Our collection of resources based on what we have learned on the ground

Resources

Q&A

How is Corporate Income Tax determined for acquired companies in China?

- June 2016

- Members Access

Under the PRC Corporate Income Tax (CIT) Law, which applies to both domestic enterprises as well as foreign and foreign-invested enterprises, income arising from the transfer of equity and assets (both fixed and intangible) is subject to CIT. While a...

presentation

Navigating Complexities: An Introduction to Dezan Shira & Associates in India

- June 2016

- Free Access

This report offers an introduction to Dezan Shira & Associates business services and information platforms for companies seeking to establish themselves in India.

webinar

Come aprire una società commerciale in Vietnam

- June 2016

- Free Access

Erasmo Indolino, International Business Advisory presso l'ufficio di Hanoi di Dezan Shira & Assocates, fornisce informazioni sulla costituzione di una società commerciale in Vietnam.

webinar

China Outlook 13th Five Year Plan

- June 2016

- Free Access

Senior Associate and Head of German Desk, Fabian Knopf, shares insights into China’s master plan for 2016-2021 and its implications and opportunities for SMEs.

presentation

Doing Business in China 2016

- June 2016

- Members Access

Riccardo Benussi, Senior Associate on Dezan Shira & Associates' IBA team, presents an introduction to the fundamentals of doing business in China.

infographic

Due Diligence Considerations in India at a Glance

- May 2016

- Members Access

India has successfully topped China in terms of FDI investment in 2015, a unique due diligence factors have to be considered during the process.

infographic

Regulatory Due Diligence in India

- May 2016

- Members Access

Brief three main points of what a foreign company should be aware of when performing due diligence in India.

infographic

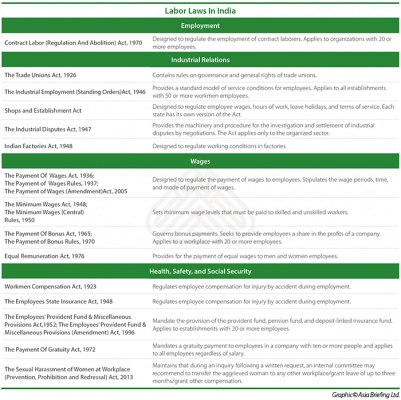

Labor Laws in India

- May 2016

- Members Access

Brief preview on labor laws in India specifically for each different sectors of employment, industrial relations, wages, and health, safety, and social security.

infographic

Recognized Central Trade Union Organizations in India

- May 2016

- Members Access

List of recognized central trade union organizations in India.

Q&A

Why is it important to conduct due diligence before entering the Indian market?

- May 2016

- Members Access

Carrying out due diligence can provide an investor with substantial information on business opportunities in their proposed market. In fact, it could be stated that the purpose of due diligence is not to learn everything about a business ...

Q&A

How can the due diligence process help a foreign investor to traverse the Indian...

- May 2016

- Members Access

A company’s success is in turn linked to the risk management and mitigation strategy that it undertakes. It is in this regard that due diligence becomes a powerful tool that companies may utilize when dealing with Indian businesses. Due diligen...

Q&A

Why should companies conduct due diligence in India?

- May 2016

- Members Access

There are two primary reasons why a company should conduct due diligence in India. Firstly, a company that plans to trade with an Indian company should verify that the business is what it appears to be. This is vital in India because several companie...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us