Our collection of resources based on what we have learned on the ground

Resources

infographic

Treaty Benefit Administrative Requirements by Income Type in China

- January 2014

- Free Access

For passive income and active income, the treaty benefit administrative requirements are different in China.

infographic

Equity Transfer, Notification Documentation in China

- January 2014

- Free Access

When establishing an offshore holding company, four parts need to be included in the notification.

infographic

China's Tax System of 2012

- January 2014

- Members Access

Current tax system in China consists of two parts: value added tax and business tax.

infographic

Value Added Tax (VAT) Calculation in China

- January 2014

- Free Access

Value added tax (VAT) calculation in China consists of two parts: output VAT and input VAT.

infographic

Automatic and Governmental-Approval Routes for FDI in India

- January 2014

- Free Access

FDI in India can be done through two routes-the automatic route and the government route- with most done through the former.

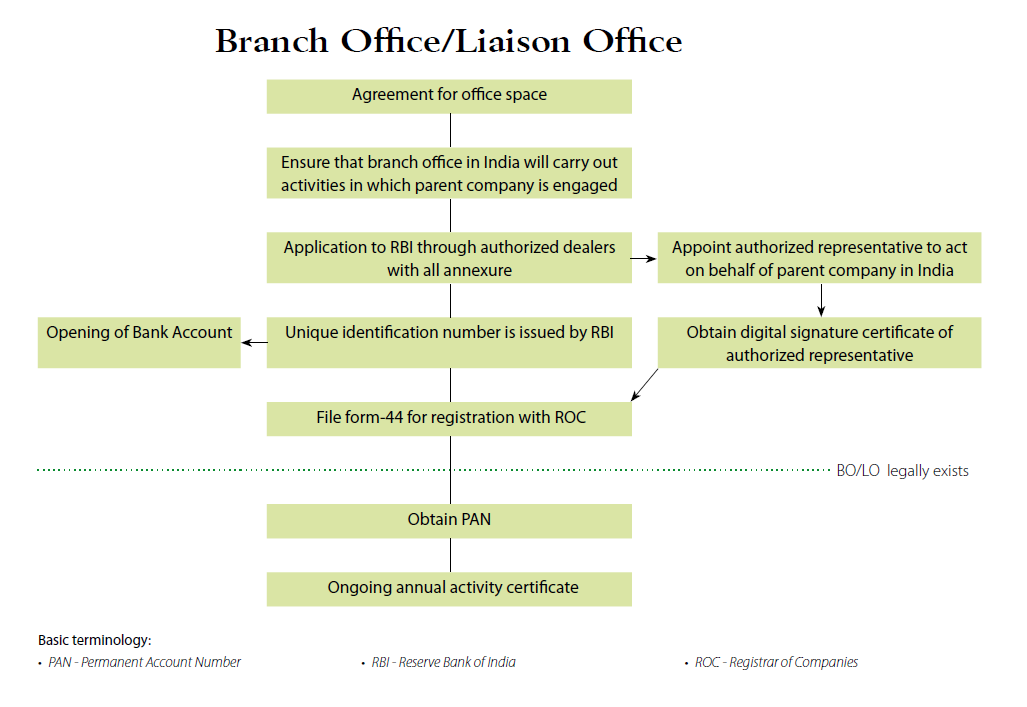

infographic

Setting up a Branch or Liaison Office in India

- January 2014

- Free Access

A flowchart showing the necessary steps to set up a branch or liaison office in India.

infographic

Key Points of Circular 110 National Value Added Tax (VAT) Reform in China

- January 2014

- Members Access

There are three key points in the Circular 110 National Value Added Tax (VAT) Reform in China.

infographic

Representative Office (RO) Document Checklist in China

- January 2014

- Free Access

Document Checklist for Representative Office (RO) in China

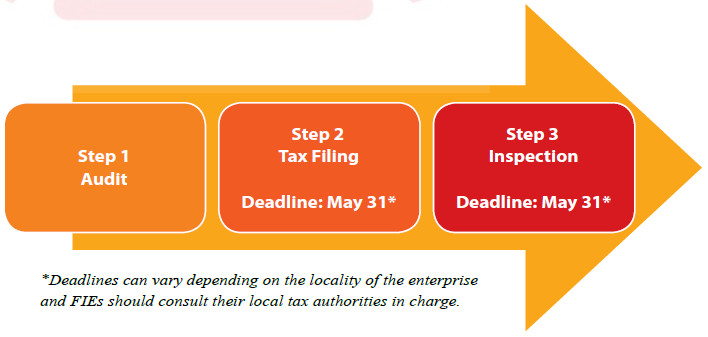

infographic

Joint Venture (JV), Wholly Foreign-Owned Enterprise (WFOE) and Foreign-Invested ...

- January 2014

- Free Access

Annual Compliance for Joint Venture (JV), Wholly Foreign-Owned Enterprise (WFOE) and Foreign-Invested Commercial Enterprise (FICE) in China

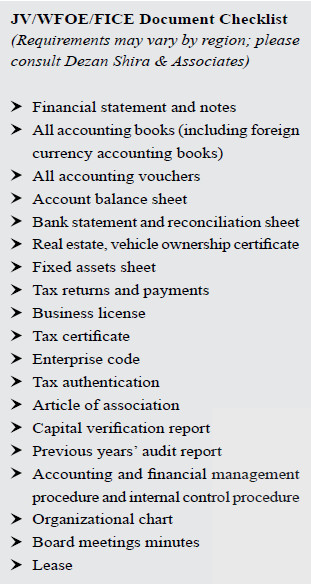

infographic

Joint Venture (JV), Wholly Foreign-Owned Enterprise (WFOE) and Foreign-Invested ...

- January 2014

- Free Access

Document Checklist for Joint Venture (JV), Wholly Foreign-Owned Enterprise (WFOE) and Foreign-Invested Commercial Enterprise (FICE) in China

infographic

Process to Become a Value Added Tax (VAT) General Taxpayer in China

- January 2014

- Free Access

Process of how to become a Value Added Tax (VAT) General Taxpayer in China

infographic

Value Added Tax (VAT) Rate in Shanghai in the Transport and Modern Services

- January 2014

- Members Access

For different services, value added tax (VAT) rate in the Transport and Modern Services is different in Shanghai.

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us