Article

Modes of Setting Up for Foreign Businesses - Corporate Establishment in China

Modes of Setting Up for Foreign Businesses - Corporate Establishment in China

Foreign firms investing in China’s complex and diverse market may be faced with various legal, regulatory as well as cultural challenges when preparing for market entry.

If these challenges are not handled with caution and vigilance, a foreign enterprise’s expansion plans may come to an abrupt halt.

One of the first tasks is choosing the best-fit corporate structure for your business. This will mitigate unnecessary business constraints, costs, and prevent regulatory scrutiny.

What are the key considerations while choosing an office type?

Certain key consideration while planning your corporate establishment route are:

- What are the business objectives?

- What are the day-to-day operational requirements of the office?

- How much domestic input is required by the foreign company?

- How does the foreign enterprise want to manage their capital requirements, legal liability, tax, commercial and hiring capacity?

In addition, foreign investors should consider the time frame for each type of set up and the type of industry and audience they intend to explore.

To avoid unnecessary expenditure or a failed attempt at market entry, investors should also seek local advice.

It may be necessary to seek guidance on how the local authorities in various regions in China view the industry the firm seeks to enter – this may prove to be an important decider for the ease of operations of the company within a particular region.

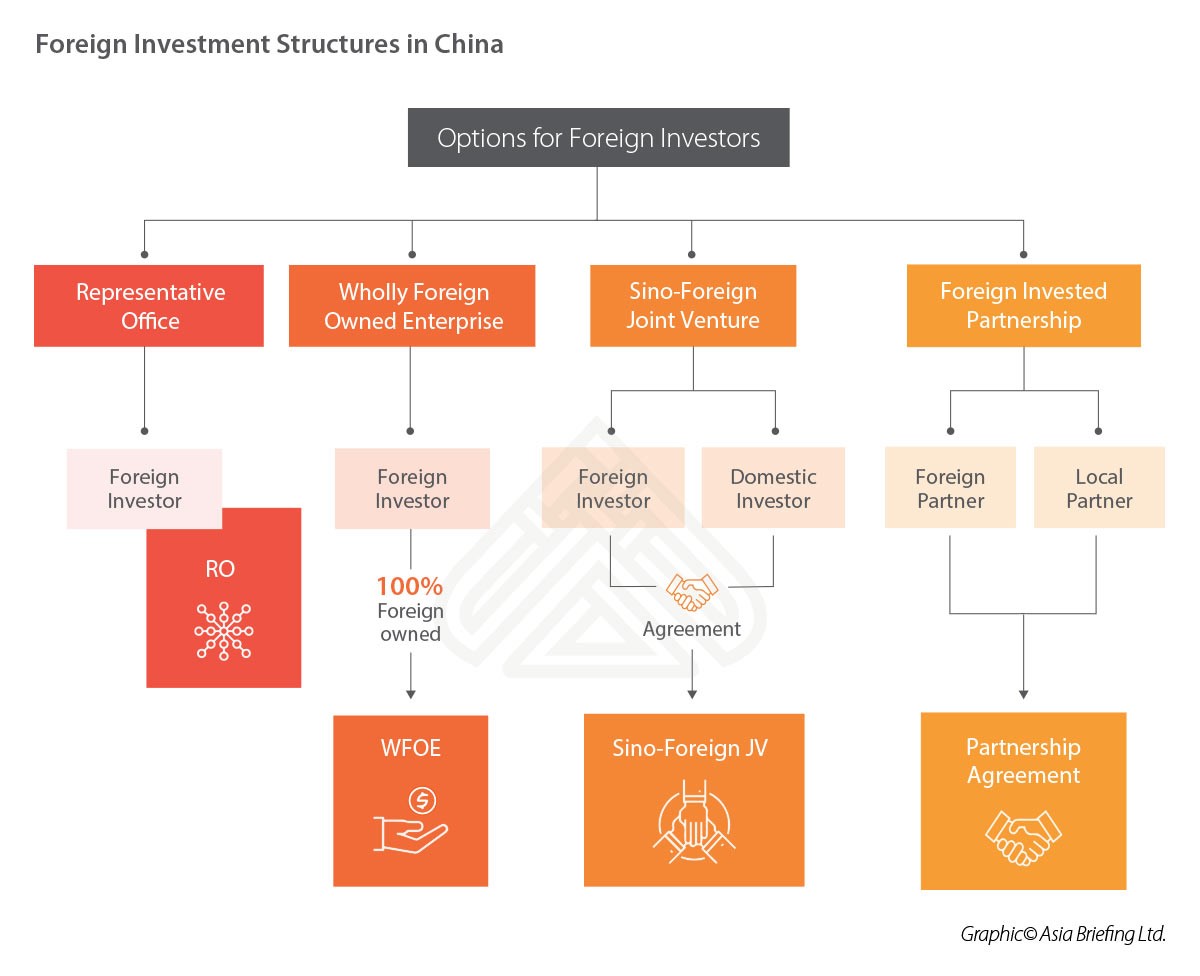

What are the different office types in China?

