Our collection of resources based on what we have learned on the ground

Resources

Q&A

What advantages does Vietnam’s Dinh Vu Industrial Zone(DUIZ) have?

- December 2015

- Free Access

Advantages of the DUIZ lie in its proximity to various outlets for exported goods, its well-established facilities and regulatory assistance, as well as easily accessible high skilled labor pools for companies to jump start their manufacturing operat...

Q&A

Why is the Hoa Khanh Industrial Zone(HKIZ) in Vietnam an attractive destination ...

- December 2015

- Free Access

HKIZ attracts manufacturers from the garments and electronics industry as its infrastructure and facilities are structured to meet the specific needs of these growing industries. Services provided to the investors include access to water, electricity...

Q&A

Why is the Vietnam Singapore Industrial Zone(VSIZ) in Vietnam a favorable option...

- December 2015

- Free Access

Located in Binh Duong province’s Thuan An district, the VSIZ has showcased Vietnam’s evolving capacity to host investors and to facilitate a variety of manufacturing from food processing to medical equipment. In addition to a series of ta...

magazine

Labor Dispute Management in China

- December 2015

- Members Access

In this issue of China Briefing, we discuss how best to manage HR disputes in China. We begin by highlighting how China's labor arbitration process - and its legal system in general - widely differs from the West, and then detail the labo...

podcast

Converting from a Representative Office (RO) to a Wholly Foreign Owned Enterpris...

- December 2015

- Free Access

Isabelle Ding, International Business Advisory Associate in Dezan Shira & Associates' Shanghai office discusses how to convert from a Representative Office (RO) to a Wholly Foreign Owned Enterprise (WFOE) in China.

podcast

Converting from a Representative Office (RO) to a Wholly Foreign Owned Enterpris...

- December 2015

- Free Access

Isabelle Ding, International Business Advisory Associate in Dezan Shira & Associates' Shanghai office discusses how to convert from a Representative Office (RO) to a Wholly Foreign Owned Enterprise (WFOE) in China.

magazine

Navigating the Vietnam Supply Chain

- December 2015

- Members Access

In this edition of Vietnam Briefing, we discuss the advantages of the Vietnamese market over its regional competition and highlight where and how to implement successful investment projects. We examine tariff reduction schedules within the ACFTA and ...

presentation

Province cinesi: Dove investire?

- December 2015

- Free Access

La seguente presentazione, redatta dall’Italian Desk di Dezan Shira & Associates, mostra i principali settori, vantaggi e svantaggi di investimento in ciascuna delle province cinesi.

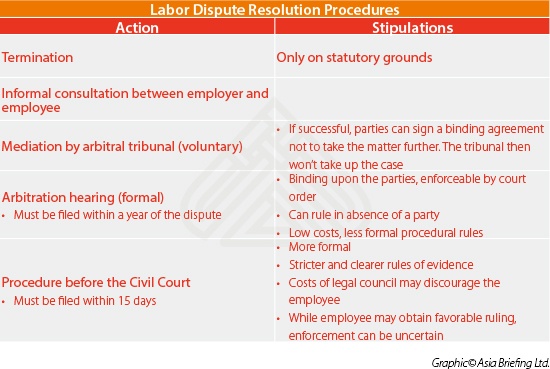

infographic

Labor Dispute Resolution Procedures in China

- December 2015

- Members Access

This infographic shows you what actions can be taken and related stipulations when companies have labor disputes with their employees.

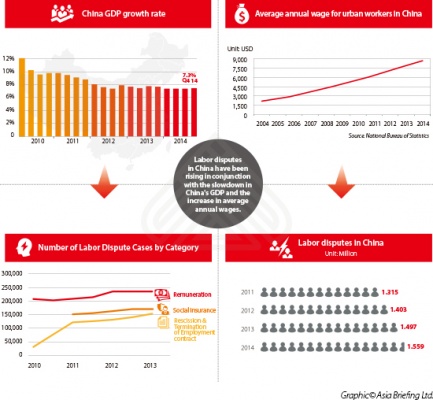

infographic

Correlation between Increasing Labor Dispute Cases with GDP Growth and Average A...

- December 2015

- Members Access

Labor disputes in China have been rising in conjunction with the slowdown in China's GDP and the increase in average annual wages.

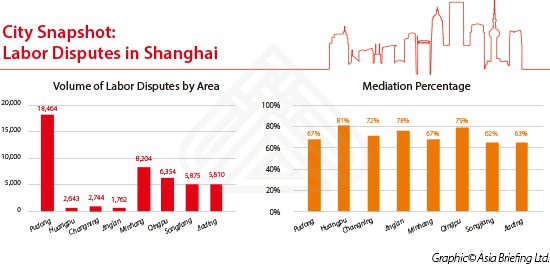

infographic

City Snapshot: Labor Dispute in Shanghai

- December 2015

- Members Access

This infographic shows the volume of labor disputes and the mediation percentage by area in Shanghai.

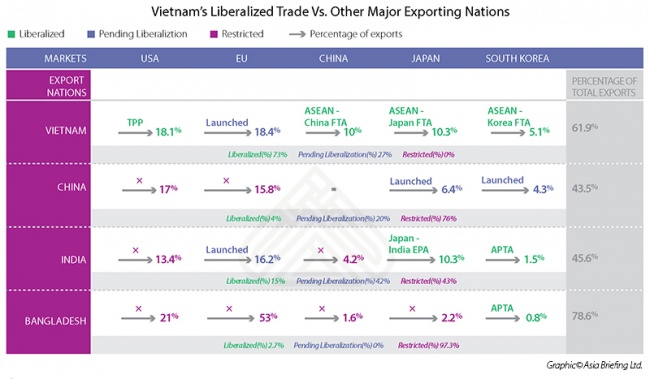

infographic

Vietnam's Liberalized Trade Vs. Other Major Exporting Nations

- December 2015

- Members Access

This infographic compares Vietnam's exports with some major global trade partners and the exports of other competing countries.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us