Our collection of resources based on what we have learned on the ground

Resources

infographic

The Shops & Establishment Acts - Delhi, Haryana & Uttar Pradesh

- August 2019

- Free Access

Infographic comparing the provisions of Shops & Establishment Act in Delhi (NCR), Uttar Pradesh & Haryana

infographic

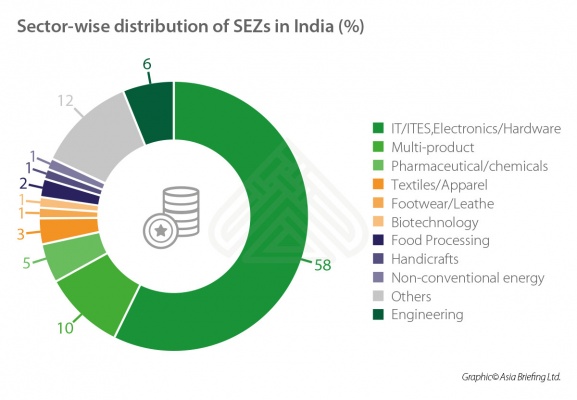

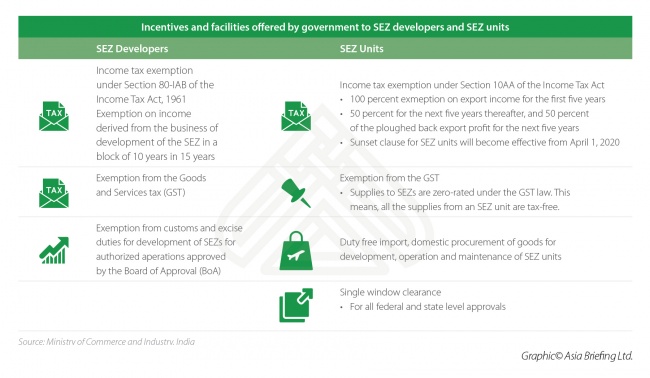

Incentives Offered by the Indian Government to SEZ Developers & Units

- June 2019

- Free Access

Special economic zone incentives in India

infographic

Pre-election Report Card: India

- April 2019

- Free Access

These infographics show the change in economic factors, such as growth, unemployment, manufacturing and FDI in India.

infographic

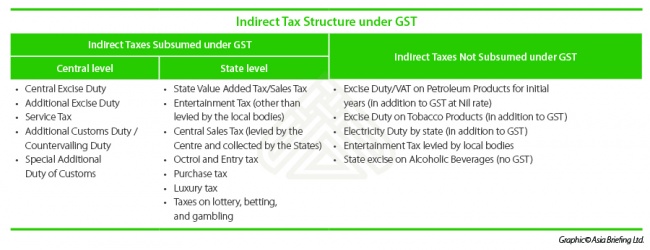

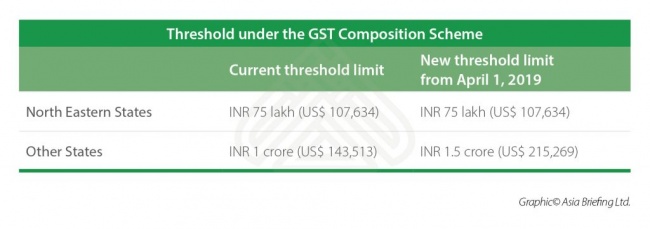

GST Composition Scheme in India

- March 2019

- Free Access

The composition scheme is a system under the Goods and Services Tax (GST) Act that allows suppliers of goods (other than exempt goods), and service providers to file their GST returns at a fixed rate.

infographic

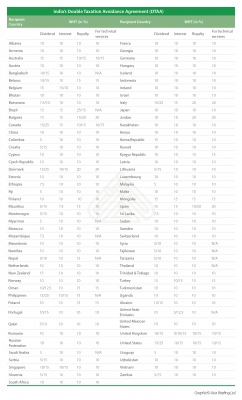

India's DTAA

- February 2019

- Free Access

List of India's Double Taxation Avoidance Agreement

infographic

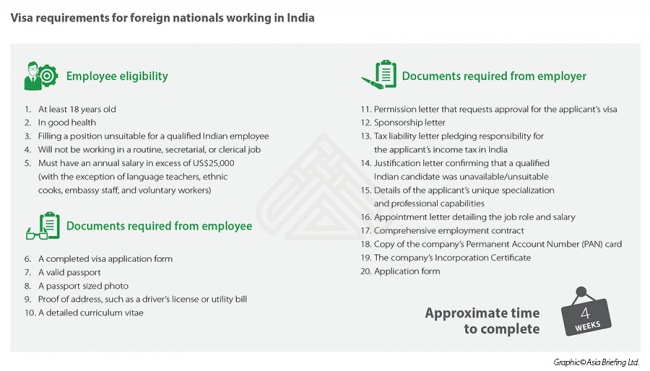

Visa Requirements for Foreign Nationals Living in India

- January 2019

- Free Access

The Indian government is progressively working on simplifying and liberalizing its visa regime.

infographic

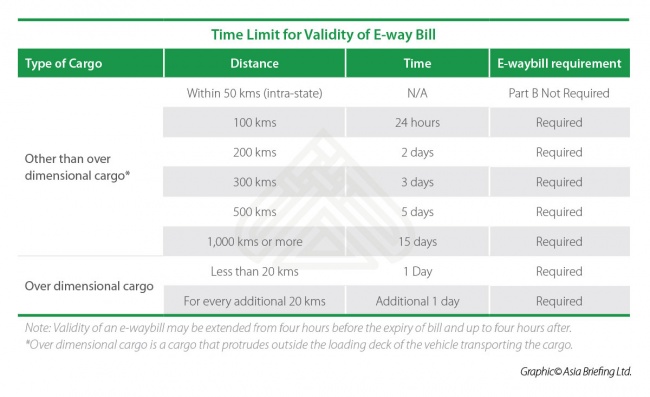

Time Limit for Validity of E-way Bill in India

- January 2019

- Free Access

An E-way bill is an electonic way bill required for the interstate movement of goods where the value of goods exceeds Rs. 50,000 (US$716), in motorized conveyance. The transportation of goods through a non-motor vehicle is exempted from the e-way bil...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us