Liaison Offices in India

Setting up a Liaison Office in India is a popular choice for foreign companies looking to enter the Indian market.

Foreign corporations may set up a Liaison Office to promote business activities of the parent company. However, India requires a number of taxation rules to be followed and also restricts the activities that a LO may engage in.

Below is a list of commonly asked questions concerning Liaison Offices (LO) in India.

What are the permitted activities that may be taken up by a Liaison Office in India?

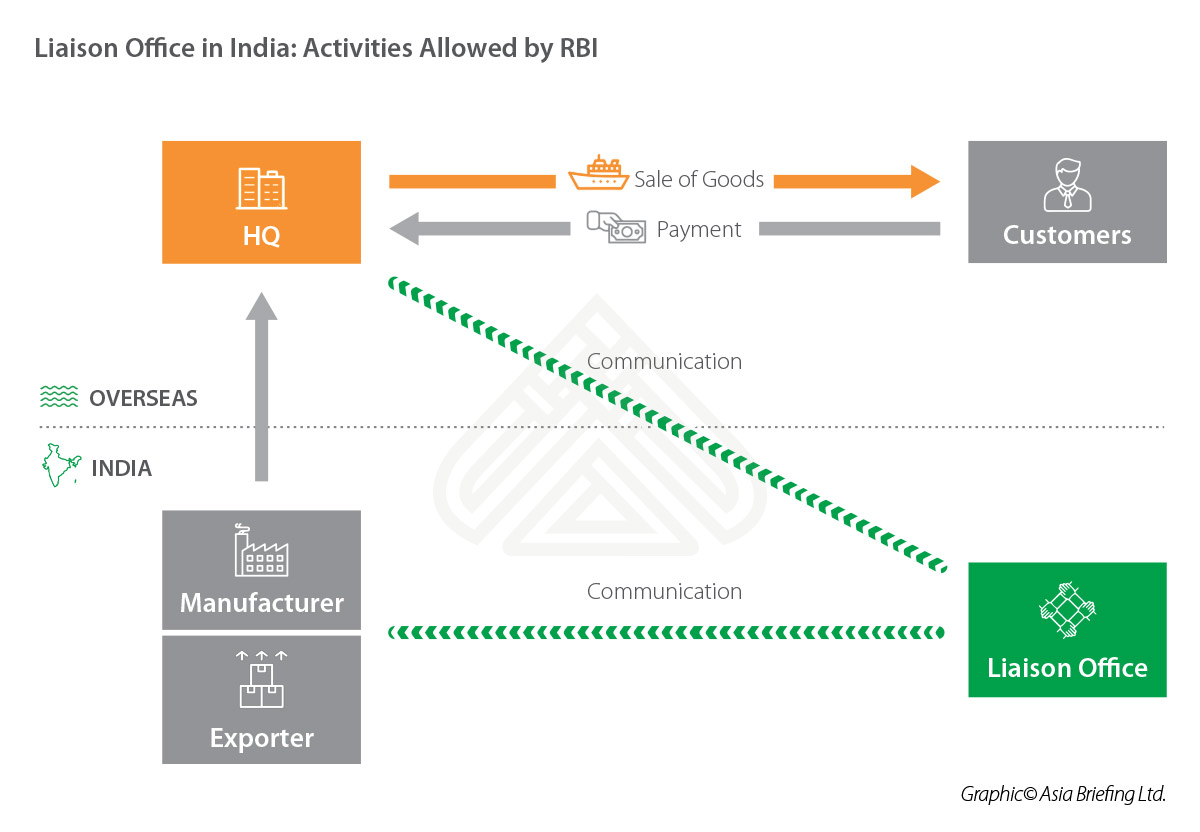

As per RBI’s Master Direction, the following are permissible activities for a Liaison Office(LO) in India:

- Representation of the parent company in India.

- Promotion of import-export from/to India.

- Promotion of technical/ financial collaborations between parent company and companies in India.

- Facilitation of communication channel between parent company and Indian companies.

