Our collection of resources based on what we have learned on the ground

Resources

Q&A

What are the future e-commerce trends for the Asia-Pacific?

- February 2015

- Free Access

Global B2C e-commerce sales will grow by more than 20 percent this year to reach US$1.5 trillion, and surpass US$2.3 trillion by 2017. This projected growth will be driven by five of the largest online retail markets in the Asia-Pacific region &ndash...

Q&A

What country in the Asia-Pacific is estimated to have the fastest growing intern...

- February 2015

- Free Access

The Philippines is estimated to have the fastest growing internet population in the world, with recent statistics estimating 530% growth over the past five years. Close behind the Philippines in global rankings are Indonesia with 430% growth, India i...

Q&A

What is Singapore?s e-commerce potential?

- February 2015

- Free Access

Singapore’s online shopping market has undergone significant growth in the past four years, from US$881 million in 2010 to a forecasted US$3.5 billion in 2015. An estimated 40% of total sales come from domestic websites. Singapore is also home ...

Q&A

What is Indonesia?s e-commerce potential? What are the challenges?

- February 2015

- Free Access

E-commerce is on the rise in Indonesia. Annual online sales are forecasted to grow from US$1 billion- $3billion in 2014 and reach US$10 billion by the end of 2015. Initial growth was focused in Jakarta, but second and third –tier cities are beg...

Q&A

What is the Philippines? e-commerce potential?

- February 2015

- Free Access

The Philippines stands out in comparison with other ASEAN countries because of its large number of internet users. With an estimated 35 million users, it is the largest English-language online market in Southeast Asia. Due to this, foreign online ret...

Q&A

What are the projected e-commerce trends for Vietnam in 2015?

- February 2015

- Free Access

According to Vietnam's E-commerce and Information Technology Agency (VECITA), by 2015 the e-commerce sales in the country will amount to more than US$25 billion. Current sales are estimated at around US$2.2 billion (2014), with average spending of US...

Q&A

What is Vietnam?s E-commerce Administration Portal and how does it aid businesse...

- February 2015

- Free Access

Companies and investors that wish to establish an e-commerce website in Vietnam must first notify the Ministry of Industry and Trade of their intent, and apply to be registered with the government. Vietnam has created the E-commerce Administration Po...

Q&A

What role does the manufacturing industry play in the growth of the Indonesian e...

- February 2015

- Free Access

The manufacturing industry counts for 24% of the country's GDP. This means that as of 2011, roughly 14.4 million out of a total of 250 million Indonesians work in this industry.

Q&A

What effect has the ASEAN- China Free Trade area had on China and ASEAN as a who...

- February 2015

- Free Access

The ASEAN–China Free Trade Area is the world’s largest free trade area in terms of population and third largest in terms of nominal GDP after the European Union and NAFTA. The original FTA reduced tariffs on nearly 8,000 product categorie...

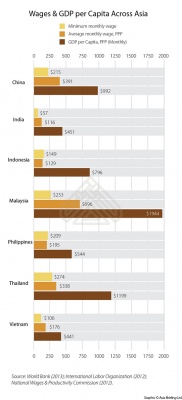

infographic

Wages & GDP per Capita Across Asia

- January 2015

- Free Access

This infographic compares minimum monthly wage, average monthly wage and GDP per Capita across various Asian countries.

Q&A

How is corporate income tax (CIT) calculated in Asia?

- January 2015

- Free Access

Corporate Income Tax (CIT) is levied on the profits of a company. The rate varies considerably for different countries - it can be anywhere between 17 and 40% and is determined by various different factors including the priorities of the government, ...

Q&A

How does indirect tax differ from corporate income and individual income tax in ...

- January 2015

- Free Access

Indirect tax adds to the price of a product which makes the consumer indirectly pay the rate of taxation. For corporate and individual income tax, a business or individual has to pay the necessary amount directly to the government. Also, the indirec...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us