Our collection of resources based on what we have learned on the ground

Resources

infographic

K�rperschaftsteuer: Anforderung und Pr�fung

- May 2015

- Free Access

Eine Übersicht der Anforderungen der Körperschaftsteuer in ASEAN sowie den Ländern China, Hong Kong und Indien

infographic

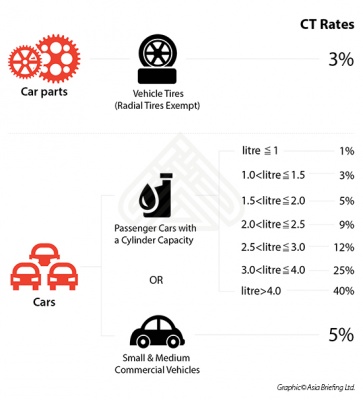

CT Rates for Cars and Car Parts in China

- May 2015

- Members Access

This infographic shows CT rates for cars and car parts in China - For cars, passenger cars with cylinder capacity - different CT rates for different amount of litres - and small & medium commercial vehicles.

Q&A

What are Wholly Owned Subsidiaries (WOS) and what is the process used to remit p...

- April 2015

- Free Access

Q&A

Which types of entities are required to file annual income tax returns by the In...

- April 2015

- Free Access

According to the 1961 Income Tax Act, all legal persons (including corporations, individuals, trusts, and partnerships) must file an annual income tax return in India. For the majority of companies, the fiscal year officially ends on March 31st, and ...

Q&A

What are the key differences between the new India Accounting Standards (Ind-AS)...

- April 2015

- Free Access

While the India Accounting Standards (Ind-AS) represent a major step towards international best practices of financial reporting, many key differences remain between Ind-AS and international financial reporting standards (IFRS). For instance, Ind-AS ...

Q&A

What are the new India Accounting Standards (Ind-AS) as of 2015, and what impact...

- April 2015

- Free Access

The new India Accounting Standards (Ind-AS) are an updated set of accounting standards put forward by the Institute of Chartered Accountants in India (ICAI) to bring India’s generally accepted accounting practices (GAAP) closer in line with int...

magazine

Managing Your Accounting and Bookkeeping in India

- April 2015

- Members Access

In this issue of India Briefing Magazine, we spotlight three issues that financial management teams for India should monitor. In the first article, we examine the new Indian Accounting Standards (Ind-AS) system, which is expected to be a boon for for...

magazine

Managing Your Accounting and Bookkeeping in China

- April 2015

- Members Access

In this issue of China Briefing, we shed light on the practice of accounting in China. We start out by introducing the reader to the development of the Chinese accounting standards, and their main differences compared to international standards. Next...

videographic

Timeline for Tax Filing in India

- March 2015

- Free Access

This prezi navigates you through the several deadlines for filing personal income tax return and other financial statements of a company in India.

Q&A

Under what circumstances are new start-up companies entitled to tax exemptions i...

- February 2015

- Free Access

The start-up company must be incorporated in Singapore, be a tax resident in Singapore and have no more than 20 shareholders for the YA. The shareholders must hold the shares directly under their own names and be individuals beneficially. If they are...

magazine

China Investment Roadmap: The Entertainment Industry

- February 2015

- Members Access

In this special edition China Briefing Industry Report, we cast our gaze over the broad landscape of Chinaâs entertainment industry, identifying where the greatest opportunities are to be found and why. Next, we detail some of the most important...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us