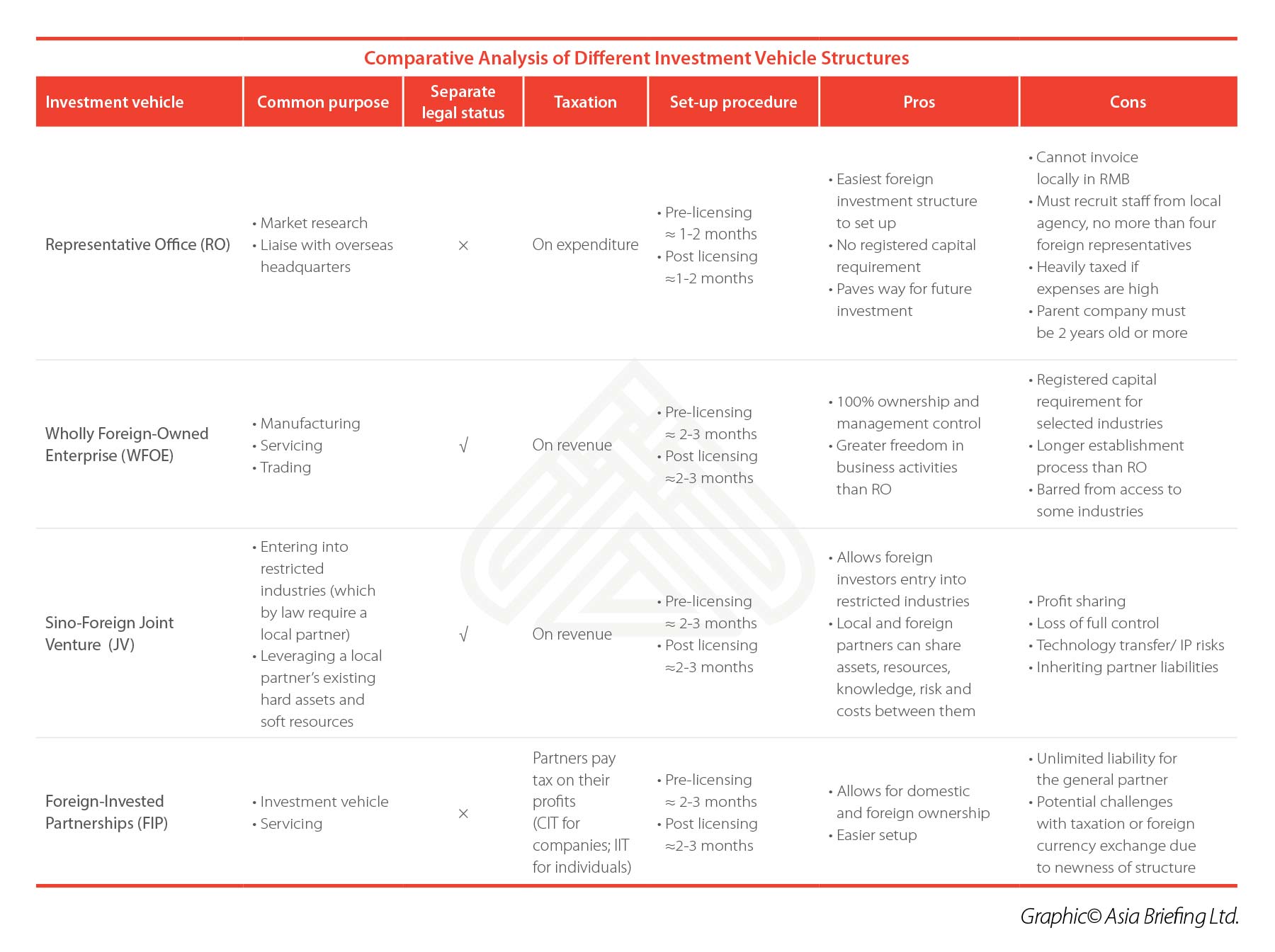

- Representative Office

A Representative Office (RO) serves as an extension of a foreign enterprise, its sole function is to facilitate the activities of its foreign parent in China.

This means that the office will merely act as a liaison office for the foreign company. The parent company is required to assume all legal and transactional liabilities and assets of the RO.

Thus, no separate legal entity is formed when an RO is established. This type of office is also limited in permissible commercial activities; including restrictions on profit generating activities and hiring of local staff - which may be done only through a qualified labor dispatch agency.

The extent of permissible commercial activity also differs from region to region in China.

- Wholly Foreign Owned Enterprise

A Wholly Foreign Owned Enterprise (WFOE) is an enterprise owned by one or more foreign investors. Unlike an RO, a WFOE is a separate legal entity as per Chinese laws. This essentially means that it has its own rights and obligations, such as the capacity to own property and the ability to enter into legally binding contracts.

A WFOE may be set up as a limited liability company, with the liability of each investor limited to the total capital paid by them.

Service (or Consulting) WFOE;A WFOE is broadly set up for three purposes:

- Trading WFOE; or,

- Manufacturing WFOE.

All three of these entities will have the same legal rights and obligations. However, their setup procedures, costs, and range of commercial activities will differ according to type.

- Sino-Foreign Joint Venture

Sino-Foreign Joint Venture (JV) is a commercial enterprise between a foreign partner and a domestic Chinese party.

There are two types of Joint Ventures:

- Equity Joint Venture (EJV); and,

- Cooperative Joint Venture (CJV).

An important thing to note is that this neither of these is a merger of the two companies, instead an entirely new legal entity is formed. However, a Cooperative Joint Venture (CJV) may be an exception to this.

