding tax on dividends to 5-8 percent. This is not something that tax authorities ...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us