Our collection of resources based on what we have learned on the ground

Resources

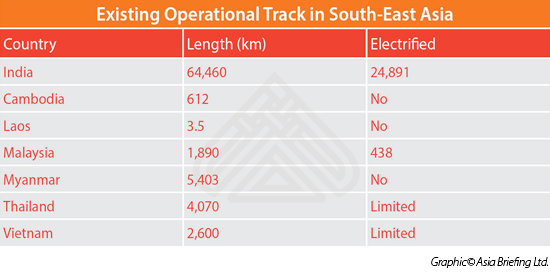

infographic

Existing Operational Track in South-East Asia

- September 2015

- Free Access

This infographic shows the list of the countries in South-East Asia, length (km) and electrified situation of each country in terms of operational track.

partner-publication

Business Now September 2015

- September 2015

- Members Access

The September issue spotlights healthcare in China, from how new indoor smoking bans are helping business to the regulations impacting the medical device and pharmaceutical industries. In the latest installment of our In-Depth Interview series, Unite...

BIT

Bilateral Investment Treaty between Philippines and Myanmar

- August 2015

- Free Access

Bilateral Investment Treaty between Philippines and Myanmar

partner-publication

Business Now August 2015

- August 2015

- Members Access

Innovation â itâs the secret ingredient China hopes to add to its economic rise. It stands as a national imperative, a prerequisite for moving up in global dominance. This issue highlights a few of the many ways Americans and American compa...

BIT

Bilateral Investment Treaty between Netherlands and Lao

- August 2015

- Free Access

Bilateral Investment Treaty between Netherlands and Lao

BIT

Bilateral Investment Treaty between Philippines and Myanmar

- August 2015

- Free Access

Bilateral Investment Treaty between Philippines and Myanmar

magazine

China Investment Roadmap: the Commercial Real Estate Sector

- August 2015

- Members Access

In this issue of China Briefing, we explore the latest trends in commercial real estate in China, and discuss how foreign companies can benefit from Chinaâs massive construction boom. We provide a guide to how firms can sell construction materia...

DTA

Double Taxation Avoidance Agreement between Vietnam and Spain

- August 2015

- Free Access

Agreement between Vietnam and Spain for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income.

DTA

Double Taxation Avoidance Agreement between the United Arab Emirates and Vietnam

- August 2015

- Free Access

Double Taxation Avoidance Agreement between the United Arab Emirates and Vietnam

Q&A

What benefits can tier 1.5 cities enjoy in China?

- August 2015

- Free Access

Locations such as Chengdu, Hangzhou and Nanjing which are considered as the transition frontrunners of tier 2 to 1 cities can enjoy greater government support compared to tier 1 cities. For instance, they are encouraged to build shopping centers larg...

Q&A

What is the impact of pollution crisis on real estate sector in China?

- August 2015

- Free Access

Due to the pollution crisis, the government is trying to build a sustainable economy in order to combat. Since buildings take up 25 percent of the energy use in China, the CCP’s twelfth Five Year Plan aims to build one billion square meters of ...

Q&A

How can selling construction materials in China create opportunities for foreign...

- August 2015

- Free Access

As the government supports the idea of ‘green’ construction and the vast majority of Chinese suppliers are still not familiar with green materials, this policy of supporting environmental friendly constructions encourages foreign investme...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us