Our collection of resources based on what we have learned on the ground

Resources

magazine

Interne Prüfung und Kontrolle

- February 2015

- Members Access

Diese Ausgabe des Asia Briefing Magazins behandelt die interne Prüfung und Kontrolle. Sie wird in den asiatischen Ländern immer wichtiger. Nicht nur, um einen Ãberblick über die Performance des eigenen Unternehmens zu bekommen, sondern au...

Q&A

Can companies listed on the stock exchange give their employees the right to buy...

- January 2015

- Free Access

Stock options are a type of remuneration where companies that are listed on a stock exchange give their employees the right to buy stocks in the company at a certain price. After one year, the options become exercisable and the employe...

Q&A

Welche notwendigen Compliance-Anforderungen stellt China?

- December 2014

- Free Access

China stellt 4 verschiedene Compliance-Anforderungen, den Jahresabschlussbericht, den Körperschaftsteuerausgleich, die jährliche Inspektion, sowie die Gewinnrückführung.

Q&A

Welche Auditformen gibt es in Indien?

- December 2014

- Free Access

Indien verpflichtet Aktiengesellschaften und nicht-börsennotierte Firmen, deren durchschnittlicher Jahresumsatz in den letzten drei Jahren bzw. deren Stammkapital und Rücklagen zu Beginn des jeweiligen Geschäftsjahres mehr als INR 5 Millionen betr...

Q&A

Was ist bei der Buchhaltung bzw. Buchf�hrung in Vietnam zu beachten?

- December 2014

- Free Access

Vietnam erlaubt ausländischen Unternehmen zwei verschiedene Buchführungssystem. Eines basiert auf den Vietnamesischen Buchhaltungsstandard (VAS) und das andere ist ein System für Unternehmen mit ausländischer Hauptniederlassung...

presentation

Taxation & Accounting: What SMEs Should Know for the Year 2013-2014

- September 2014

- Members Access

This presentation by Richard Cant, Regional Director, will address a number of taxation and accounting related topics for SMEs in China.

presentation

New Regulations for Representative Offices in China

- August 2014

- Members Access

This presentation by Rosario Di Maggio, Manager, will guide you through tax related changes in China, including: the increase of minimum deemed profit tax rate, tax exemption changes, and more stringent regulations on accounting requirements and othe...

podcast

The Implications of Hong Kong?s New Companies Ordinance for Private Businesses

- August 2014

- Free Access

Constance Chang, manager of company secretarial service in Dezan Shira & Associates’ Hong Kong Office provides insights into the new Hong Kong Companies Ordinance and its implications for private businesses.

podcast

Triggering Permanent Establishment Status in China presented by Angela Ma

- July 2014

- Free Access

Angela Ma, International Business Advisory associate, provides insights into how permanent establishment (PE) is triggered in China and some of the major tax implications associated with permanent establishment.

podcast

Setting up a Wholly Foreign Owned Enterprise in China presented by Angela Ma

- July 2014

- Free Access

Ms. Angela Ma,talks about the process of setting up a wholly foreign-owned enterprise (WFOE) in China.

podcast

Establishing a Representative Office in Vietnam

- July 2014

- Free Access

In this podcast we will introduce the advantages and the procedures of establishing a representative office in Vietnam and the alternatives to the RO once its mission is finished.

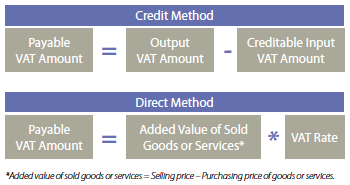

infographic

Two Methods for Calculating VAT in Vietnam

- June 2014

- Free Access

This infographic details the two methods for calculating value-added tax in Vietnam

Enquire for more information about our services, and how we can help solve challenges for your organization

Contact Us