Our collection of resources based on what we have learned on the ground

Resources

infographic

Taxable Allowances

- May 2017

- Members Access

This infographic shows fully and partly taxable allowances.

infographic

Calculation of Tax in Metropolitan and Non-Metropolitan Areas

- May 2017

- Members Access

This infographic shows tax calculations in metropolitan and non-metropolitan areas, based on an annual income of RS 1,500,000.

infographic

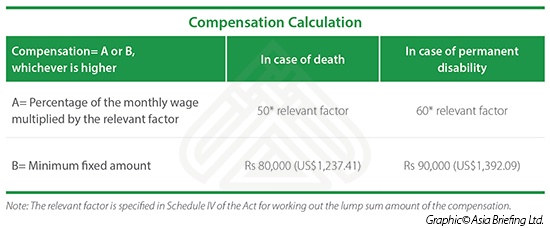

Compensation Calculation

- May 2017

- Members Access

This table shows how to calculate compensation in case of death or permanent disability.

infographic

India's Social Security Schemes

- May 2017

- Members Access

This infographic explains five of India's social security schemes.

infographic

Commercial Relationship between India and ASEAN Countries

- March 2017

- Free Access

This infographic shows India's main exports to ASEAN and ASEAN main exports to India.

infographic

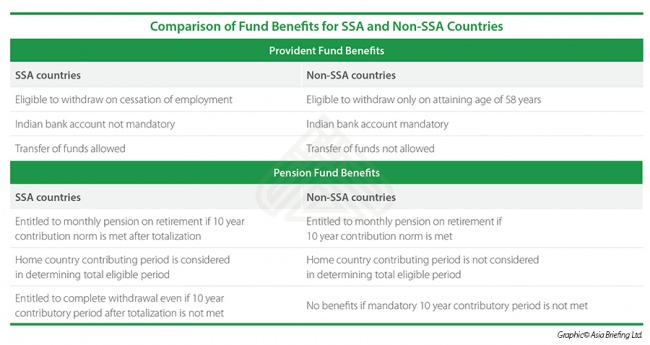

Social Security Obligations for Foreign Nationals Working in India

- March 2017

- Members Access

Countries with whom India has a Social Security Agreement (SSA) benefit from particular conditions.

infographic

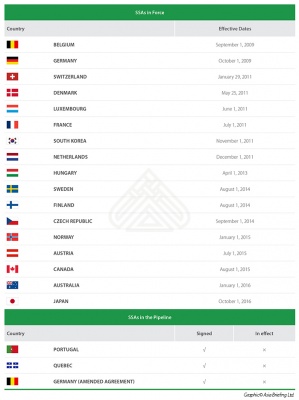

Social Security Agreements (SSA) in Force between India and Other Countries

- March 2017

- Free Access

Currently there are 17 Social Security Agreements (SSA) in force between India and other countries, plus 3 that have been signed but not yet implemented.

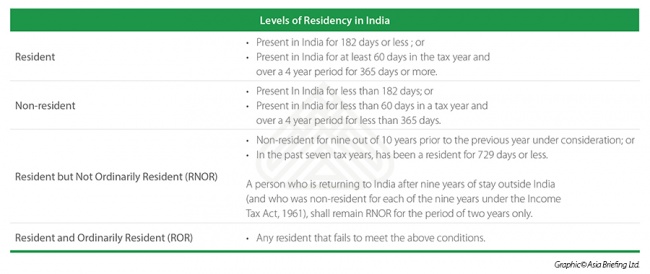

infographic

Levels of Residency in India

- March 2017

- Members Access

Foreign employees in India must file tax returns by 31 July. When filing, expatriate workers should be aware of their residential status, on which the taxability will be based.

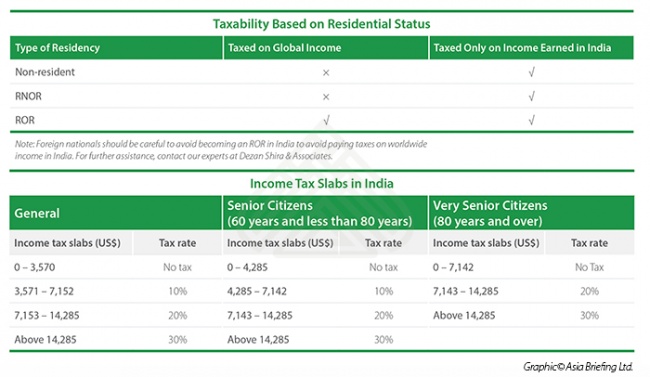

infographic

Taxability Based on Residential Status and Income Tax Slabs in India

- March 2017

- Members Access

Foreign employees must file tax returns by 31 July. When filing, expatriate workers should be aware of their residential status, on which the taxability will be based.

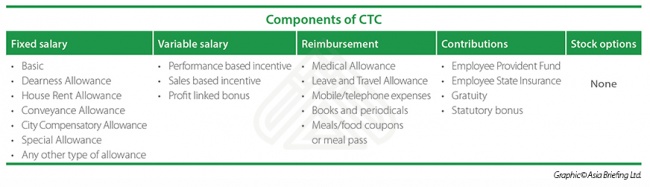

infographic

India's Salary Structure: the Cost to Company (CTC)

- March 2017

- Members Access

India's salary structure consists of basic salary, gross salary, net salary, and cost to company (CTC).

infographic

Liaison Office in India

- February 2017

- Free Access

This infographic shows the relationships between the liaison office in India and the heaquarter overseas.

infographic

How a Branch Office Functions in India

- February 2017

- Free Access

This infographic shows the activities branch offices are allowed to carry out and the relationship with the customers, headquarter and manufacturer.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us