Our collection of resources based on what we have learned on the ground

Resources

Q&A

What is the importance of inter-company agreements between overseas related part...

- July 2016

- Free Access

In previous years, Chinese tax authorities primarily focused on taxpayers’ transfer pricing issues with respect to their main business operations. However, authorities have recently been paying closer attention to taxpayers’ single relate...

magazine

Bekannte Routen, neue Ziele - Chinas Initiative ,Neue Seidenstraße'

- June 2016

- Members Access

Zum zweiten Quartal 2016 veröffentlichen wir das Magazin „Bekannte Routen, neue Ziele – Chinas Initiative ‚Neue Seidenstraße´“, in der wir über die institutionelle Ausrichtung der Volksrepublik China auf der OBOR berichten. Hierbei gehen ...

magazine

Revisione contabile e compliance in Vietnam

- June 2016

- Members Access

In questo numero di Vietnam Briefing, mostriamo le più recenti modifiche alle procedure di revisione e forniamo indicazioni su come garantire che le attività di compliance siano completate in modo efficiente ed efficace. Ci soffermeremo in particol...

magazine

Understanding Mergers & Acquisitions in China

- June 2016

- Members Access

In this issue of China Briefing magazine, we set out to guide foreign investors through the mergers and acquisitions process, from initial market research, to set-up procedures and regulatory hurdles, and finally through important due diligence consi...

magazine

The 2016/17 ASEAN Tax Comparator

- June 2016

- Members Access

In this issue of ASEAN Briefing, we examine regional taxation in ASEAN through a comparison of corporate, indirect, and withholdings taxation. We further present an overview of the compliance environments found across the region and analyze ASEAN’s...

Q&A

How is Corporate Income Tax determined for acquired companies in China?

- June 2016

- Members Access

Under the PRC Corporate Income Tax (CIT) Law, which applies to both domestic enterprises as well as foreign and foreign-invested enterprises, income arising from the transfer of equity and assets (both fixed and intangible) is subject to CIT. While a...

presentation

Navigating Complexities: An Introduction to Dezan Shira & Associates in India

- June 2016

- Free Access

This report offers an introduction to Dezan Shira & Associates business services and information platforms for companies seeking to establish themselves in India.

webinar

Come aprire una società commerciale in Vietnam

- June 2016

- Free Access

Erasmo Indolino, International Business Advisory presso l'ufficio di Hanoi di Dezan Shira & Assocates, fornisce informazioni sulla costituzione di una società commerciale in Vietnam.

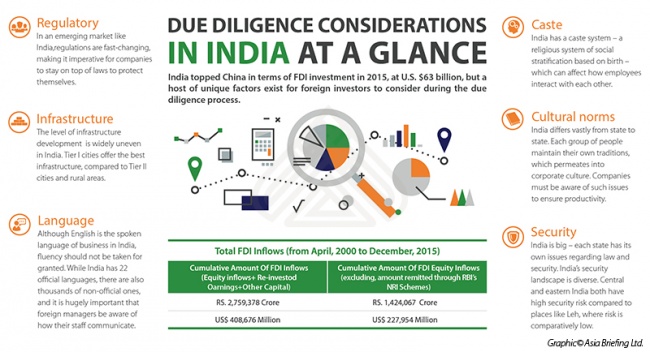

infographic

Due Diligence Considerations in India at a Glance

- May 2016

- Members Access

India has successfully topped China in terms of FDI investment in 2015, a unique due diligence factors have to be considered during the process.

Q&A

Which governmental bodies and general restrictions should be noted with regard t...

- May 2016

- Members Access

The Ministry of Finance (MOF) and State Bank of Vietnam (SBV) are two main governmental bodies investors have to take note of. MOF has the power to adjust tax rates and regulate remittances, whereas SBV is in charge of regulating banking and fo...

Q&A

Prior to remitting profits, investors may be faced with withholding tax which is...

- May 2016

- Members Access

Currently remittances are segmented into the following four categories: dividends, interest, royalties, and technical service fees. For dividends, no tax is currently imposed unless paid to individuals, whereas interest paid to a non-resident is subj...

Q&A

What are the obligations companies have to fulfill before being able to remit pr...

- May 2016

- Members Access

Companies have to make the following taxes before being able to remit profits: CIT which now has been reduced to 20% for both local and foreign enterprises, except for some special industries; VAT which is imposed at three different rates namely 0%, ...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us