Our collection of resources based on what we have learned on the ground

Resources

Q&A

Why is it best to set up a foreign currency bank account after investors enter V...

- May 2016

- Members Access

A foreign currency bank account has to be utilized for all foreign currency transactions carried out within the country. Further, there are a list of activities that require a foreign currency account which include receipt of charter capital up until...

Q&A

What are some of the restrictions placed on remitting profits in Vietnam?

- May 2016

- Members Access

There are a number of restrictions enforced upon remitting profits. For example, under Vietnamese law, profits may only be remitted once per year. Furthermore, dividends may not be carried out during a year in which a company has not turned a profit....

magazine

Pre-Investment Due Diligence in India

- May 2016

- Members Access

In this issue of India Briefing Magazine, we examine issues related to pre-investment due diligence in India. We highlight the different regulatory, tax, and socio-economic issues that a company should be aware of before entering the Indian market. W...

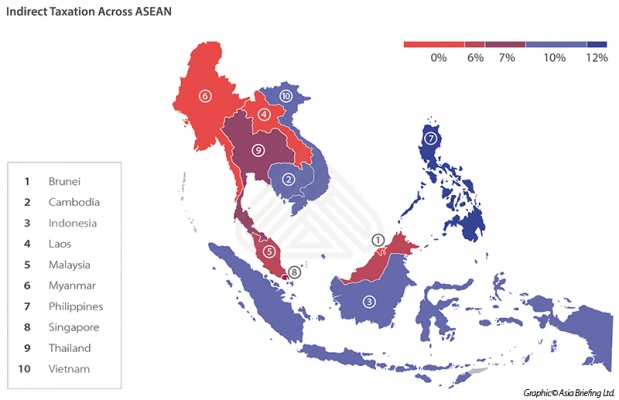

infographic

Indirect Taxation Across ASEAN

- May 2016

- Members Access

This infographic displays varying indirect taxation across ASEAN members.

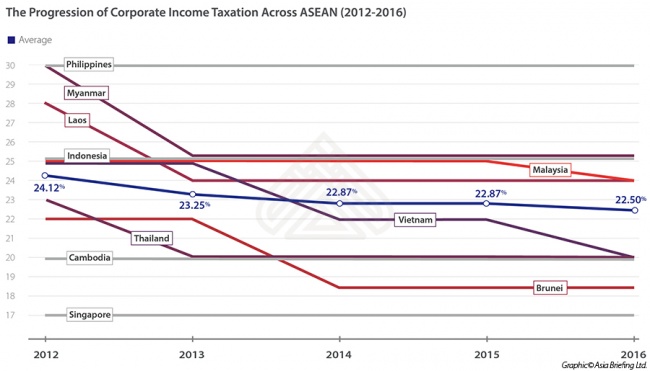

infographic

The Progression of Corporate Income Taxation Across ASEAN (2012-2016)

- May 2016

- Members Access

This infographic shows that ASEAN countries have lowered their corporate income taxes in the past decade to attract investment.

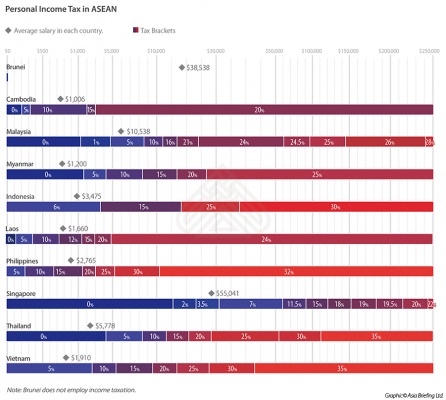

infographic

Comparison of Personal Income Tax Brackets in ASEAN

- May 2016

- Members Access

This infographic compares the different PIT taxation brackets across ASEAN member countries.

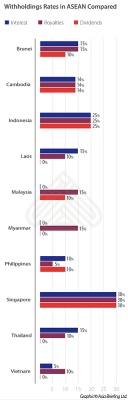

infographic

Withholdings Rates in ASEAN Compared

- May 2016

- Members Access

This infographic compares the withholdings rate for different types of funds in different ASEAN member countries.

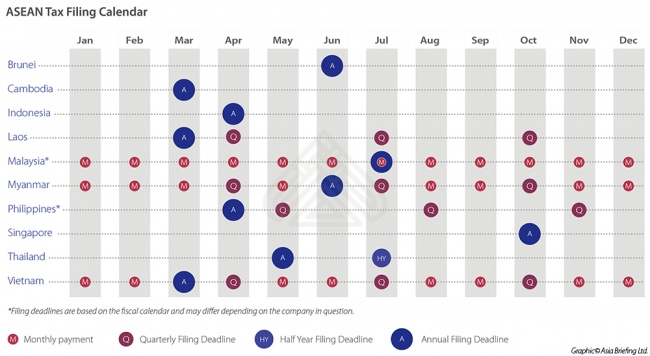

infographic

ASEAN Tax Filing Calendar

- May 2016

- Free Access

This infographic highlights key tax filing deadlines for those investing within ASEAN.

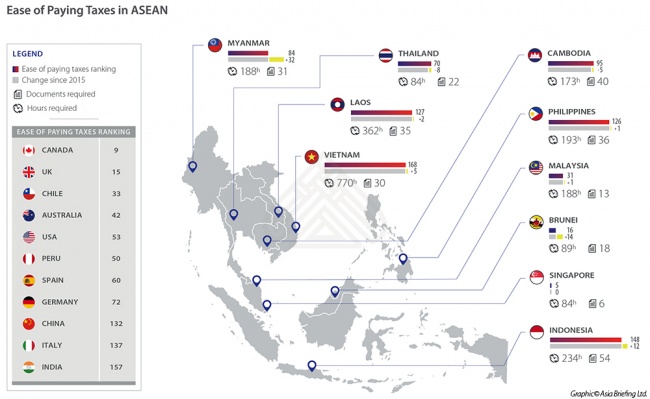

infographic

Ease of Paying Taxes in ASEAN

- May 2016

- Members Access

This infographic compares the ease with which taxes are paid in ASEAN countries.

Q&A

What are the categories of taxes applicable to foreign businesses in ASEAN?

- May 2016

- Members Access

There are numerous taxes categories which will be applicable for foreign businesses in ASEAN, including Corporate Income Tax(CIT), Personal Income Tax(PIT), and indirect taxes such as Value Added Tax (VAT) and Goods and Services Tax (GST). While PIT ...

Q&A

How does Personal Income Tax work in different countries in ASEAN?

- May 2016

- Members Access

Except for Brunei which employs no Personal Income Tax (PIT) and Cambodia a fixed 20 percent rate, most ASEAN members apply a progressive PIT regime wherein an individual is taxed according to how much they earn. Such regime results in individuals wh...

Q&A

What is withholding tax and what are the three types of it?

- May 2016

- Members Access

A withholding tax is a tax applied to funds that companies wish to send aboard. Countries in Asia typically divide withholding tax into dividends, interest, and royalties payments, with the amount of each varying considerably in each country. These a...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us