Our collection of resources based on what we have learned on the ground

Resources

magazine

Doppelbesteuerungsabkommen

- September 2012

- Members Access

Die technische Sprache, die das Thema Doppelbesteuerung umgibt, macht das Gebiet für Laien zu einer Herausforderung. In dieser Ausgabe von China Briefing sollen einige Begriffe wie das âPrinzip der wirtschaftlichen Betrachtungsweiseâ, â...

Q&A

What is a permanent establishment (PE)?

- September 2012

- Free Access

A permanent establishment (PE) can be a place of management, a branch, an office, a factory, etc. or certain activities, such as a building site or construction project or rendering of consultancy services that last over a specified time (stipulated ...

Q&A

Can an ?agent of independent status? operating on behalf of an enterprise of one...

- September 2012

- Members Access

According to the Article 5 of the DTA, an “agent of an independent status” acting in the ordinary course of their business will not be deemed to be a PE. Circular 75 provides that the activities of an agent should meet the below two crit...

Q&A

Will income derived by a resident of a Contracting State from immovable property...

- September 2012

- Members Access

Will income derived by a resident of a Contracting State from immovable property situated in the other Contracting State be taxed in that other State (China and Singapore DTA Agreement)?

Q&A

In which case are the business profits of an enterprise in one Contracting State...

- September 2012

- Free Access

According to Article 7 of the DTA, the profits of an enterprise of a Contracting State can be taxed in the other Contracting State when the enterprise carriers on business in the latter through a PE situated therein. In this case, the profits of the ...

Q&A

How will dividends paid by a company resident in a Contracting State to a reside...

- September 2012

- Members Access

According to Article 10 of the DTA, if the beneficial owner of the dividends is a resident of the other Contracting State, the tax should not exceed: 5% of the gross amount of the dividends if the beneficial owner is a company (other than a partne...

Q&A

What is the situation in China for foreign companies wishing to obtain Double Ta...

- September 2012

- Members Access

The determination of beneficial owner requires the disclosure of a good amount of business information, including information about the number of employees, information about revenue, and so on. In addition, there is always the possibility tha...

podcast

Introduction to Doing Business in Singapore presented by Dezan Shira Alumni Nath...

- August 2012

- Free Access

Dezan Shira & Associates' Business Manager for the Singapore office, Nathanael Susanto discusses questions relevant to foreign investors setting up businesses in Singapore.

podcast

Joint Venture Drivers & Dissolution presented by Rachel Xuan

- August 2012

- Free Access

Mrs. Xuan expounds upon how to avoid incurring major losses from JV dissolution due to ignorance. Covering topics such as: current drivers of JV activity for foreign SMEs, conditions of dissolution, how to dissolve a JV, “deadlock provision” expl...

guide

An Introduction to Doing Business in Myanmar

- July 2012

- US $8.99

Myanmar is finally opening its doors to the rest of the world. A few months ago, the military-led government pushed political and economic reforms, attracting the attention of potential investors worldwide.

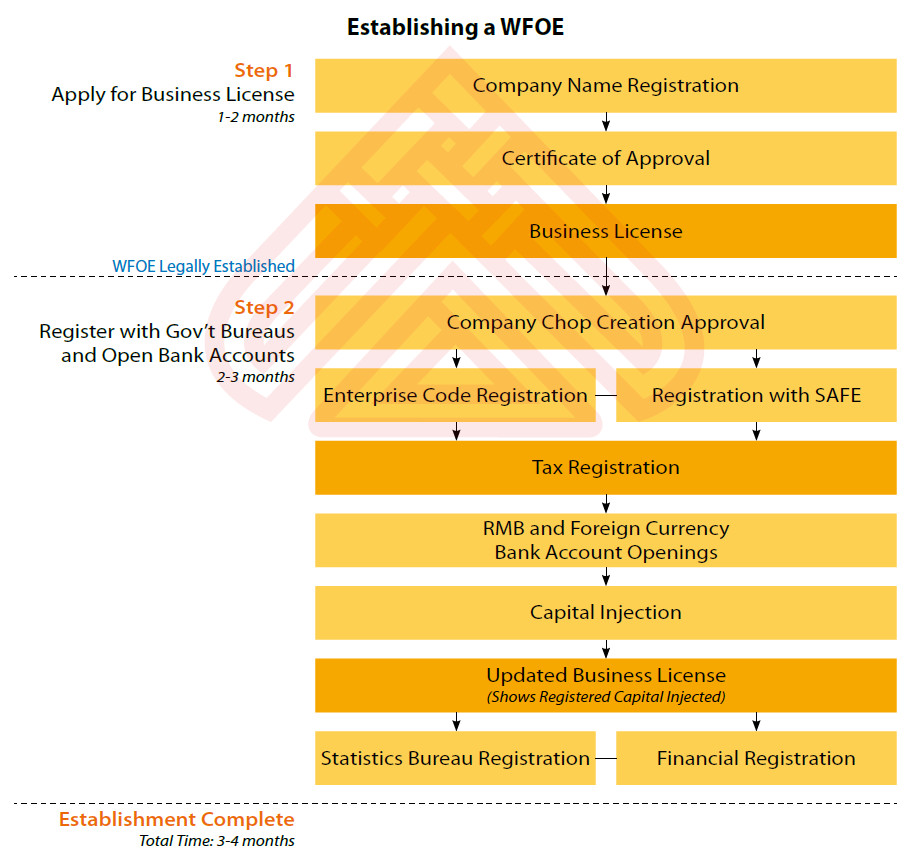

infographic

Establishing a Wholly Foreign Owned Enterprise (WFOE) In China

- June 2012

- Free Access

The flow chart shows the process of establishing a wholly foreign owned enterprise (WFOE) in China.

infographic

Liquidating a Wholly Foreign Owned Enterprise (WFOE) in China

- June 2012

- Free Access

The flow chart shows the procedure of liquidating a wholly foreign owned enterprise (WFOE) in China.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us