Our collection of resources based on what we have learned on the ground

Resources

webinar

Establishing a Joint Venture in India and Understanding its Legal Aspects

- October 2020

- Free Access

On October 22, Business Advisory Services Senior Associate Vikas Saluja and International Business Advisory Manager Sahil Aggarwal discussed the process of setting up a joint venture in India and due diligence for foreign investors.

Q&A

Establishing a Joint Venture in India

- October 2020

- Free Access

Generally, the JV is set up by forming a separate limited company for the Joint Venture so that each party will have the limited liability i.e. up to amount of share capital invested by them. However, the tax position must be assessed as transferring...

webinar

Signs of Economic Recovery in India and Emerging Opportunities Amid COVID-19

- September 2020

- Free Access

India’s economy is showing signs of recovery after witnessing major COVID-19 led business disruptions, including prolonged nationwide shutdowns. What role has the government played in supporting businesses? What are the emerging opportunities amid ...

Q&A

Opportunities for Foreign Investors in India’s Healthcare Industry

- September 2020

- Free Access

To make India self-reliant and to reduce dependence on China for raw materials such as drug intermediates, APIs, key starting materials (KSMs), and medical devices, the government has announced Production-linked incentive (PLI) scheme for bulk drugs ...

Q&A

Opportunities for Foreign Investors in India’s Media & Entertainment Industry

- August 2020

- Free Access

This Q&A seesion discusses the opportunities for investment in India's media and entertainment industry.India is the fifth largest M&Emarket in the world. More than 1800 films are produced every year in various languages in India. The country has a l...

webinar

Summit India-UE 2020: Quando un Accordo di Libero Scambio?

- August 2020

- Free Access

Le trattative per un patto commerciale e di investimento fra le due regioni sono rimaste ferme per alcuni anni a causa delle resistenze ad assicurare libero accesso al mercato per le merci e professioni. Ora Bruxelles e Dehli intendono alleggerire la...

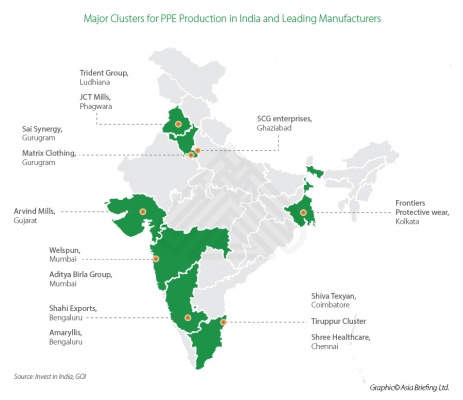

infographic

Major Clusters for PPE Production in India and Leading Manufacturers

- July 2020

- Free Access

Besides Bengaluru, which has emerged as a hub for producing PPE, other cities in India manufacturing PPE kits or products include – Tiruppur, Chennai, and Coimbatore in Tamil Nadu; Ahmedabad and Vadodara in Gujarat; Amritsar, Phagwara, and Ludhiana...

webinar

L’economia dell’india dopo il lockdown

- July 2020

- Free Access

Un breve commento ai piani adottati dal Governo Indiano per rivitalizzare la propria economia dopo il lockdown. Quali riforme e semplificazioni necessarie per diventare una destinazione alternativa alla Cina per gli Investimenti Diretti Esteri.

webinar

Post-COVID-19: Shifting of Supply Chains to India

- July 2020

- Free Access

The COVID-19 outbreak has led to major disruptions in global supply chains. To mitigate risks in future, companies have started focusing on a geographic diversification of their sourcing base. In this webinar, Koushan discuss the Post-COVID-19 busine...

webinar

Manufacturing in India: Investment Opportunities and Role of Integrated Industri...

- June 2020

- Free Access

Dezan Shira & Associates in collaboration with Mahindra World City hosted a webinar to discuss India’s manufacturing landscape and the role of integrated industrial ecosystems in providing ease of doing business to foreign investors.

Q&A

Opportunities for Foreign Investors in India’s Manufacturing Sector

- June 2020

- Free Access

What do foreign investors need to know about the manufacturing sector in India?

Q&A

What You Need to Know Before Setting Up in India

- May 2020

- Free Access

What are the major challenges foreign companies face while setting up in India? India’s ranking has significantly improved in Ease of Doing Business list. However, before entering the Indian market, an enterprise requires professional advice t...

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact UsOur Clients

Discover our esteemed global clients across diverse sectors. We believe in providing our clients with exceptional service and a commitment to being their partner for growth in Asia.

See what our clients say about us