The liaison office is, however, not allowed to operate in any way commercial, trading and industrial activities, directly and indirectly. Thus, the only way to sustain such office is by private remittance received from its foreign parent company. The remittance must be made through usual banking channels.

Is a liaison office subject to taxation in India?

A liaison office (LO) is not subjected to taxation as it does not generate or accrue any income in India due to being prohibited to conduct commercial / trading / industrial activity, directly or indirectly.

An LO is to be maintained via outward remittances received from its parent company abroad.

However, the legal stance as explained above may change if the activities of a liaison office are of a nature that they create a “permanent establishment” or a “business connection” for the foreign company in India.

How to trigger a permanent establishment status in India by a liaison office?

Permanent establishment status will be triggered when a direct business connection is established between the liaison office and its foreign parent company. If the status is triggered, then the liaison office in India will be deemed as a foreign entity for tax purposes, and other options will be more cost-efficient.

If the liaison office has not triggered a permanent establishment status, then it is not subject to any tax treatment.

What are liaison offices required to file in India?

Liaison office(s) that are not engaged in any trading, manufacturing or other commercial activities in India are (with approval of the Reserve Bank of India which is valid up to the end of the relevant accounting year) only required to file Indian business accounts, along with:

- A copy of an approval letter issued by the Reserve Bank of India, valid up to the end of the relevant accounting year.

- Statement of receipts of payments made by the Indian branches of the company.

- A statement of the company’s assets and liabilities in India.

- A certificate that the company did not carry out any trading, manufacturing or commercial activity or undertake any invoicing of goods in India.

All statements must be verified by:

- An authorized representative of the foreign office; and,

- A Chartered Accountant practicing in India.

In addition, the liaison office is required to obtain a Permanent Account Number (PAN) from the Income Tax Department and a Unique Identification Number (UIN) from the Reserve Bank of India. Further, within 30 days of establishment, the office must be registered with the Registrar of Companies (RoC) by filing e-Form FC-1 via the Ministry of Corporate Affairs’ online portal.

These documents must be submitted to the Registrar of Companies within 9 months from the end of the financial year of the entity.

These documents must be submitted to the Registrar of Companies within 9 months from the end of the financial year of the entity.

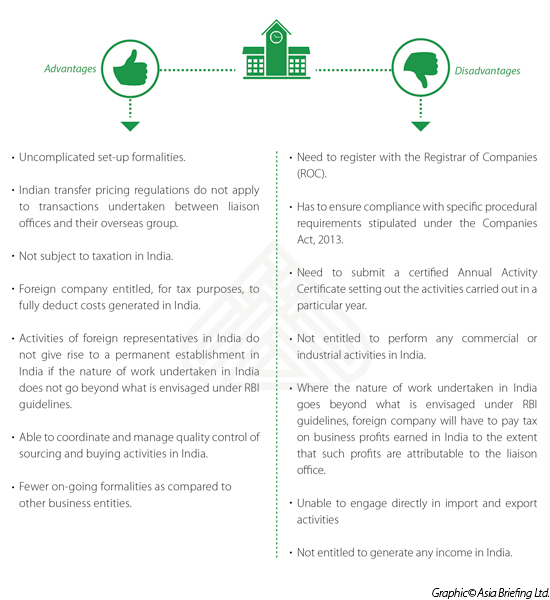

What are the advantages and disadvantages of setting up a Liaison Office in India?

Liaison offices offer foreign investors a method to explore business opportunities in India.

Although liaison offices are prohibited from engaging in direct commercial activity, they allow investors to facilitate communication with possible business partners, explore market conditions, or oversee the management of indirect business activities in India.

Under such restrictions, the range of activities which an LO can carry out are limited to simply collecting market information for the parent companies and also advertising for them.

However, liaison offices are relatively quick and inexpensive to open. Thus, providing foreign investors a stepping stone towards establishing operations in India.

CONTACT US

We provide expert advisory and corporate services across Asia, guiding businesses through complex markets and regulations.