Our collection of resources based on what we have learned on the ground

Resources

infographic

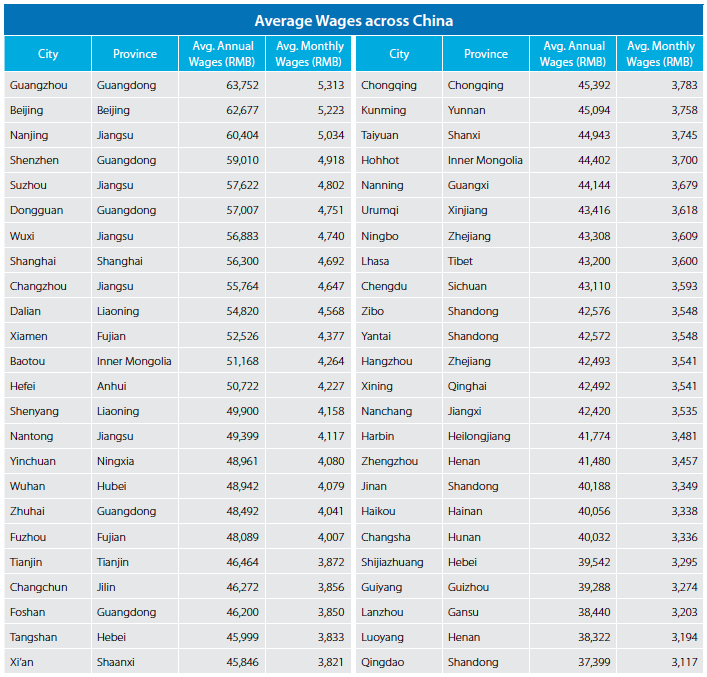

Average wages across China

- May 2014

- Free Access

Average wages for main cities across China.

Q&A

When can an individual collect basic pension in China?

- May 2014

- Free Access

An individual can collect basic pension on a monthly basis if the cumulative premium payment period reaches 15 years at the time he or she reaches the statutory retirement age. In China, the statutory retirement age for men is 60; for white-collar fe...

Q&A

How is deemed profit rate calculated under Chinese corporate income tax law?

- February 2014

- Members Access

According to the “Administrative Measures for the Assessment and Collection of Corporate Income Tax on Non-Resident Enterprises (Guoshuifa [2010] No.19, ‘Circular 19’),” non-resident enterprises are required to keep accurate a...

podcast

Asia Briefing Magazine, January 2014 Issue: "Payroll Processing Across Asia

- January 2014

- Free Access

Sisi Xu, Senior Manager in Dezan Shira and Associates Shenzhen office, introduce payroll from a financial and legal perspective.

infographic

Limited Double Taxation Agreements (DTAs) in Hong Kong and Singapore

- January 2014

- Free Access

There are 26 Limited Double Taxation Agreements (DTAs) in Hong Kong and 7 in Singpore.

infographic

Comprehensive Double Taxation Agreements (DTAs) in Hong Kong and Singapore

- January 2014

- Free Access

There are 18 Comprehensive Double Taxation Agreements (DTAs) in Hong Kong and 69 in Singapore.

infographic

Mandatory Welfare Payments in Selected Cities (2012)

- January 2014

- Members Access

Mandatory Welfare Payments in Selected Cities in China (2012): Beijing, Shanghai, Guangzhou, Shenzhen, Dalian, Hangzhou.

infographic

Monthly Mandatory Benefit Handling Process in China

- January 2014

- Free Access

Monthly Mandatory Benefit Handling Process in China

infographic

Corporate Taxes in China

- January 2014

- Members Access

Introduction to Corporate Taxes in China, including corporate income tax, value-added tax, standard tax on dividends.

infographic

Individual Income Tax Rate in China

- January 2014

- Members Access

For different level of income, Individual Income Tax Rates are different in China

infographic

Individual Income Tax Rate in Singapore

- January 2014

- Members Access

Singapore imposes a progressive tax ranging from 0 to 20 percent on the individual income of a tax resident.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us