Our collection of resources based on what we have learned on the ground

Resources

Q&A

What are some factors that need to be considered when doing the annual audit wor...

- November 2015

- Free Access

1) Bank statements: The balance on the bank book needs to be the same as that stated in the bank statement. 2) Expense report: Audit fees, salaries, rentals, utilities, FESCO fees and any other expenses need to be properly accrued with contracts or ...

Q&A

What does ?Regulations on the Administration of Registration of Resident Represe...

- November 2015

- Free Access

On the 19th of November, 2010, the State Council issued the regulations and it came into effect on the 1st of March, 2011. This regulation concentrates the degree of business and their valid financial records. The submission date required is from the...

Q&A

What is needed needs to be prepared when going through annual tax filing process...

- November 2015

- Free Access

Since the responsibility for tax filing in China is with the taxpayer, the bureau does not need to send out tax returns and it is the taxpayer’s responsibility to collect and file tax forms according to relevant regulations. Although regional v...

Q&A

Why is it recommended to start preparing for China?s annual audit in November in...

- November 2015

- Free Access

Most companies in China start preparing for the annual audit in January and February, however it is sometimes recommended to start instead as early as November. This gives companies enough time to carry out a preliminary audit first before the final ...

Q&A

Why is Vietnam the major beneficiary member of the Trans-Pacific Partnership?

- November 2015

- Members Access

This partnership will open up significant markets for Vietnamese manufactured goods, especially in North America. Although Vietnam has serious concerns over the balance of trade it has with China, it seems that this partnership will help Vietnam&rsqu...

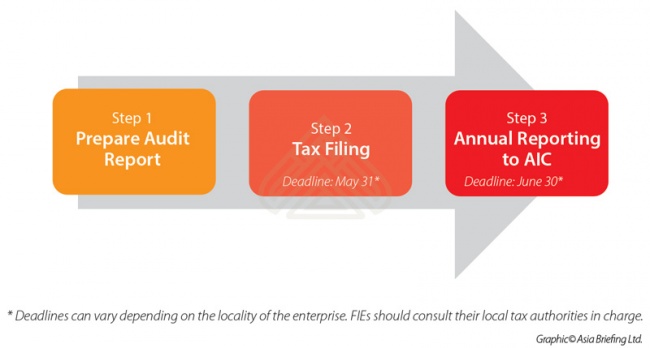

infographic

Annual Compliance Timeline - Annual Audit in China

- November 2015

- Free Access

This infographic shows the timeline of the annual audit process in China.

infographic

Steps of preparing the annual audit in China

- November 2015

- Free Access

This infographic shows steps of preparing the annual audit in China - from preparing the report to reporting to AIC.

magazine

Importing and Exporting in India

- October 2015

- Members Access

In this issue of India Briefing Magazine, we examine Indiaâs import and export landscape, basic import and export procedures, and customs duties. We note that Indiaâs import-export figures have remained stable despite significant economic c...

magazine

Import & Export in Vietnam: Key Industries & Free Trade Agreements

- October 2015

- Members Access

In this issue of Vietnam Briefing magazine, we discuss the key aspects of Vietnamâs import and export landscape, focusing on textiles, telephones and computer products, and automotive parts. We then analyze opportunities for Vietnam among its in...

magazine

Bestimmungen zu Verrechnungspreisen in Asien

- October 2015

- Members Access

China hat Anfang dieses Jahres weitere zwingende Auflagen an Verrechnungspreise für ausländische Firmen aufgestellt. Insbesondere die Priorität eines aussagekräftigen Funktionsnachweis, welcher Verrechnungen über Staatsgrenzen hinweg g...

report

Upgrading Your China Business

- July 2015

- Members Access

Representative Offices in China are not permitted to trade and cannot have their own import-export licenses. In this report we discuss why foreign companies in China increasingly choose to move away from Representative Offices (ROs) and open up Wholl...

Q&A

How is the tax system different in Cambodia compared to China?

- July 2015

- Free Access

In Cambodia, all businesses are subject to tax under the Self-Assessment System (Real Regime Tax System), regardless of their business or their revenue. There is no Double Tax Treaties in place which means that all withholding taxes are chargeable at...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us