Our collection of resources based on what we have learned on the ground

Resources

Q&A

What are some of the factors which determine wages in India?

- May 2017

- Members Access

Wages in India depend on the size of the company, region, and the type of industry. In addition, minimum wages and living costs differ from one state to another. It should be noted that in some establishments, wages must be paid by check or credit in...

infographic

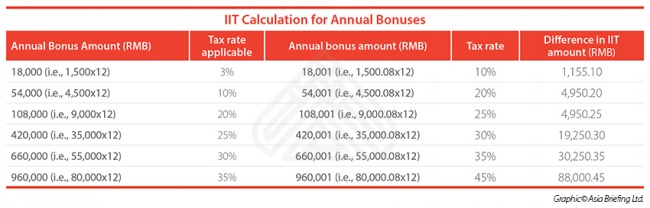

IIT Calculation for Annual Bonuses

- April 2017

- Members Access

This table shows the optimal compensation package for employees, allowing them to take home the most value within the parameters set by China's tax laws.

infographic

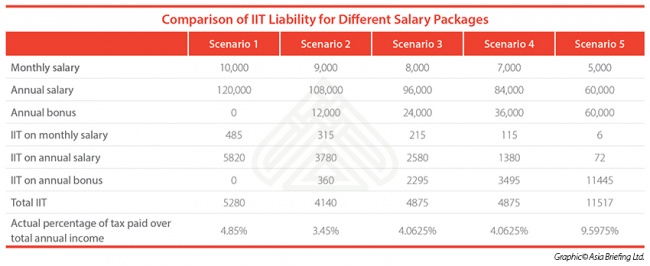

Comparison of IIT Liability for Different Salary Packages

- April 2017

- Members Access

This infographic shows how IIT liability varies depending on the monthly or annual salary and annual bonus.

infographic

Monthly Taxable Income: Chinese and Foreign Nationals

- April 2017

- Free Access

This table and the descriptions presents the tax income of both Chinese and Foreign Nationals that involves based Salary, fringe benefits, Mandatory Social Security contribution, and Deductible allowances.

infographic

Minimum Financial Investment Requirements for Setting Up a Business in Thailand

- March 2017

- Members Access

This infographic shows the capital requirements for setting up different types of entities in Thailand.

infographic

Current State of IFRS Adoption in ASEAN

- March 2017

- Members Access

This infographic shows the current state of IFRS adoption for Indonesia, Thailand, Malaysia, the Philippines, and Singapore.

infographic

Key Differences Between IFRS/IAS and Current Indian Accounting Standards

- February 2017

- Free Access

This infographic shows the key differences between IFRS/IAS and current Indian accounting standards.

infographic

Documents to be Maintained for Financial Statements by Type of Transaction

- January 2017

- Free Access

This infographic shows the documents that need to be maintained for financial statement by type of transaction.

podcast

Annual Audit in China

- January 2017

- Free Access

In this podcast, Fabian Knopf, Senior Associate at Dezan Shira & Associates, provides insights into China's annual audit process.

videographic

Steps on How to Pay Corporate Profit

- December 2016

- Free Access

This prezi explains crucial steps on how to pay corporate profit.

magazine

Accounting and Bookkeeping in Vietnam

- November 2016

- Members Access

In this issue of Vietnam Briefing, we outline the basic framework of accounting applied in Vietnam and provide guidance on how to ensure compliance. We discuss existing Vietnamese accounting standards, highlight differences between Vietnamese and int...

magazine

Analyse de la Réforme de la TVA en Chine

- November 2016

- Members Access

Début 2012, la Chine a débuté une réforme massive de son système fiscal en lançant le remplacement de sa “taxe sur les affaires” (“business tax” ou “BT”) par la taxe sur la valeur ajoutée (“TVA”). Avant cette réforme, la TVA n...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us