Our collection of resources based on what we have learned on the ground

Resources

Q&A

What are a company’s options for repatriating funds from a Wholly Owned Subsid...

- September 2016

- Members Access

Foreign companies with long-term goals in the Indian business environment often choose to establish a Wholly Owned Subsidiary (WOS), as it offers a company more flexibility, longevity and a stronger legal foundation. All funds repatriated throu...

Q&A

What are some potential risks of China's transfer pricing environment?

- July 2016

- Members Access

Although China's transfer pricing legislation has developed over the past 20 years, the country's transfer pricing administration is still considered to be very strict. Chinese tax authorities require taxpayers to make a related party filing in conju...

Q&A

According to Chinese tax law, do foreign businesses need to prepare transfer pri...

- July 2016

- Free Access

According to China tax law, taxpayers who meet certain legislative requirements must prepare annual transfer pricing contemporaneous documentation, which includes a transfer pricing study. Taxpayers who don't meet the requirements are not legally req...

Q&A

What is the importance of inter-company agreements between overseas related part...

- July 2016

- Free Access

In previous years, Chinese tax authorities primarily focused on taxpayers’ transfer pricing issues with respect to their main business operations. However, authorities have recently been paying closer attention to taxpayers’ single relate...

magazine

Bekannte Routen, neue Ziele - Chinas Initiative ,Neue Seidenstraße'

- June 2016

- Members Access

Zum zweiten Quartal 2016 veröffentlichen wir das Magazin „Bekannte Routen, neue Ziele – Chinas Initiative ‚Neue Seidenstraße´“, in der wir über die institutionelle Ausrichtung der Volksrepublik China auf der OBOR berichten. Hierbei gehen ...

guide

Transfer Pricing in China 2016

- May 2016

- US $24.99

Transfer Pricing in China 2016, written by Sowmya Varadharajan in collaboration with Dezan Shira & Associates and Asia Briefing, explains how transfer pricing functions in China. It examines the various transfer pricing methods that are available to ...

magazine

La Cintura Economica della Via della Seta

- February 2016

- Members Access

In questo numero di Asia Briefing presentiamo le principali caratteristiche della Cintura Economica della Via della Seta, evidenziando nel dettaglio il percorso via terra in Asia Centrale e quello via mare nel Sud-Est Asiatico. Nei prossimi decenni, ...

report

Transfer Pricing in China

- January 2016

- Members Access

When a business transaction occurs between businesses that are controlled by the same entity, the price is not determined by market forces, but by the entity controlling the two businesses. This is called transfer pricing. Such transactions can serve...

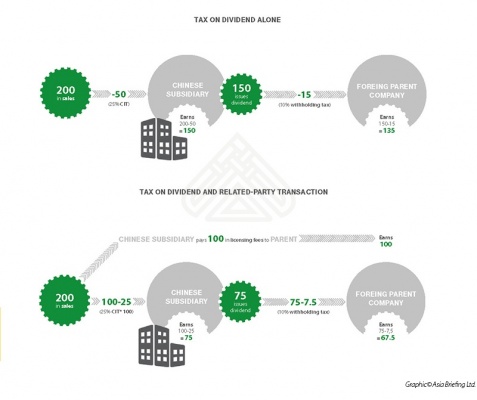

infographic

How Does Transfer Pricing Work

- January 2016

- Members Access

Tax on dividend alone and tax on dividend and related-party transaction

infographic

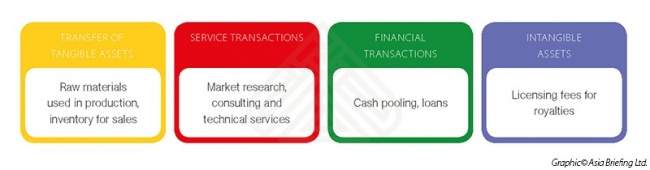

Various Transaction Types Related to Transfer Pricing in China

- January 2016

- Members Access

Various types of transactions are eligible to use in related-party transactions.

magazine

Bestimmungen zu Verrechnungspreisen in Asien

- October 2015

- Members Access

China hat Anfang dieses Jahres weitere zwingende Auflagen an Verrechnungspreise für ausländische Firmen aufgestellt. Insbesondere die Priorität eines aussagekräftigen Funktionsnachweis, welcher Verrechnungen über Staatsgrenzen hinweg g...

FTA

Free Trade Agreement between China and Hong Kong (Closer Economic Partnership Ar...

- April 2015

- Free Access

Supplement III to the Mainland and Hong Kong closer economic partnership agreement.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us