Our collection of resources based on what we have learned on the ground

Resources

partner-publication

DPRK Business Monthly Vol. II, No. 12, January 2012

- January 2012

- Members Access

The latest issue of DPRK Business Monthly is now available for complimentary download. The regular magazine looks at current international, domestic, and peninsular affairs concerning North Korea while also offering commentary and tourism information...

DTA

Double Taxation Avoidance Agreement between Lao and Malaysia

- January 2012

- Free Access

Agreement between the Government of the Lao People's Democratic Republic and the Government of Malaysia for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income.

DTA

Double Taxation Avoidance Agreement between Panama and Singapore

- December 2011

- Free Access

Double Taxation Avoidance Agreement between Panama and Singapore

partner-publication

China Expat - A Decade of Writing 2001-2011

- November 2011

- Members Access

This complimentary book has been produced to mark the 10th anniversary of the popular China Expat portal, and features a variety of different pieces from the titles four in-house writers who have contributed pieces during that time.

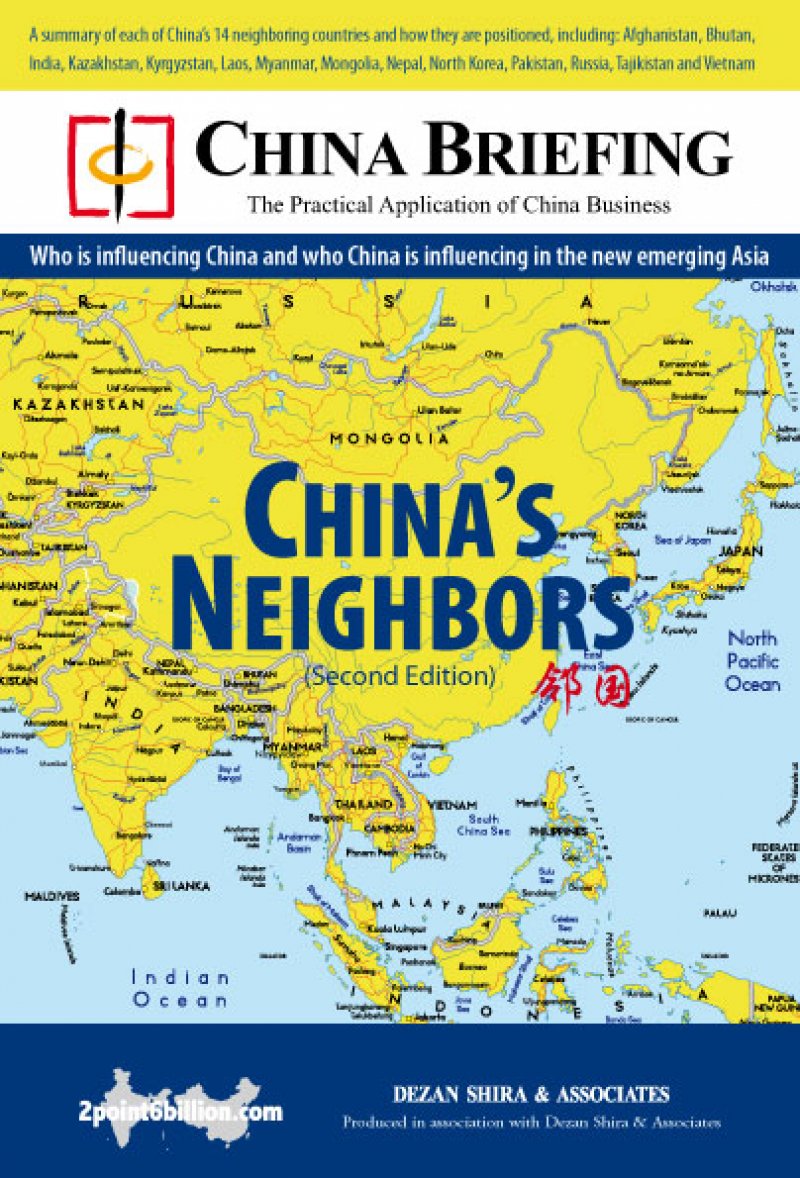

guide

China’s Neighbors (Second Edition)

- September 2011

- US $8.99

A look at Chinaâs relationship with its 14 neighbor countries: Afghanistan, Bhutan, India, Kazakhstan, Kyrgyzstan, Laos, Myanmar, Mongolia, Nepal, North Korea, Pakistan, Russia, Tajikistan and Vietnam.

DTA

Double Taxation Avoidance Agreement between Albania and Singapore

- July 2011

- Free Access

Double Taxation Avoidance Agreement between Albania and Singapore

DTA

Double Taxation Avoidance Agreement between Saudi Arabia and Singapore

- July 2011

- Free Access

Double Taxation Avoidance Agreement between Saudi Arabia and Singapore

partner-publication

DPRK Monthly, Vol. 2, No. 1, February 2011

- February 2011

- Members Access

This issue of the DPRK Business Monthly looks at current international, domestic, and peninsular affairs concerning North Korea.

DTA

Double Taxation Avoidance Agreement between Singapore and U.K. Protocol

- January 2011

- Free Access

Double Taxation Avoidance Agreement between Singapore and U.K. Protocol

DTA

Double Taxation Avoidance Agreement between Malaysia and Kazakhstan

- January 2011

- Free Access

Double Taxation Avoidance Agreement between Malaysia and Kazakhstan

DTA

Double Taxation Avoidance Agreement between Malaysia and U.K. Protocol

- December 2010

- Free Access

Double Taxation Avoidance Agreement between Malaysia and U.K. Protocol

DTA

Double Taxation Avoidance Agreement between Libya and Singapore

- December 2010

- Free Access

Double Taxation Avoidance Agreement between Libya and Singapore

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us