Our collection of resources based on what we have learned on the ground

Resources

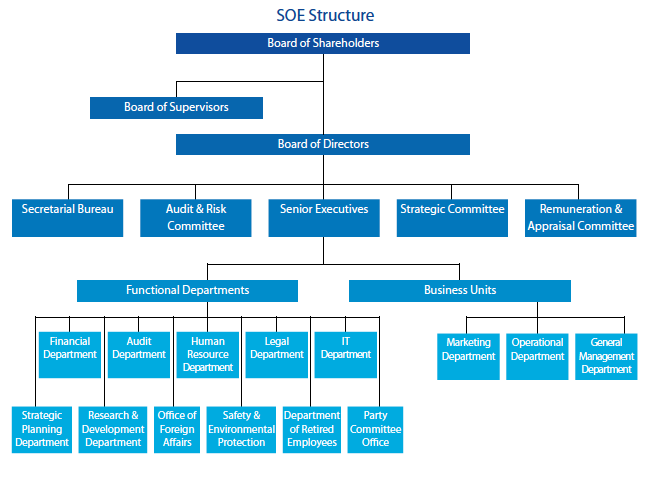

infographic

State-Owned Enterprise Structure

- May 2014

- Free Access

Structure for an State-Owned Enterprise.

Q&A

How are State-Owned Enterprise (SOE) structured in China?

- May 2014

- Free Access

SOEs in China maintain close contact with the government in a variety of ways, many of which the average investor or employee is unaware. Before making any systemic decisions likely to effect change to the company, the senior executives of SOEs must ...

Q&A

What is the difference between a State-Owned Enterprise and a State-holding ente...

- May 2014

- Free Access

A State-Owned Enterprise (SOE) is an enterprise entirely owned by the state while a State-holding enterprise is an enterprise in which a majority of shares are held by the State.

Q&A

How does one qualify for an Interest Charge Domestic International Sales Corpora...

- May 2014

- Free Access

Interest Charge Domestic International Sales Corporation (IC-DISC) is a measure solely for U.S. companies. Export companies can qualify for this to help save on taxes. A U.S. domestic corporation must pass two main tests: The qualified export rece...

magazine

The Gateway to ASEAN: Singapore Holding Companies

- March 2014

- Members Access

In this issue of Asia Briefing Magazine, we highlight and explore Singaporeâs position as a holding company location for outbound investment, most notably for companies seeking to enter ASEAN and other emerging markets in Asia. We explore the nu...

infographic

Definition of Related Party in China

- January 2014

- Members Access

Seven parts about Related Party in China.

infographic

Foreign Exchange in China

- January 2014

- Members Access

Foreign Exchange in China,including fully convertible current account transactions and not fully convertible capital account transactions.

infographic

Corporate Taxes in India

- January 2014

- Members Access

Corporate Taxes in India, including corporate income tax, value-added tax and standard tax on dividends.

Q&A

What should foreign investors beware of when relocating within or between tax di...

- January 2014

- Free Access

When possible, relocation should be avoided for cost and time reasons. Meanwhile, foreign investors considering relocation for other reasons should be aware up front that the process is quite likely far more challenging than you anticipate. Re...

Q&A

Besides tax de-registration, what else does a foreign investor have to do in ord...

- January 2014

- Members Access

Beyond tax de-registration, the transfer process requires a foreign investor to re-do essentially all the steps taken in initially establishing the WFOE. Beyond merely the large number of steps required, the need to minimize costs, potential labor li...

Q&A

What is not legally allowed when changing address within a tax district in China...

- January 2014

- Members Access

To cut corners, many investors have been misadvised by other companies to have separate registered and operational addresses (i.e. the company first registers on the outskirts of a city and operate in the downtown). This set-up is not legall...

Q&A

What is the difference between transferring to a new tax district as opposed to ...

- January 2014

- Members Access

No tax officer wants to lose your company’s revenue by letting you relocate to another district and you should expect resistance in conducting the processes for tax closing. This resistance will crop up during the tax audit, which will s...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us