Our collection of resources based on what we have learned on the ground

Resources

infographic

Seven Factors Disfavorable to Being Named a Beneficial Owner in China

- January 2014

- Free Access

There are seven factors disfavorable to being named a beneficial owner in China.

infographic

Treaty Benefit Administrative Requirements by Income Type in China

- January 2014

- Free Access

For passive income and active income, the treaty benefit administrative requirements are different in China.

infographic

Equity Transfer, Notification Documentation in China

- January 2014

- Free Access

When establishing an offshore holding company, four parts need to be included in the notification.

Q&A

What does salary in India include?

- January 2014

- Free Access

Section 17 of the Income Tax Act defines salary to include: Wages Pensions or Annuities Gratuities Advance of Salary Any fee, commission, perquisites (the value of rent-free accommodation provided by the employer or...

Q&A

How are wages paid in India and how do they vary?

- January 2014

- Members Access

Wages vary considerably, depending on industry, company size and region. The national minimum wage of India is currently at INR115 (US$2.24) per day (effective from April 1, 2011); though this varies by state. Companies use both time and piece ...

infographic

China's Tax System of 2012

- January 2014

- Members Access

Current tax system in China consists of two parts: value added tax and business tax.

infographic

Value Added Tax (VAT) Calculation in China

- January 2014

- Free Access

Value added tax (VAT) calculation in China consists of two parts: output VAT and input VAT.

Q&A

What are allowances and what do they include in India?

- January 2014

- Free Access

Allowances are categories of expenditures in India that are not taxable, provided they match certain specifications and do not exceed a certain amount. Allowances in India include those for: House Rent Transport Medical Meal Coupons Leave Tra...

Q&A

What is the house rent allowance in India?

- January 2014

- Members Access

If a company chooses to provide House Rent Allowance (HRA) to its employees, the amount of this allowance exempt from tax is the lowest of three numbers: 50 percent of salary in metropolitan areas (40 percent in non-metropolitan areas) Total rent...

infographic

Automatic and Governmental-Approval Routes for FDI in India

- January 2014

- Free Access

FDI in India can be done through two routes-the automatic route and the government route- with most done through the former.

Q&A

What is the transport allowance in India?

- January 2014

- Members Access

Transport payments of up to INR800 (US$14.22) per month for an employee commuting between residence and place of work are exempt from tax. In the case of blind or orthopedically handicapped employees, INR1,600 (US$28.61) per month is exempt from...

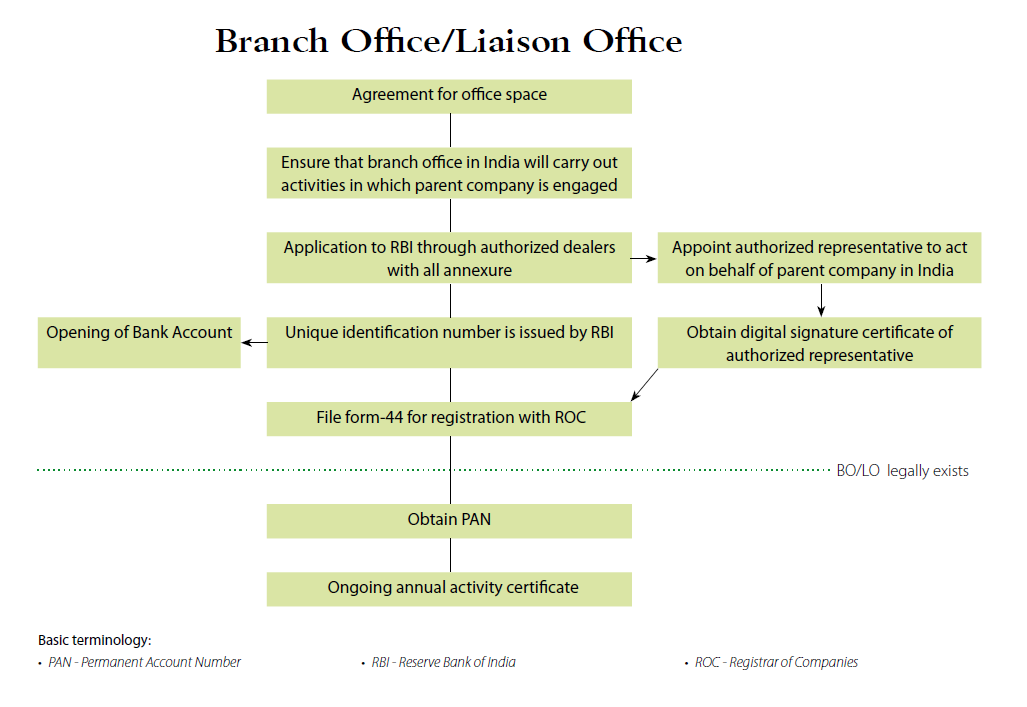

infographic

Setting up a Branch or Liaison Office in India

- January 2014

- Free Access

A flowchart showing the necessary steps to set up a branch or liaison office in India.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us