Our collection of resources based on what we have learned on the ground

Resources

infographic

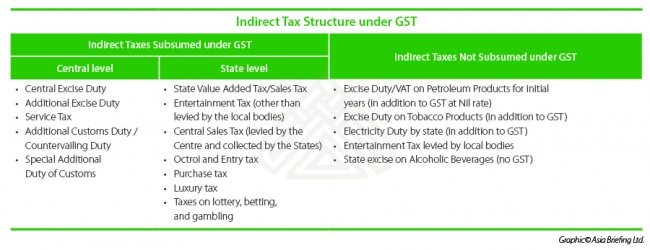

Indirect Tax Structure Under India's GST Regime

- October 2018

- Free Access

For more information, visit India Briefing or contact us.

infographic

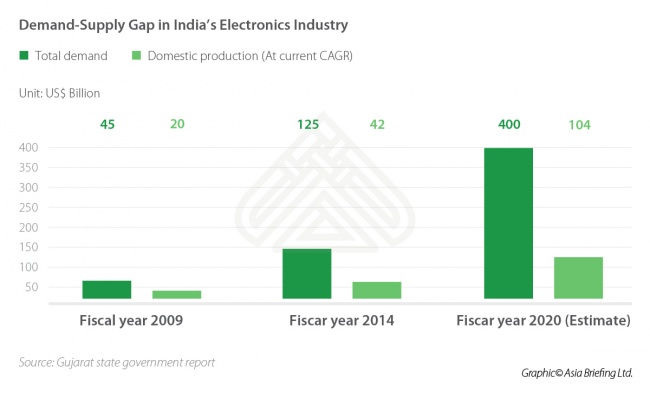

Demand and Supply Gap in India's Electronics Industry

- October 2018

- Free Access

To know more about business opportunities in India [button::Contact Us:: https://www.dezshira.com/contact] For more details about India's electornics market [button::Visit India Briefing::https://www.india-briefing.com/news/india-ince...

infographic

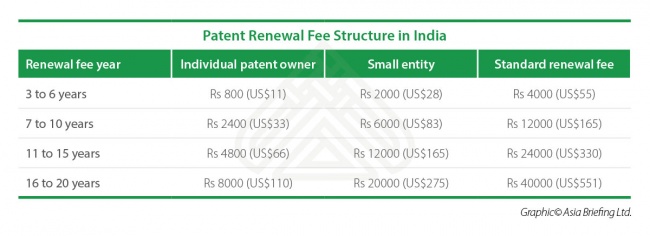

Patent Renewal Fee Structure in India

- October 2018

- Free Access

To know more about business opportunities in India [button::Contact Us:: https://www.dezshira.com/contact] For more details about patent renewals in India [button::Visit India Briefing::https://www.india-briefing.com/news/patent-renewal-india-f...

infographic

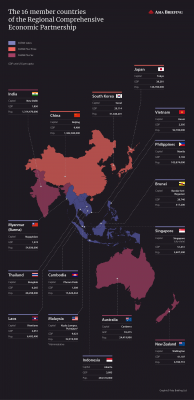

The 16 Member Countries of the Regional Comprehensive Economic Partnership

- September 2018

- Free Access

infographic

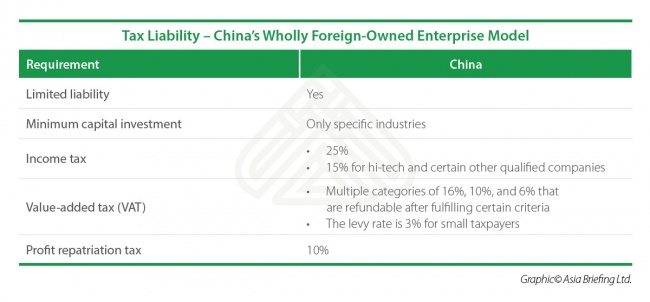

Corporate Structuring in India, China - WFOE vs WOS

- September 2018

- Free Access

In China, a wholly foreign-owned enterprise (WFOE) is a limited liability company (LLC) formed by one or more foreign investor(s). In this type of corporate structure, there is no mandatory requirement to collaborate with a domestic partner...

infographic

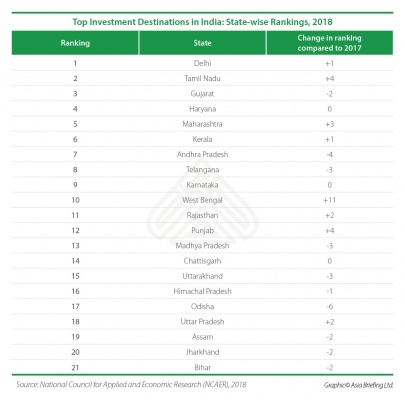

Highlights of the 2018 State Investment Potential Index- Doing Business in India

- September 2018

- Free Access

The NCAER publishes its annual State Investment Potential Index by reviewing Indian states based on six key categories – land, labor, infrastructure, economic climate, political stability and governance, and business perceptions. The top-performin...

infographic

India's Double Taxation Avoidance Agreements and Withholding Tax Rates (II)

- December 2017

- Members Access

DTAAs prevent double taxation by allowing the tax paid in one of the two countries to be offset against the tax payable in the other country. India has entered into double tax agreements with over 90 countries.

infographic

ASEAN-India Trade in Goods 2014-2016

- December 2017

- Free Access

This infographic shows the trade balance between India and ASEAN from 2014 to 2016.

infographic

Singapore-India FDI Flows 2014-2016

- December 2017

- Free Access

This infographic shows the foreign direct investment flows between India and Singapore.

infographic

India's Free Trade Agreements

- December 2017

- Free Access

India has negotiated trade liberalization arrangements with several countries and trade blocs.

infographic

India's Double Taxation Avoidance Agreements and Withholding Tax Rates (I)

- December 2017

- Members Access

DTAAS prevent double taxation by allowing the tax paid in one of the two countries to be offset against the tax payable in the other country. India has entered into double tax agreements with over 90 countries.

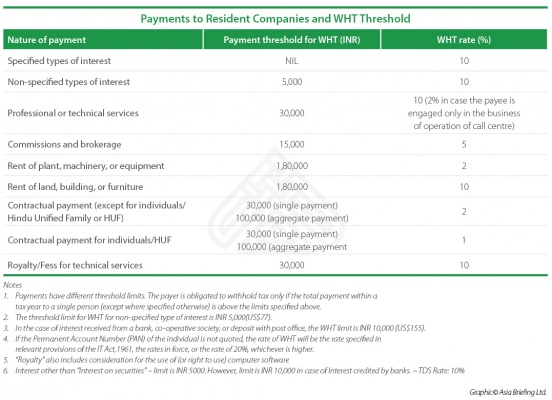

infographic

Withholding Tax (WHT) Rates on Payments to Resident Companies in India

- July 2017

- Members Access

This table shows the rates applied to parts of resident companies' income in India.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us