An EJV is a limited liability company where profits and losses are distributed between parties in proportion to their respective equity interest. Normally, a foreign investor in a JV should own at least 25 percent of total shares. Also, a Chinese individual cannot normally be a JV shareholder, barring exceptional circumstances.

A CJV structure offers more flexibility for investors. It can operate as a limited liability company or as a non-legal entity, depending on the required function of the entity. Further, unlike the EJV structure, the terms of the business are negotiated through a contract.

This means that the profit, risk and control are not divided in proportion to equity interests of the partners.

Investors commonly opt for a JV when foreign companies want access to a restricted industry sector which stipulates the necessity of a Chinese partner to meet investment requirements.

Or else, foreign companies form JVs when they want to leverage the Chinese partners sales and distribution network.

Foreign Invested Partnership

Like JVs, a Foreign Invested Partnership (FIP) involves two or more investors coming together for commercial purposes.

There are no minimum capital requirements for a FIP, which allows it to be set up as an unlimited liability company.

The Partnership Enterprise Law regulates the set-up and operation of partnership arrangements.

However, on terms relating to its operation, the law often awards discretion to the FIP and dictates that the agreement shall prevail in case of any discrepancies with other requirements laid out.

This provides partners a high level of autonomy on how they operate the business.

However, investors need to assume more liability under this model, making it a less favored option among foreign investors.

For more information on doing business in China, contact us or visit our online business intelligence platform - China Briefing.

We provide expert advisory and corporate services across Asia, guiding businesses through complex markets and regulations.