ASIAPEDIA

Infographic

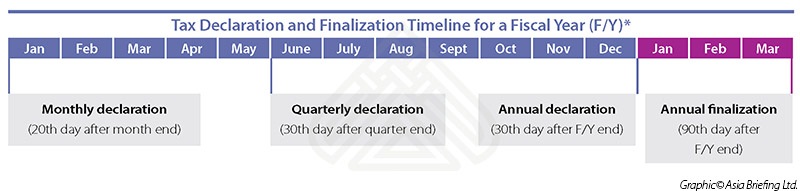

Tax Declaration and Finalization Timeline in Vietnam for a Fiscal Year (F/Y)

Tax Declaration and Finalization Timeline in Vietnam for a Fiscal Year (F/Y)

Foreign owned Enterprises in Vietnam must conduct CIT finalization at the end of every year. Submission of finalization paperwork must be submitted to the head of relevant tax agencies 90 days prior to the end of the fiscal year.

We provide expert advisory and corporate services across Asia, guiding businesses through complex markets and regulations.