Our collection of resources based on what we have learned on the ground

Resources

magazine

Payroll Management in Vietnam

- May 2017

- Members Access

In this edition of Vietnam Briefing, we discuss Vietnam’s current statutory requirements regarding payment, social insurance withholdings, and individual income taxation. We go on to explain the areas where compliance is likely to become a concern ...

infographic

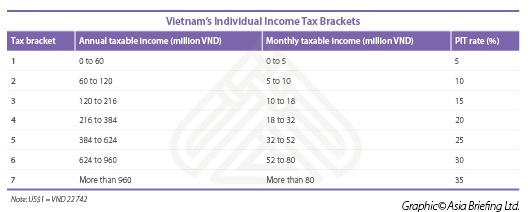

Vietnam's Individual Income Tax Brackets

- May 2017

- Members Access

This table shows Vietnam's individual income tax brackets.

report

Introducción: Hacer Negocios en China 2017

- May 2017

- Members Access

La guía Hacer Negocios en China 2017 está diseñada para introducir los fundamentos de la inversión en China. Compilada por los profesionales de Dezan Shira & Associates, esta guía es ideal, no sólo para las empresas que buscan entrar en el mer...

infographic

Taxable Allowances

- May 2017

- Members Access

This infographic shows fully and partly taxable allowances.

infographic

Calculation of Tax in Metropolitan and Non-Metropolitan Areas

- May 2017

- Members Access

This infographic shows tax calculations in metropolitan and non-metropolitan areas, based on an annual income of RS 1,500,000.

Q&A

What are some allowances given in India?

- May 2017

- Members Access

Allowances are considered as the financial benefits that are given to the employee from the employer, in addition to their salary. They could include, for example, expenses incurred by the employee during discharge of service. Some allowances are tax...

presentation

Indian Income Tax Return Form ITR-1 SAHAJ

- April 2017

- Free Access

This is the Indian Tax Return Form ITR-1 SAHAJ for individuals having income from salaries, one house property, other sources (interest etc.) and having total income up to rs.50 lakh.

presentation

Indian Income Tax Return Form ITR-2

- April 2017

- Free Access

This is the Indian Income Tax Return Form ITR-2 for individuals and HUFs not carrying out business or profession under any proprietorship.

presentation

Indian Income Tax Return Form ITR-3

- April 2017

- Free Access

This is the Indian Income Tax Return Form ITR-3 for individuals and HUFs having income from a proprietary business or profession.

presentation

Indian Income Tax Return Form ITR-4 SUGAM

- April 2017

- Free Access

This is the Indian Income Tax Return Form ITR-4 SUGAM for presumptive income generated from business and profession.

presentation

Indian Income Tax Return Form ITR-5

- April 2017

- Free Access

This form is to be used to file the income tax returns of firms, association of people and body of individuals.

presentation

Indian Income Tax Return Form ITR-6

- April 2017

- Free Access

This form is to be used by companies that do not claim any deductions under Section 11 of the Income Tax Act 1961.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us