Our collection of resources based on what we have learned on the ground

Resources

article

China’s IIT Reform: Seven Key Points from the Draft Implementation Rules

- November 2018

- Free Access

Many taxpayers in China have had questions about how the government would change the individual income tax (IIT) law since the amendment was passed earlier this year. Recently, however, the tax authorities released a draft of the amendment&...

report

Введение в ведение бизнеса в Индии 2020

- November 2018

- Free Access

Вступление к ведению бизнеса в Индии в 2020 году предоставит читателям обзор основных принципов инвестирования и ведения бизнеса в Индии....

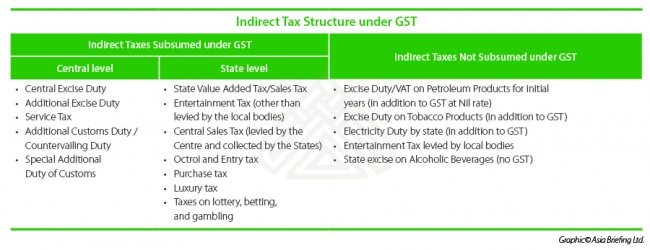

infographic

Indirect Tax Structure Under India's GST Regime

- October 2018

- Free Access

For more information, visit India Briefing or contact us.

Q&A

What are the new items that will be deductible for Individual Income Tax in Chin...

- August 2018

- Free Access

Under the first draft amendments to IIT Laws in China, resident taxpayers will be allowed to deduct certain additional items from their comprehensive income. These additional deductible items are categorized as ‘additional itemized deductions ...

presentation

Global Mobility: Managing a Global Workforce in China

- June 2018

- Free Access

A major challenge facing investors entering the Chinese market, or even fully-established enterprises is HR and legal concerns. Whether you are an employer or an employee in China it is essential that you stay in compliance with the relevant labor la...

magazine

Transfer Pricing in Vietnam

- April 2018

- Members Access

In this issue of Vietnam Briefing, we introduce the concept of transfer pricing and outline its importance to foreign investors operating in Vietnam. We highlight current compliance requirements, outline changes that have been made in recent months, ...

guide

Establishing & Operating a Business in China 2018

- December 2017

- US $24.99

China’s foreign investment landscaped changed significantly in 2017, where strategic investors will find that their options have broadened significantly. Establishing and Operating a Business in China 2018 is designed to explore the establishment p...

magazine

Tax Incentives in Vietnam

- December 2017

- Members Access

In this issue of Vietnam Briefing, we discuss the importance of taxation to new investment projects and outline the role that corporate tax incentives can play in reducing costs in Vietnam. We highlight Vietnam’s current preferential tax rates and ...

infographic

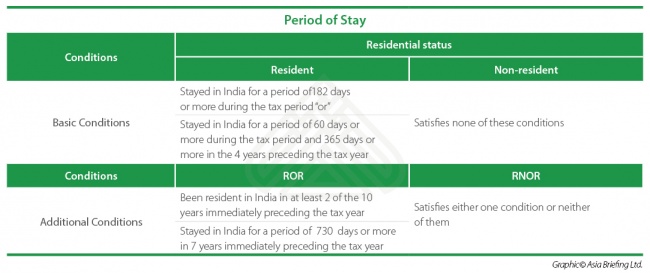

Determining Individual Income Tax (IIT) for Expatriates based on Residence Statu...

- July 2017

- Members Access

This table shows the conditions on the different residential status to determine expatriates Individual Income Tax (ITT).

infographic

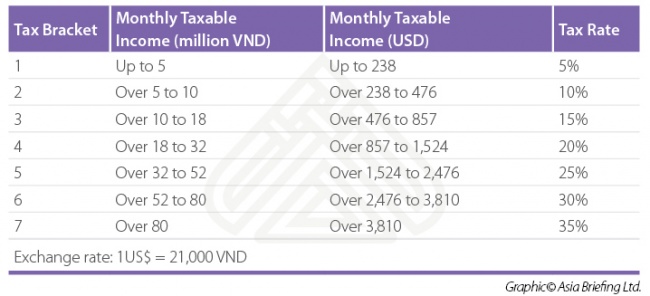

Personal Income Tax (PIT) Rates for Resident Taxpayers in Vietnam

- July 2017

- Members Access

This table shows Personal Income Tax (PIT) rate variation according to resident taxpayer income in Vietnam.

magazine

Payroll Processing and Compliance in Singapore

- June 2017

- Members Access

In this issue of ASEAN Briefing, we discuss payroll processing and reporting in Singapore as well as analyze the options available for foreign companies looking to centralize their ASEAN payroll processes. We begin by discussing the various regulatio...

Q&A

Which deductions can be made from an employee's salary according to the Vietname...

- May 2017

- Members Access

Currently, the following deductions are permitted under the Vietnamese tax code: Personal allowances of VND 9 million (US$395); Dependent allowances of VND 3.6 million (US$158) per dependent; All mandatory contributions to Vietnam’s social...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us