Our collection of resources based on what we have learned on the ground

Resources

magazine

Come finanziare la tua impresa in Cina

- July 2015

- Members Access

Le conseguenze di una strategia poco o mal preparata possono tradursi rapidamente in spiacevoli e costose disavventure burocratiche e fiscali. Il tema del finanziamento dellâimpresa risulta, dunque, di particolare interesse, poiché le societ�...

webinar

Vietnam - New Workshop of the World

- July 2015

- Free Access

As manufacturing costs in China, and locations around the world, continue to rise, investors are searching for the new low-cost destination for their operations. Vietnam has arisen as a key manufacturing location in Southeast Asia.

magazine

Importing and Exporting in China: A Guide for Foreign Trading Companies

- July 2015

- Members Access

In this issue of China Briefing, we discuss the latest import and export trends in China, and analyze the ways in which a foreign company in China can properly prepare for the import/export process. With import taxes and duties adding a significant c...

magazine

Investing in Vietnam: Corporate Entities, Governance and VAT

- July 2015

- Members Access

In this issue of Vietnam Briefing, we highlight the forms of corporate presence available to foreign investors in Vietnam. We take a look at the countryâs system of corporate governance, and discuss how the form of presence a company chooses aff...

infographic

Import & Export Taxes in China

- July 2015

- Free Access

This infographic shows import taxes and the process of calculation and export VAT rebates and the process of calculation.

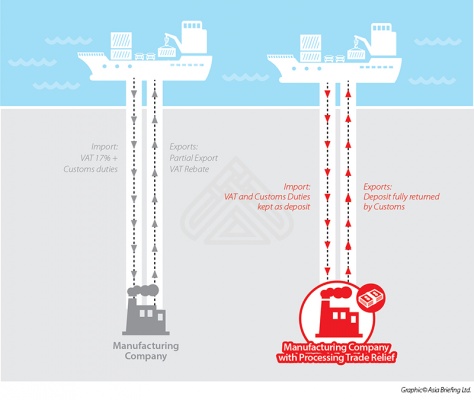

infographic

Processing Trade Relief in China

- July 2015

- Free Access

This infographic shows the process of trade relief in China by comparing the two models - 1. Processing of consigned imported material and 2. Processing of purchased imported materials.

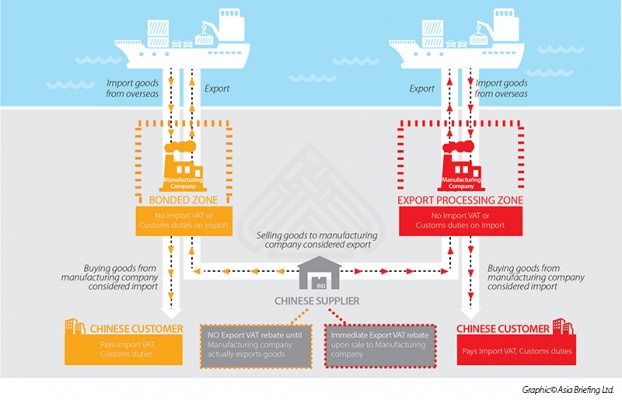

infographic

Foreign Investment Zones and its processes in China

- July 2015

- Free Access

This infographic shows processes of export processing zones in China. The parties are Chinese customer and Chinese supplier - explained in both ways; bounded zone and export processing zone.

Q&A

What is a ?red invoice,? and what is their significance to commercial operations...

- June 2015

- Free Access

Simply put, a “red invoice” is the nickname given to Vietnam’s Value Added Tax (VAT) invoices. Such invoices are mandated to undertake commercial activities such as the sale of goods and services, imports of foreign goods, and expor...

Q&A

How many types of Value Added Tax (VAT) invoices exist in Vietnam, and what are ...

- June 2015

- Free Access

In Vietnam, the tax system supports self-printed Value Added Tax (VAT) invoices, e-invoices, ordered invoices, and invoices purchased from the local Municipal Taxation Department. Enterprises within hi-tech parks and economic development zones, along...

magazine

How to Restructure an Underperforming Business in China

- June 2015

- Members Access

In this issue of China Briefing magazine, we explore the options that are available to foreign firms looking to restructure or close their operations in China. We begin with an overview of what restructuring an unprofitable business in China might en...

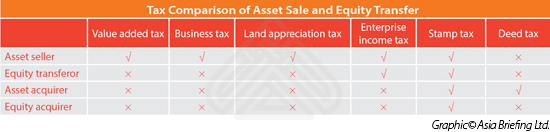

infographic

Tax Comparison of Asset Sale and Equity Transfer in China

- June 2015

- Free Access

This infographic shows which tax is needed to be applied to asset seller, equity transferor, asset acquirer and equity acquirer in China.

infographic

China, India & Vietnam Taxes at a Glance

- May 2015

- Members Access

This infographic compares various tax categories in China, India, and Vietnam.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us