Our collection of resources based on what we have learned on the ground

Resources

article

Transfer Pricing in India - An Explainer

- December 2018

- Free Access

In taxation and accounting, transfer pricing refers to the rules and methods for pricing transactions within and between enterprises under common ownership or control. According to the Indian Income-tax Act, 1961, income ari...

article

Transfer Pricing in Thailand

- December 2018

- Free Access

The current law in Thailand requires taxpayers to be able to justify on any Thai Revenue Department review that both domestic and international related party transactions have been carried out at ‘market price’. Currently, Thailand&rsquo...

presentation

China's Transfer Pricing Documentation Requirements

- December 2018

- Members Access

In this presentation, Paul Dwyer, Dezan Shira & Associates' Head of International Tax and Transfer Pricing, introduces the key implementation of the Announcement on the Enhancement of the Reporting of Related Party Transactions and Administration of ...

magazine

How to Repatriate Profits from China

- October 2018

- Members Access

Repatriating profits from China has long been a complicated and challenging issue for foreign businesses with subsidiaries in the country. China has a notoriously strict system of foreign exchange controls, which tightly restrict the flow of capital ...

webinar

Singapore's Transfer Pricing Laws - 2018

- September 2018

- Members Access

On 25 September 2018, an international audience tuned-in to hear our Head of International Tax and Transfer Pricing, Paul Dwyer, our Singapore Tax Manager Richelle Tay and Transfer Pricing Associate Filippo Bortoletti, summarise the new transfer pric...

webinar

Singapore's Transfer Pricing Laws - 2018

- September 2018

- Members Access

On 25 September 2018, an international audience tuned-in to hear our Head of International Tax and Transfer Pricing, Paul Dwyer, our Singapore Tax Manager Richelle Tay and Transfer Pricing Associate Filippo Bortoletti, summarise the new transfer pric...

Q&A

When might a special transfer pricing investigation take place in China?

- July 2018

- Free Access

On March 17, 2017, the State Administration of Taxation (SAT) issued Public Notice 6 which provides rules on a variety of topics including transfer pricing investigations and adjustments. Public Notice 6 highlights the tax authorities' emphasi...

magazine

How to Manage Transfer Pricing in China

- May 2018

- Members Access

Countries across Asia have been amending their transfer pricing legislation to come into alignment with the OECD/G20 Action Plan for Tax Base Erosion and Profit Transfer Projects – or the BEPS Action Plan – since it was unveiled in 2015. China an...

infographic

Contemporaneous Documentation in China

- May 2018

- Free Access

An overview of the documents needed to be prepared and submitted to tax authorities in China, depending on the scope of business.

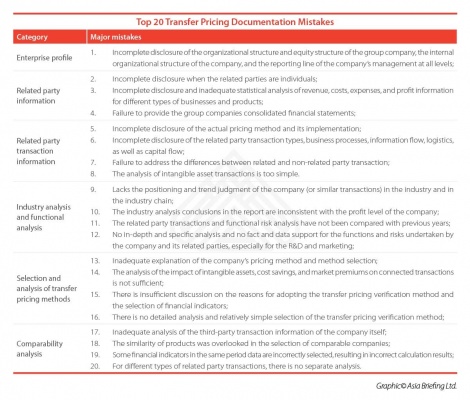

infographic

Top 20 Transfer Pricing Documentation Mistakes

- May 2018

- Free Access

Advice on what to watch out for when preparing transfer pricing documents.

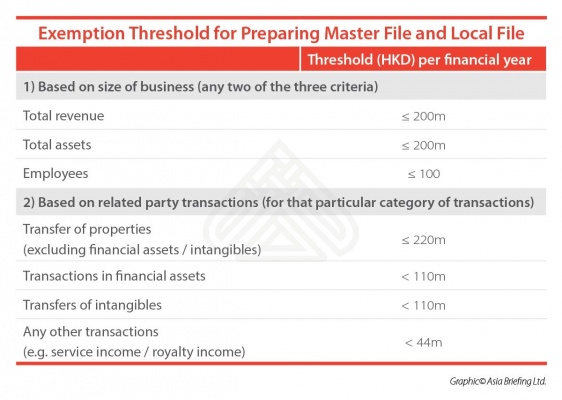

infographic

Exemption Threshold for Preparing Master File and Local File

- May 2018

- Free Access

All companies carrying out trade or business in Hong Kong are required to prepare master and local file reports for accounting periods beginning on or after April 1, 2018, unless they meet one of the exemption thresholds available, as shown in the ta...

magazine

Les accords de libre-échange et de double imposition de l’Inde

- April 2018

- Members Access

Dans ce numéro du magazine India Briefing, nous examinons les accords commerciaux bilatéraux et multilatéraux que l’Inde a actuellement en place et mettons en évidence les accords qui sont en cours de négociation. Une poussée des politiques i...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us