Our collection of resources based on what we have learned on the ground

Resources

videographic

Establishing a FICE in China

- March 2015

- Free Access

This Prezi by Dezan Shira & Associates provides an outline of the necessary documents and steps required to establish a foreign invested commercial enterprise (FICE) in China.

videographic

Kontrolle ist gut, Vertrauen ist besser - ohne Kontrolle kein Vertrauen

- March 2015

- Free Access

Die nachfolgende Videografik zeigt die Unternehmensstruktur der WFOE und Joint Venture. Außerdem wird die Wichtigkeit der Unternehmensstempel und der Risikobereiche aufgelistet.

videographic

Bewerbung zur Produkt Lizenz in China

- March 2015

- Free Access

Diese Prezi von Dezan Shira & Associates bietet einen Überblick über die notwendigen Dokumente und Schritte, welche für den Erhalt der Produktlizenz in China benötigt werden.

Q&A

Wie ist die Einkommenssteuer in China abzuf�hren?

- March 2015

- Free Access

Die Einkommenssteuer wird in der Regel vom Arbeitgeber vom Gehalt oder Lohn des Arbeitnehmers einbehalten und monatlich an die Steuerbehörde gezahlt. Monatliches Einkommen von bis zu 1,500RMB wird mit 3% versteuert; bis zu 4,500RMB wird mit 1...

Q&A

Was sind die wichtigsten Steuern in China?

- March 2015

- Free Access

In China ist die Steuerplanung aufgrund der Unterschiede in den Regionen schwierig zu erläutern, da die Steuersätze können je nach Ort variieren. Die wesentlichen Steuern sind die Körperschaftssteuer, Gewerbesteuer, Umsatzsteue...

Q&A

Under what circumstances are new start-up companies entitled to tax exemptions i...

- February 2015

- Free Access

The start-up company must be incorporated in Singapore, be a tax resident in Singapore and have no more than 20 shareholders for the YA. The shareholders must hold the shares directly under their own names and be individuals beneficially. If they are...

Q&A

What are the two main methods by which Singapore and its treaty partners grant r...

- February 2015

- Members Access

There are two main methods which are used including the credit method and the exemption method. The credit method means that Singapore will grant a foreign tax credit to an entity that has paid taxes on business profits derived in the source state. T...

Q&A

Who can take advantage of the benefits of the double tax agreements (DTAs) in Si...

- February 2015

- Free Access

Only Singapore residents or Singapore treaty partners can benefit from the double tax agreements in Singapore. In fact, you also have to obtain a Certificate of Residence (COR) from the Inland Revenue Authority of Singapore before you can claim benef...

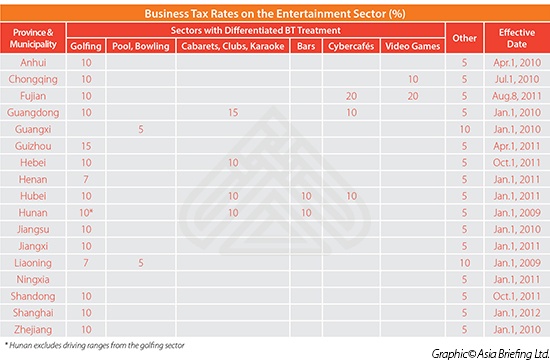

infographic

Business Tax Rates on the Entertainment Sector (%)

- February 2015

- Members Access

List of provinces and municipalities and their business tax rates on different entertainment sectors in China.

magazine

China Investment Roadmap: The Entertainment Industry

- February 2015

- Members Access

In this special edition China Briefing Industry Report, we cast our gaze over the broad landscape of Chinaâs entertainment industry, identifying where the greatest opportunities are to be found and why. Next, we detail some of the most important...

magazine

Using India's Free Trade & Double Tax Agreements

- February 2015

- Members Access

In this issue of India Briefing magazine, we take a look at the bilateral and multilateral trade agreements that India currently has in place and highlight the deals that are still in negotiation. We analyze the countryâs double tax agreements, ...

Q&A

What are Double Tax Agreements (DTAs) and how might foreign investors in India b...

- February 2015

- Free Access

Double Tax Agreements (DTAs) are bilateral agreements under which two states formalize tax rates (for taxes ranging from corporate to withholding tax) for individuals and corporate entities. India has over 90 such arrangements with other countries. F...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us