Our collection of resources based on what we have learned on the ground

Resources

Q&A

Hosting a Website in China

- January 2019

- Free Access

This Q&A session briefly considers the basic requirements, advantages, and disadvantages of hosting a website inside China. For a more detailed overview, use our clickable resources. What are the compliance requirements when hosting a webs...

Q&A

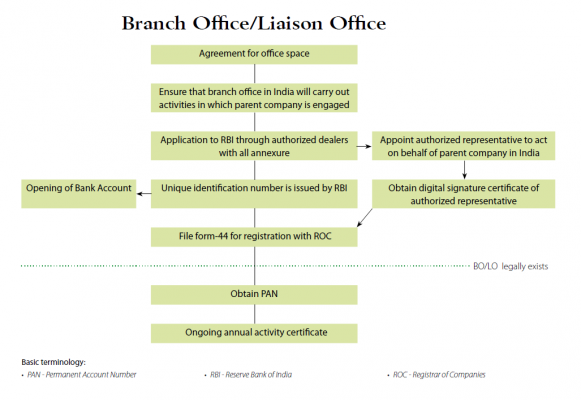

Setting Up a Liaison Office in India

- January 2019

- Free Access

Setting up a Liaison Office in India is a popular choice for foreign companies looking to enter the Indian market. Foreign corporations may set up a Liaison Office to promote business activities of the parent company without incurring the cost...

Q&A

Risk Management for Foreign Investors in China

- January 2019

- Free Access

This Q&A session covers some of the basic types of fraud that foreign invested companies in China need to look out for. Further, we briefly outline internal control mechanisms for risk management in China. Within the text body, you will find cl...

Q&A

¿Qué es la tecnología en la nube y cómo funciona en China?

- January 2019

- Free Access

La tecnología en la nube (también conocida como "computación en la nube" o simplemente "la nube") es cuando los servidores, el almacenamiento, las bases de datos, las redes, el software y los procesos de análisis se alojan...

Q&A

¿Cuáles son las actividades que puede llevar a cabo una Oficina de Enlace en I...

- January 2019

- Free Access

De acuerdo con el Banco de la Reserva de la India (RBI, por sus siglas en inglés), las siguientes actividades son las que una Oficina de Enlace puede realizar en India: -Representación de la empresa matriz en India. -Promoción de...

Q&A

¿Cuáles son las debilidades en el control interno de las PYMES?

- December 2018

- Free Access

Las debilidades comunes observadas en el control interno de una PYME incluyen: Falta de políticas de control interno adecuadas y formación de los empleados Revisiones o aprobaciones para el control interno limitadas debido a l...

Q&A

¿Qué hacer si descubre fraude en su empresa? Gestión de riesgos para empresas...

- December 2018

- Free Access

Si una empresa con inversión extranjera detecta alguna prueba de fraude interno, especialmente en los casos en que un accionista minoritario o el gerente general puedan estar involucrados, se debe llevar a cabo una investigación interna...

Q&A

¿Cuáles son las condiciones para establecer una sucursal en India?

- December 2018

- Free Access

De acuerdo con las directrices marcadas por el Banco de la Reserva de India (el banco central de India), una empresa extranjera debe cumplir las siguientes condiciones para establecer una sucursal en India: • Un historial de ganancias durante l...

Q&A

What are the weaknesses of Internal Controls for SMEs?

- October 2018

- Free Access

The common weaknesses observed in an SMEs internal control include: Improper control policies and employee training Internal control reviews or approvals dependent on limited company resources Inadequate documentation and implementation of...

Q&A

What are the new items that will be deductible for Individual Income Tax in Chin...

- August 2018

- Free Access

Under the first draft amendments to IIT Laws in China, resident taxpayers will be allowed to deduct certain additional items from their comprehensive income. These additional deductible items are categorized as ‘additional itemized deductions ...

Q&A

What are the Key Considerations for Choosing a Location?

- August 2018

- Free Access

Real Estate Rental or purchasing cost, location, site and building amenities and utilities need to be assessed to balance the cost and usability of the facility. Connectivity Major infrastructure and transportation options as well as ease ...

Q&A

What are the Key Challenges for Expatriate Management in China?

- August 2018

- Free Access

• Navigating China’s complex tax environment An individual is taxed in China on one’s income by category. China’s IIT law groups income into 11 categories. Each income category has its own tax rate, allowable deductions etc. ...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us