Our collection of resources based on what we have learned on the ground

Resources

magazine

Internal Control in China

- July 2017

- Members Access

While fraud is a well-known issue for foreign investors doing business in China, many companies underestimate the risks of fraud occurring from within their own organizations. The answer to limiting exposure to these risks is internal control. In thi...

infographic

Tax Incentives for Government-Encouraged Sectors in Vietnam

- July 2017

- Members Access

This table shows the preferential tax rates and exemptions for enterprises investing in Vietnam's government-encouraged sector-category A.

infographic

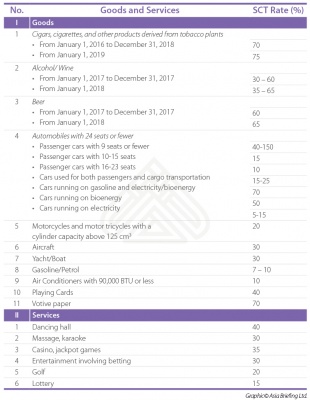

Special Consumption Tax (SCT) Tax Rates for Goods and Services in Vietnam

- July 2017

- Members Access

This table shows the Special Consumption Tax (SCT) rates for specific goods and services in Vietnam.

infographic

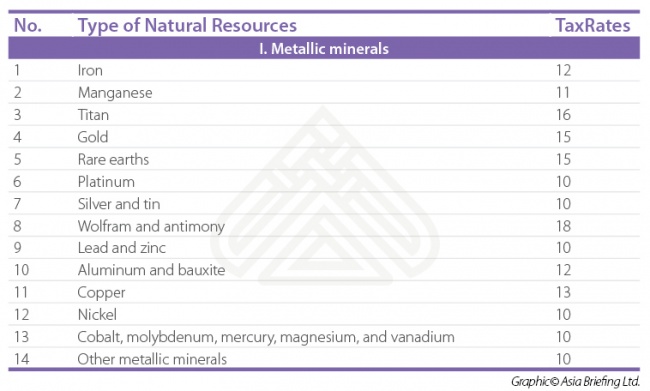

The Natural Resources Tax (NRT) Rates in Vietnam

- July 2017

- Members Access

This table shows the Natural Resources Tax (NRT) rates for different types of natural resources in Vietnam.

infographic

Environment Protection Tax Rates in Vietnam

- July 2017

- Members Access

This table shows the Environment Protection Tax (EPT) rate variation for specific goods in Vietnam.

infographic

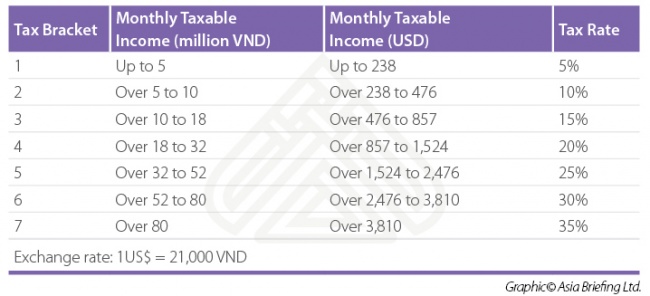

Personal Income Tax (PIT) Rates for Resident Taxpayers in Vietnam

- July 2017

- Members Access

This table shows Personal Income Tax (PIT) rate variation according to resident taxpayer income in Vietnam.

magazine

Gestire la contabilità in Vietnam

- June 2017

- Members Access

In questo numero di Vietnam Briefing delineiamo la struttura di base delle norme contabili in vigore, approfondiamo il tema dei principi contabili vietnamiti esistenti evidenziando le differenze esistenti con i principi contabili internazionali. Infi...

Q&A

What are the types of pension offered monthly in India?

- May 2017

- Free Access

Widows' pension for death while in service. Pension uppon superannuation or disability. Orphan's pension. Children's pension. It should be noted that there are different pension funds for seamen, civil servants, employees in tea plantations i...

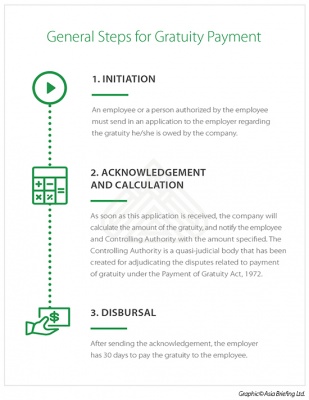

infographic

General Steps for Gratuity Payment

- May 2017

- Members Access

This infographic shows the steps needed to calculate gratuity payment.

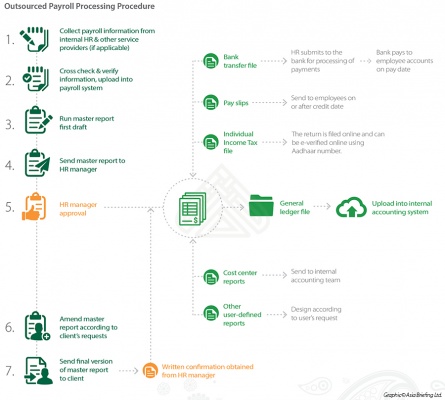

infographic

Outsourced Payroll Processing Procedure

- May 2017

- Members Access

This infographic shows the 7 steps in outsourcing payroll processing.

report

Introducción: Hacer Negocios en China 2017

- May 2017

- Members Access

La guía Hacer Negocios en China 2017 está diseñada para introducir los fundamentos de la inversión en China. Compilada por los profesionales de Dezan Shira & Associates, esta guía es ideal, no sólo para las empresas que buscan entrar en el mer...

infographic

Calculation of Tax in Metropolitan and Non-Metropolitan Areas

- May 2017

- Members Access

This infographic shows tax calculations in metropolitan and non-metropolitan areas, based on an annual income of RS 1,500,000.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us