Our collection of resources based on what we have learned on the ground

Resources

podcast

Demographic Comparison of China and India presented by Chris Devonshire-Ellis

- July 2012

- Free Access

Dezan Shira & Associates' founder Chris Devonshire-Ellis compares the economies, population and recent histories of China and India

magazine

Mehrwertssteuerreform

- July 2012

- Members Access

Als Teil von Chinas Steuerreform unter dem 12. Fünfjahresplan (2011-2015), wird die Mehrwertsteuer die Gewerbesteuer ersetzen. Mit der Verabschiedung einer Pilotreform für den Transportsektor und sechs weitere moderne Industrien hat Shanghai ei...

magazine

Réforme concernant la taxe à valeur ajoutée

- July 2012

- Members Access

La taxe à valeur ajoutée découlant de la réforme de taxe Chinoise et, plus précisément, contenue dans le douzième ââPlan de cinq ansââ (2011 - 2015), remplacera la taxes dâaffaires actuellement en vigueu...

magazine

Reforma del impuesto sobre el valor añadido

- July 2012

- Members Access

Como parte de la reforma fiscal de China en el marco del 12º Plan de Cinco Años (2011 - 2015), el impuesto sobre el valor añadido reemplazará al impuesto sobre el negocio. Shanghai ha tomado la delantera en la reforma del impuesto sobre...

magazine

La riforma dell ' imposta sul valore aggiunto

- July 2012

- Members Access

Come previsto dal programma di riforma fiscale in Cina, in base al XII Piano Quinquennale (2011 - 2015), lâimposta sul valore aggiunto sostituirà la business tax. Shanghai ha fatto da apripista nella riforma dellâimposta sul valore agg...

partner-publication

DPRK Business Monthly July 2012

- July 2012

- Members Access

The latest issue of DPRK Business Monthly is now available as a complimentary PDF download on the Asia Briefing Bookstore. The regular magazine looks at current international, domestic, and peninsular affairs concerning North Korea while also offerin...

magazine

Value-Added Tax Reform

- July 2012

- Members Access

As part of China's tax reform under the 12th Five Year Plan (2011 - 2015), value-added tax will replace business tax. Shanghai has taken the lead in the value-added tax (VAT) reform, having instituted a Pilot Reform Program for the transportation sec...

interview

SKY TV-Desk China: Intervista ad Alberto Vettoretti, Managing Partner di Dezan S...

- June 2012

- Free Access

Alberto Vettoretti, Managing Partner di Dezan Shira & Associates, parla delle attività del gruppo e delle opportunità asiatiche, nel programma di SKY TV, Desk China, in collaborazione con Class, CNBC.

webinar

Individual Income Tax presented by Dezan Shira Alumni Manuela Reintgen

- June 2012

- Free Access

Dezan Shira & Associates alumni Manuela Reintgen from its Beijing office, divulges the integral information necessary to handle individual income tax in China. Manuela explores three main topics: First she explains who pays, when they pay, and what i...

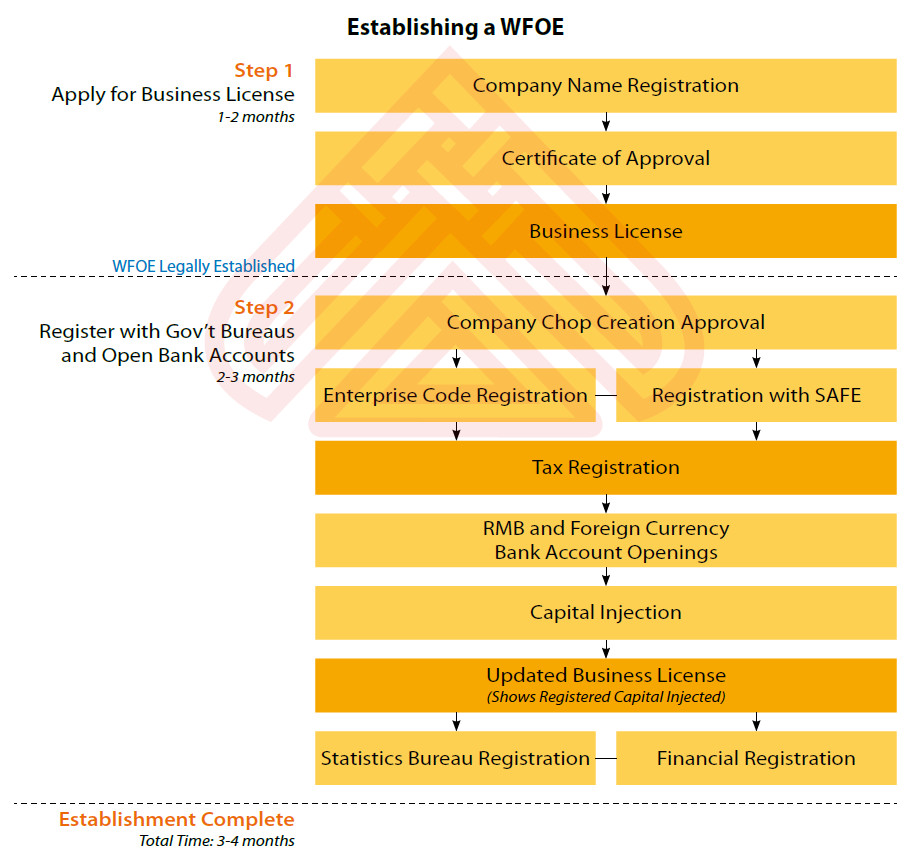

infographic

Establishing a Wholly Foreign Owned Enterprise (WFOE) In China

- June 2012

- Free Access

The flow chart shows the process of establishing a wholly foreign owned enterprise (WFOE) in China.

infographic

Liquidating a Wholly Foreign Owned Enterprise (WFOE) in China

- June 2012

- Free Access

The flow chart shows the procedure of liquidating a wholly foreign owned enterprise (WFOE) in China.

infographic

Tax Liabilities During Liquidation in China

- June 2012

- Members Access

The table shows the tax liabilities and liability calculations during liquidations of a foreign-invested enterprise in China.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us