Our collection of resources based on what we have learned on the ground

Resources

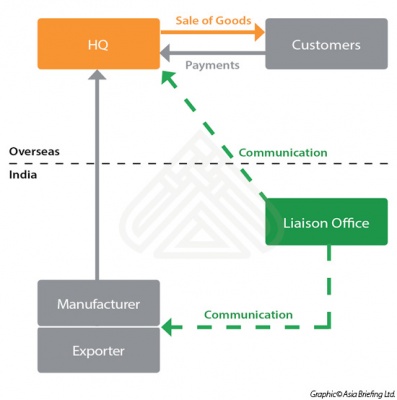

infographic

The Function of a Liaison Office in India

- July 2015

- Free Access

This infographic shows the communicative function a liaison office has when set-up in India.

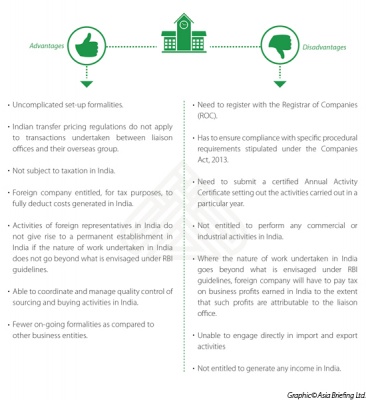

infographic

The Advantages & Disadvantages of Running a Liaison Office in India

- July 2015

- Free Access

This infographic outlines the several advantages and disadvantages related to running a liaison office in India.

magazine

How to Establish a Business in India: Choosing a Low-Risk Entry Model

- June 2015

- Members Access

In this issue of India Briefing Magazine, we explore market entry options that allow foreign investors to test the water before diving into the Indian market. In the first article, we examine the governmentâs new eBiz portal. This portal provide...

Q&A

How does India’s eBiz Portal work?

- June 2015

- Free Access

Services on the eBiz Portal can be accessed only after registering through a two-step process. The first step requires entrepreneurs to login as individuals to receive login credentials, while the second step requires registering the business to acce...

Q&A

What is India’s eBiz Portal?

- June 2015

- Free Access

In a bid to improve the ease of doing business and ultimately the competitiveness of India’s economy, the Indian government has launched the eBiz Portal to integrate several government services into a single website to facilitate faster deliver...

Q&A

What are the criteria for registering a Liaison Office (LO) in India?

- June 2015

- Free Access

The Foreign Exchange Department of the Reserve Bank of India (RBI) will assess the application for registering an LO based on three criteria: investment route, profitability and net worth. Foreign enterprises investing in industries where they are al...

Q&A

What are the required steps following approval by the Reserve Bank of India to s...

- June 2015

- Free Access

Several forms and documents are required by the Indian government officials after foreign companies have received LO approval from the Reserve Bank of India (RBI). These are Form 44 for the Registrar of Companies, an Annual Activity Certificate (ACC)...

Q&A

What are some of the advantages of setting up a Liaison Office in India?

- June 2015

- Members Access

Liaison Offices (LOs) in India function as a communication channel between the parent companies abroad and the local companies. They promote the parent companies’ brand and businesses in the local market whilst overseeing their manufacturing pr...

videographic

Everything You Need to Know About the eBiz Portal of India

- June 2015

- Free Access

This prezi introduces you the eBiz Portal in India which the Indian Government designs to optimize the registration and approval process for doing business in India.

videographic

Everything You Need to Know About the eBiz Portal of India

- June 2015

- Free Access

This prezi introduces you the eBiz Portal in India which the Indian Government designs to optimize the registration and approval process for doing business in India.

Q&A

What are common causes that lead to business restructuring in China?

- June 2015

- Free Access

Causes that lead to business restructuring may be internal or external to the business itself. Oftentimes, business owners make the mistake of assuming that the business model of the parent company at home will share the same success in China. Howeve...

partner-publication

Business Now June 2015

- June 2015

- Members Access

First up, the cover story takes a closer look into how the mobile device in your hand (or on your wrist) revolutionizes how hotels and travel companies attract and cater to Chinese tourists. Read it to see what member companies Marriott and Qunar are...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us