Our collection of resources based on what we have learned on the ground

Resources

Q&A

How do you set up a branch office in China?

- January 2014

- Members Access

The process of establishing a branch office is essentially an abbreviated WFOE setup. Establishing a branch does not require approval from the Ministry of Commerce, rather, the branch can be directly registered with the Administration of Indus...

Q&A

What can a representative office (RO) do in China?

- January 2014

- Free Access

An RO is only permitted to engage in the following activities: Market surveys, product or service displays and promotional activities related to the products or services of its head office; Liaison activities in connection with produ...

Q&A

What are the two types of fapiaos in China?

- January 2014

- Members Access

Fapiaos can mainly be sorted into two categories – general invoices and VAT invoices. Although the two are often used interchangeably, there are notable differences between the two that consumers should be aware of. Firstly, the latter can b...

Q&A

How to find a permanent establishment for the foreign headquarter?

- January 2014

- Free Access

Under most double tax treaties between China and other countries, a permanent establishment will be constituted if: The Chinese entity receives services from foreign entities, be the service rendered in China or overseas; and The duration of the ...

podcast

Vietnam Briefing Magazine, February 2014 Issue: ?A Guide to Understanding Vietna...

- January 2014

- Free Access

This issue of Vietnam Briefing aims to clarify the entire VAT, short for value-added tax, process by taking you through an introduction as to what VAT is, liabilities that come with it, and how to pay it properly.

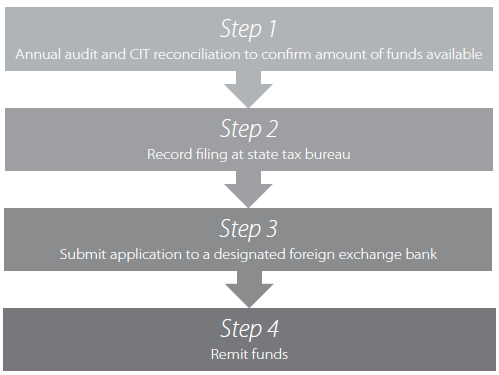

infographic

Profit Repatriation Procedure in China

- January 2014

- Members Access

All foreign-invested enterprises in China are required to carry out annual compliance procedures as mandated by various governmental departments. Here are the steps for profit repatriation in China.

Q&A

What kind of double taxation agreements does Vietnam have?

- December 2013

- Members Access

In Vietnam, double tax agreements impact both corporate and personal income taxes for residents of Vietnam or citizens of the country that Vietnam had signed double tax agreements with, or both. To be considered a resident, following conditions have ...

magazine

Revisiting China's Value-Added Tax Reform

- December 2013

- Members Access

In this issue of China Briefing Magazine, we attempt to demystify some of the confusion revolving around Chinaâs recent value-added tax reform by reintroducing the basics and discussing how the reform will impact your particular business. While ...

Q&A

How does investing in Vietnam help targeting the emerging ASEAN region?

- November 2013

- Free Access

Vietnam's export to the rest of ASEAN nations have reached US$ 13.6 billion in 2011 and accounted for about ten percent of the country's total GDP in 2012 (US$ 138.1 billion). With tariffs reduced on over 4,000 different products, average tariff rate...

Q&A

What kinds of taxes exist in Vietnam and what are their rates?

- November 2013

- Members Access

The main taxes in Vietnam are: Corporate income tax - On June 19, 2013 the National Assembly approved CIT reduction from 25 to 22 percent, which will be further reduced to 20 percent by 2016; Value-added tax standard rate is ten percent. But depe...

magazine

Guida fiscale per l'Asia per il 2014

- November 2013

- Members Access

Le opportunità di vendita ai consumatori asiatici non sono mai state più marcate di quanto lo siano oggi, e tali opportunità continueranno a crescere e svilupparsi nel corso dei tre decenni a venire. La chiave per la comprensione e lâac...

magazine

The 2014 Asia Tax Comparator

- November 2013

- Members Access

In this issue of Asia Briefing Magazine, we examine the different tax rates in 13 Asian jurisdictions â the 10 countries of ASEAN, plus China, India and Hong Kong. We examine the on-the-ground tax rates that each of these countries levy, includi...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us