Our collection of resources based on what we have learned on the ground

Resources

infographic

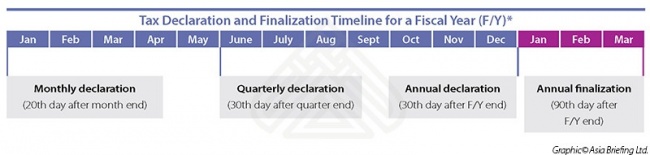

Tax Declaration and Finalization Timeline in Vietnam for a Fiscal Year (F/Y)

- January 2016

- Free Access

Foreign owned Enterprises in Vietnam must conduct CIT finalization at the end of every year.

infographic

Steps in the Vietnam Auditing Process

- January 2016

- Free Access

Auditing in Vietnam can be divided into 3 main steps

infographic

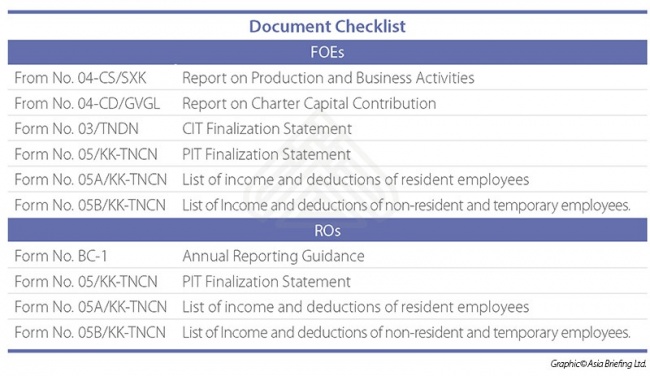

Document Checklist for Foreign Owned Enterprises and Representative Offices for ...

- January 2016

- Free Access

The requisite documentation needed for FOEs and ROs in the auditing process in Vietnam.

infographic

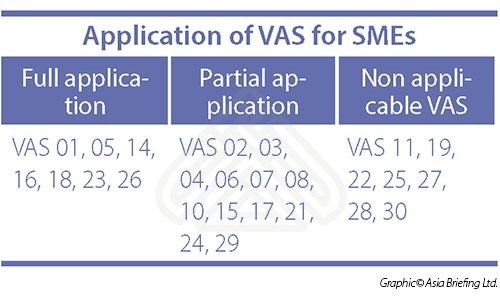

Application of Vietnamese Accounting Standards for Small and Medium Sized Enterp...

- January 2016

- Members Access

Vietnam requires that SMEs comply with a simplified set of accounting standards.

infographic

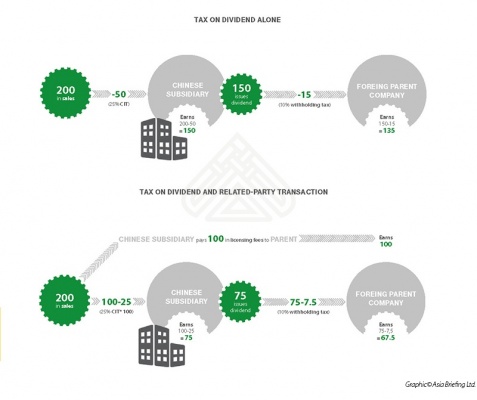

How Does Transfer Pricing Work

- January 2016

- Members Access

Tax on dividend alone and tax on dividend and related-party transaction

infographic

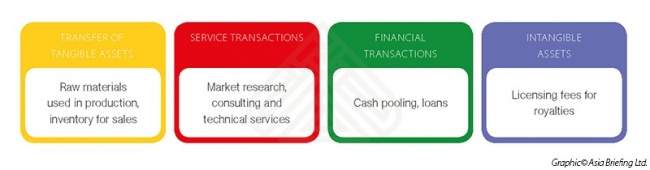

Various Transaction Types Related to Transfer Pricing in China

- January 2016

- Members Access

Various types of transactions are eligible to use in related-party transactions.

infographic

Transfer Pricing Services

- January 2016

- Members Access

Various transfer pricing services in China

Q&A

What are the penalties imposed in Vietnam if a company fails to comply with repo...

- January 2016

- Free Access

If a company fails to comply with VAT regulations and misses the deadline, penalties will be ensued and in many cases profits will also be affected. In addition, a taxpayer who pays tax later than the deadline has to pay the outstanding tax liabiliti...

magazine

Navigating the Vietnam Supply Chain

- December 2015

- Members Access

In this edition of Vietnam Briefing, we discuss the advantages of the Vietnamese market over its regional competition and highlight where and how to implement successful investment projects. We examine tariff reduction schedules within the ACFTA and ...

presentation

IP meets Tax Planning - Nanjing EUCCC seminar TP and IP

- November 2015

- Members Access

This was presented by one of our associates in Shanghai, Riccardo Benussi about the topic: Intellectual Property meets tax planning.

Q&A

What are some factors that need to be considered when doing the annual audit wor...

- November 2015

- Free Access

1) Bank statements: The balance on the bank book needs to be the same as that stated in the bank statement. 2) Expense report: Audit fees, salaries, rentals, utilities, FESCO fees and any other expenses need to be properly accrued with contracts or ...

Q&A

What does ?Regulations on the Administration of Registration of Resident Represe...

- November 2015

- Free Access

On the 19th of November, 2010, the State Council issued the regulations and it came into effect on the 1st of March, 2011. This regulation concentrates the degree of business and their valid financial records. The submission date required is from the...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us